Following Prime Day, with many other annual marketplace events still to come in the calendar, Ryan Higginson, Vice President & UK/ROI Country Leader, Sending Technology Solutions, Pitney Bowes, today asks ‘How do annual marketplace events impact the carrier landscape?’:

Following Prime Day, with many other annual marketplace events still to come in the calendar, Ryan Higginson, Vice President & UK/ROI Country Leader, Sending Technology Solutions, Pitney Bowes, today asks ‘How do annual marketplace events impact the carrier landscape?’:

Annual online marketplace events continue to be a highlight in the ecommerce calendar for buyers, retailers and partners alike. Small businesses selling on these platforms enjoy the revenue boost it brings them, while bargain-seeking shoppers look for the opportunity to make savings on everything from electronics to household items. Even aside from these 24- or 48-hour sales, the rise in ecommerce has been phenomenal over the past year.

As many shops temporarily closed and others faced interruptions to their supply chains, we turned to online shopping for items we’d usually buy in-store. Everything from toilet roll to batteries, household cleaning products to garden products, was delivered to our doorsteps. Now, research is finding that we’ve enjoyed online shopping so much over the past 18 months or so, we plan to continue – and we’re in no rush to change these habits and head back to shops, despite the strong progress of the vaccination rollout. US consumer pulse survey BOXpoll™ found that in May 2021, 32% of purchases were made online -percentages have hovered around this point throughout 2021 and show no signs of dipping. Fifty three percent of consumers questioned say they are continuing to shop online more than they were pre-pandemic.

Parcel volumes keep on growing

More online shopping results in more parcels. The latest Pitney Bowes Parcel Shipping Index reveals that – pre-pandemic – the UK generated around 3.8 billion parcels. That’s 120 parcels per second, or 10 million each day. Parcel volume just keeps on growing, placing huge pressure on carriers and delivery firms. Some carrier firms such as Royal Mail reported parcel revenue in 2020 overtook mail for the first time ever.

When marketplace events add to the pressure, scalability and digital services are key

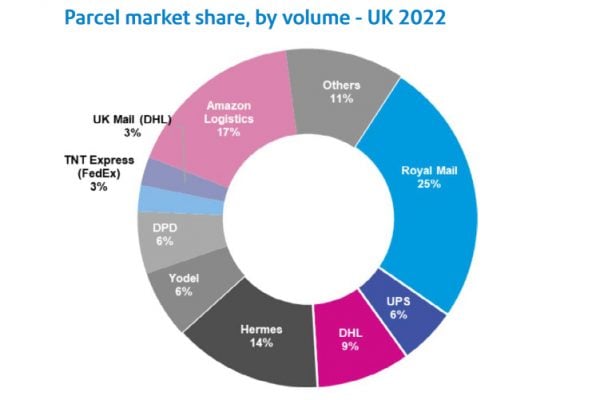

PostNord announced their movement of 9.1m parcels over the week of Black Friday in 2020, up 31% year over year. Their success, they said, was down to careful preparation and good collaboration with customers. Meanwhile, Amazon’s own logistics firm is likely to ship many orders from Prime Day in the UK. Amazon Logistics is now second only to Royal Mail in terms of market share by parcel volume, accounting for 15%, while Royal Mail accounts for 35%.

Over the past 18 months, these organisations have had to quickly rethink their operations to keep employees and customers safe, while maintaining business continuity and fulfilling any universal service obligations. Those carriers and senders whose digital transformations were in mature stages had the advantage and could respond quickly. Others have rapidly developed their digital offerings – and they’re not alone. Consultants McKinsey estimated that businesses have accelerated their digital transformation by an average seven years in 2020 – rising to ten years for countries in Asia – finding they had spent more on digital investments than any other measure to drive business continuity during the early stages of the pandemic.

Scalability is everything. Carriers continue to accelerate investment in infrastructure and services, to build on the momentum generated by consumers’ profound love of online shopping and allow themselves to deliver at scale. Shifts to contactless delivery, digital capabilities such as the ability to print shipping labels at home, and new services such as Royal Mail’s Parcel Collect are reshaping the landscape and set to remain, even in a post-pandemic world. Other carriers are making significant investments in capacity expansion, as well as fleet and facility modernization.

Senders are accelerating technology investments too

For senders looking for value and profitability, managing increasing parcel volumes requires accurate postage costs, efficient tracking services and greater visibility of their shipments’ end-to-end journeys. Higher parcel volumes can leave them more susceptible to parcel fraud such as doorstep piracy or false claims of non-delivered items. Senders have turned to cloud-based sending technologies to help them provide transparent, tracked, automated parcel management with the ability to scale up or down and deliver the best customer experience.

Shipping and sending in a post-pandemic world

As consumers, we’ve developed new habits, learnings, behaviours and preferences over the past 18 months, some of which we’ll be glad to let go while others will remain. Businesses, services and – above all – people we previously took for granted have been celebrated, appreciated now more than ever before.

For many carriers and senders, the connection between themselves and their customers has never been stronger or felt more significant.