Christoph Rieche, CEO of small business finance company iwoca, is naturally a bit of an expert in finance. Having previously been a Vice President at Goldman Sachs, he knows how to assess a businesses financial arrangements balancing risk with reward.

Christoph Rieche, CEO of small business finance company iwoca, is naturally a bit of an expert in finance. Having previously been a Vice President at Goldman Sachs, he knows how to assess a businesses financial arrangements balancing risk with reward.

Today Christoph takes a look at Amazon’s financial arrangements and breaks down how the lessons learned can be applied to small business finances.

Amazon

Amazon is the envy of the retail industry. Third party sellers may be driving their growth but Amazon itself still accounts for a whopping 60% of all units sold through their platform. So what can other online sellers learn from a heavyweight like Amazon? What lessons can we take from how they manage their finances?

The great thing about public companies is that all the key financial data is freely available. You can download Amazon’s quarterly and annual returns from their investor relations website – it’s worth looking through them regularly and applying some of the lessons to your own business, whether large or small.

Amazon’s balance sheet

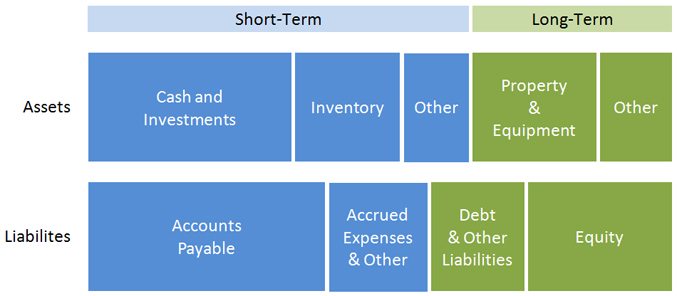

Let’s look at the specific example of Amazon’s balance sheet – assets (cash, inventory, property, etc.) and liabilities (accounts payable, debt, equity, etc.).

At the end of 2012 Amazon was sitting on close to $33bn in total assets. That included an $11.5bn pile of cash and investments (comfortable, but compare to Apple’s mind-blowing $136bn of cash and investments) and close to $10bn in other short-term assets (largely inventory). The remaining 35% of assets were of a long-term nature, primarily property and equipment.

How does Amazon finance $33bn in assets? Its suppliers and other creditors finance 75% of it with only 25% financed with equity. $19bn is financed with current liabilities – i.e. short term credit. Notice that they finance long-term assets with long-term liabilities and short-term assets with short-term liabilities. The ratios of blue to green match in the two bars in the diagram.

What can we learn from Amazon’s strategy?

The first lesson is that Amazon is making extensive use of credit to invest in their business. This has allowed them to scale fast without devaluing the equity of their investors. If you’re looking to grow your business you should be looking to do the same. Just make sure the extra profit generated is higher than the cost of credit.

Fortunately for Amazon, its suppliers provide credit at a low or zero cost – total interest expenses amounted to only $92 million in 2012. That looks like a big competitive advantage. But you have your own competitive advantages, which come from being smaller. For instance, you can be more flexible in sourcing stock so can take advantage of high margin opportunities. Make sure to capitalise on these opportunities.

The second lesson from Amazon is that they finance short-term assets with short-term debt and long-term assets with long-term debt. This makes absolute sense. The term of your financing should match the time you expect to hold an asset. Fast-moving stock should be funded with short-term credit that can scale to fit the opportunities available. On the other hand long-term assets, such as warehouses, should be financed with long-term loans that give your business stability. If secured by the asset these are likely to come at a lower cost but you’re committed to paying for the finance for a longer time.

Every business works differently but try to take a look at your own balance sheet and compare it to Amazon’s. See what lessons you can learn.

5 Responses

Who would have thought it, a finance company recommending the use of credit!!

Now that the “out of context” scoff has been made, there are some good points made.

There is a difference between “debt” and “managable debt”.

We have built up a partnership with our suppliers that has meant better payment terms, in effect free credit and we also take advantage of credit card companies who offer, say, 6 months 0%APR deals and if they fall right we can get stock in June/July that we do not have to pay for until Nov/Dec, once most has been sold.

In my opinion, the people that get into trouble are those that are trying to get to their goals too fast and borrow too much to quickly and end up having too drop prices to get cash in to service debt.

As a business (6 years old) we are on a sound footing with cash and assets and a plan.

Lee

Good post, Amazon do finance their stock through their suppliers though, as they demand everything on sale or return.

We met with them to discuss supply on this basis and basically they take a suppliers whole range on sale or return, one of each. Then they order once or twice a week from you to start to build up a picture of what sells and order more of it. If it doesn’t sell then you have to offer discount or collect it…simples!

I think if we could all do that we would all be the size of Amazon.

.

Thankfully we have cash in the bank, & decided to demand/get better prices by paying upfront.

We achieve a 10-20% discount his way, hence our prices are cheaper, as our competitors have credit accounts & pay list.