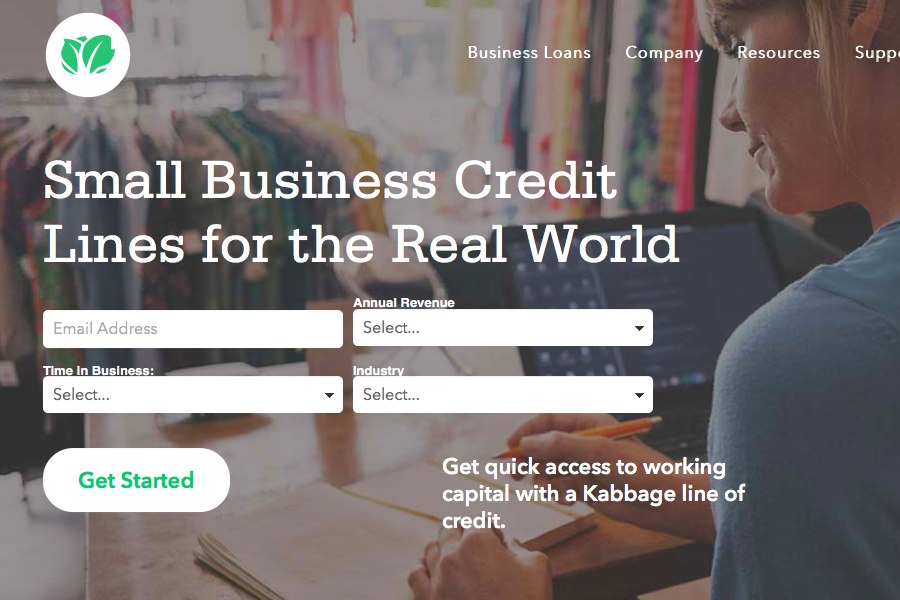

Specialist online SME lender Kabbage has received a $250 million investment from the Japanese firm Softbank. Only last week we reported that India’s Flipkart takes $2.5 billion from Japan’s SoftBank. Kabbage is predominantly a US lender, where it has made $3bn in loans to over 100k SMEs, but is also available in the UK.

The investment will be used to fund future growth and development at the lender which is valued at over $1bn. Kathryn Petralia, co-founder of Kabbage says that 19 out of 20 SME borrowers “have a 100 per cent automated experience” with Kabbage and applications often take as little as 10 minutes to complete. “Our customers can get a checking account at a bank, but they just can’t get a small business loan — the banks won’t lend to them — so they have no choice but to come to us,” said Petralia.

Since the credit crunch and the most recent recession there’s no doubt that small businesses on both side of the Atlantic have had difficulty accessing finance. Cashflow is a key concern and even small loans and access to an overdraft facility can make a big difference. It could be funding for development or having the capital to take advantage of a decent stock offering or investing ahead for Christmas. It’s hard to grow if you don’t have adequate access to capital at a decent price. Both PayPal and Amazon offer credit to ecommerce SMEs and firms like iwoca are well known.

Specifically, they take into account the trading record of the applicants and take payments from monthly sales (in the case of Amazon) to make the system as trouble free as possible for merchants.

But has the situation for SMEs (specifically online) improved when it comes to the traditional High Street banks? It’s difficult to say. Have you had a recent positive experience or have you just not bothered to apply?