January is the longest month, it has a whole 31 days. Mind you, so does March, May, July, August, October and December but these months don’t fall just after Christmas. Plus, many employers pay the final pay check of the year before Christmas so for some it can be almost 7 weeks between pay cheques. This for many is why yesterday was the so called ‘Blue Monday’ – the most miserable day of the year, and why so many turn to payday loan sharks to ease the last few days of the month.

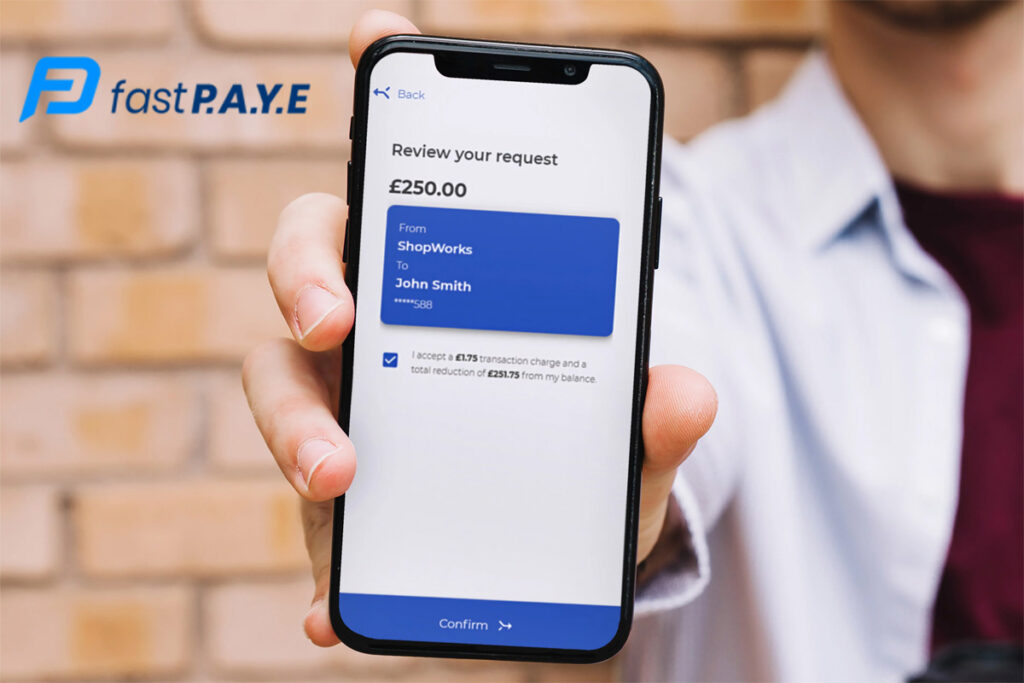

We know many in the ecommerce industry help their staff out with short term loans until payday, but it’s not an ideal situation as it’s an informal arrangement. That’s why fastPAYE have launched a new app to offer businesses a service where they can pay staff part of their already earned salary in advance of payday. Backed by both ShopWorks and investors including Sir Terry Leahy and Bill Currie the fastPAYE proposition isn’t a loan, therefore charges no interest. Earned salary is drawn down for a small transaction fee but, crucially, the service is free to those who earn the minimum wage.

This isn’t a loan in the sense that you’re borrowing money you haven’t earned. fastPAYE is in effect offering the ability to draw down salary that the employee has already earned and access it before payday comes around.

“Via our fastPAYE app we are allowing employers to give employees access to their money when they need it in a way that is controlled and transparent. 10 million pay-day loans were taken out in 2018, with half being used cover unexpected living expenses. By offering instant access to earned wages employees longer need to rely on these costly short-term loan agreements.

Through our sister business ShopWorks, we know the pressures facing employers and employees alike. fastPAYE has been designed to address the vast numbers of workers who live payday-to-payday, as well as their employers who battle employee retention and expectation on a daily basis.”

– Lee Bowden, Chief Commercial Officer, fastPAYE

fastPAYE has differential pricing so that staff on the national minimum wage are paid for by the employer to remove any possibility that the staff are paid below the minimum wage. There is a flat fee for other draw downs of salary which appears to be around £1.75 – about the same as you’d pay to get some cash from a cashpoint that charges for withdrawals.

If you only have one or two employees, you may be happy to give them a cash bung until payday to help them get through the month, but this is unregulated and either you’re reliant on them returning the money in cash or deducting it from their next pay cheque without a proper paper trail. fastPAYE offers the same flexibility for helping save your workers from payday loan sharks in a more structured environment where you keep control and your employees know they can turn to you in times of emergency… but you’ll only be advancing them money that they have already earned.