Amazon Business are making some changes to how merchants send invoice to business buyers with a change to the Amazon Business invoicing policy. The change will mean that you can no longer send invoices directly to business buyers, but will need to either produce them through Amazon or manually upload them to Amazon.

“From March 20, 2020, the Amazon Business invoicing policy will no longer allow you to use the Buyer-Seller Messaging Service to provide invoices and credit notes to Amazon Business customers.”

– Amazon

Amazon say that Business customers have indicated that they prefer to be able to download invoices from their account rather than receiving them as email attachments. This makes sense as emails are easily lost and many companies will want to have all their invoices downloaded by their accounts department – sending them to the registered business owner will often mean that the accounts team simply won’t ever get invoices from Amazon sales.

From the 20th of March, you will be required to provide downloadable invoices and credit notes either by using the Amazon VAT Calculation Service or by uploading them on Seller Central. You can upload invoices manually via Manage Orders or automatically through many third-party solutions.

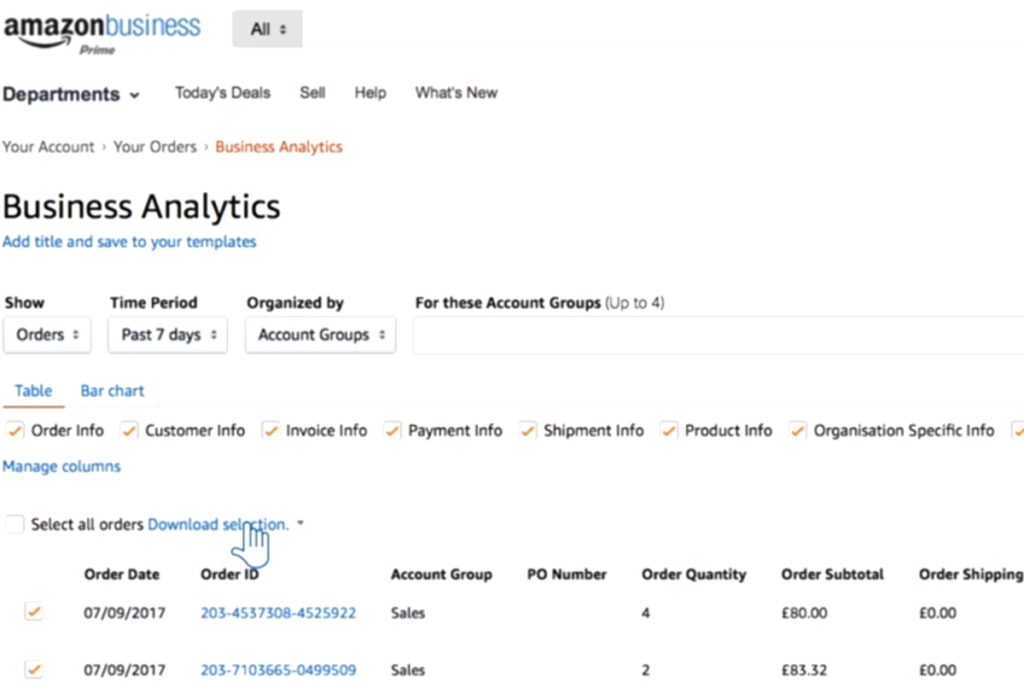

Whilst this is a change for many merchants who have become accustomed to emailing invoices, it does open up the advantages of automation. Most business buyers using Amazon Business will require invoices and it will save time once you’ve automated the production of invoices and leave it to the buyer to download them at their own convenience. It also means that if a Business Buyer subsequently requests invoices at a later date you can simply refer them to their Amazon Business account – Amazon tell Business Buyers that “VAT invoices are conveniently stored in your account and can be downloaded in bulk through Amazon Business Analytics”.

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)