The report from the House of Commons Public Accounts Committee looking at online marketplaces and VAT fraud, typically from overseas sellers, makes for interesting reading. And in the nearly 20 years I’ve been involved with ecommerce it is also doubtless the most significant regulatory intervention regarding online marketplaces in the UK that I’ve known.

The impetus from the PAC in examining online marketplaces and VAT fraud is twofold. Firstly, they want the Exchequer coffers to be swelled by what is legitimately owed. If you’re an overseas business, if your goods ship in from outside the UK or from within it, then you owe HM Treasury VAT on those sales and it seems that missing billions may be much greater than HMRC is estimating.

But the committee is also worried about businesses that are playing fair and paying their fair share of VAT. They’ve asked HMRC to assess the extent to which retailers who are VAT compliant are suffering unfair competition and losing out too.

There is also a fairly obvious tone in the report that suggests that the Public Accounts Committee knows more can be done.

There is direct criticism of HMRC for not taking full advantage of the powers they have to make overseas sellers comply. There is also a slight exasperation that there hasn’t been more progress yet, a prosecution at all and an example setting test case. And equally they recognise that more powers for HMRC may very well be necessary. They are edging towards calling for VAT collection powers and responsibilities for the marketplaces on the so called split payments basis. But they also acknowledge that’s a long way off.

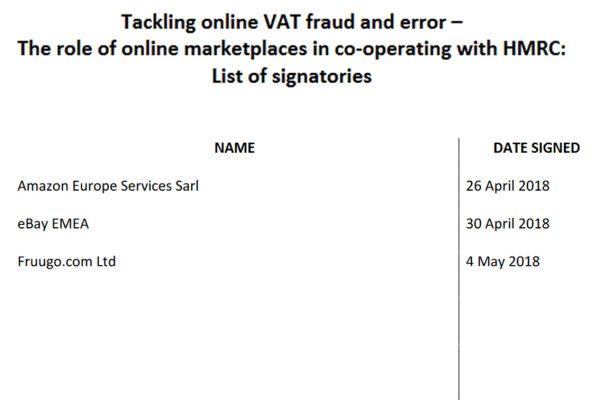

And it seems to us that they also know that the marketplaces are complying to the letter of the laws but maybe not the spirit. Both Amazon and eBay were honest and clear that they were cheerfully cooperating and even doing more than HMRC demanded. But as the seller groups who made contributions noted even a cursory look at the marketplaces shows sellers not complying. the committee agreed after some mystery shopping trips when they bought items themselves and asked for VAT receipts.

Underlying this whole report is an attempt by Parliamentarians to sort out this problem with expedience. HMRC and the marketplaces can work together better and legislation can be avoided to make that happen. And they want more cooperation.

The issue of VAT fraud and online marketplaces is one that should concern every online retailer who is paying their VAT and generally working hard to earn a crust. The PAC report is a step in the right direction. But will it be enough?

2 Responses

I think it was 2013, around the same time best match came in, half the products I was importing and retailing to the uk market suddenly became available from uk warehouses at a few dollars over cost price, from Chinese / hk based businesses

They’re all way over the vat threshold

It’s taken 4 years for them to realise how big the problem is

How many uk sellers have given up in this time??

Whilst Ebay have made millions off them in fees