Sellers are leveraging Amazon Advertising to drive lifetime customer value over short-term sales, says new Brands and Amazon: Insights, Opportunities, and Concerns in the Age of E-Commerce report by Feedvisor.

The research analysed the journeys of more than 500 US brands and their relationships with Amazon — how the platform fits into their overall ecommerce plan, motivating factors for selling on it, advertising goals, monthly ad spend and annual revenue figures and specific strategies for driving sales.

According to the report, 74% of the polled US merchants say that they use Amazon advertising to acquire new customers, putting their attention on building a customer lifetime value. This is followed by 59% who state that they use the service to increase brand awareness. These statements stand in contrast with 49% and 45% of the respondents whose goals are to merely “generate leads” and “drive sales,” respectively.

How much brands are spending on Amazon Advertising?

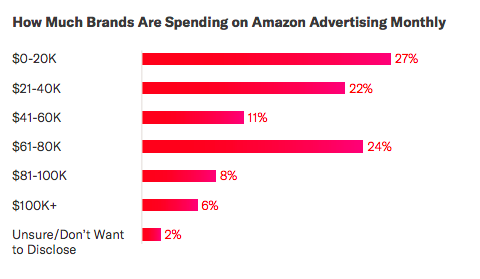

When asked how much sellers spend on Amazon Advertising, almost half (49%) say that they spend more than $40k per month to reach their advertising objectives. Some 38% say that they spend more than 60k on Amazon Advertising monthly.

The report sat that both hybrid and first-party brands are spending more significantly on advertising than brands selling on the third-party marketplace. With regard to selling model, more than two-thirds of hybrid and 1P brands are paying for advertising, and 33% of 3P brands are also investing to be competitive.

An analysis of category-specific spend reveals industries, where advertising spend, is substantially higher. Categories such as toys and games, arts, crafts, and sewing, clothing and accessories, and beauty show spend levels significantly above the per month average for Amazon Advertising.

Significant advertising budgets are evident in the pet supplies category, where brands tend to spend more than $100K per month and in the toys and games category, where spend is between $60-80K per month on average.

A cohesive value proposition and brand story are paramount to convincing buyers to purchase. However, sellers can’t rely on their advertising strategies alone. Sellers must prioritise frequent communication, high-quality products, competitive pricing, and differentiating their storefront with value-added features and benefits — all of which can increase customer loyalty and drive future purchases.