Managing currency risk is often an after thought in ecommerce, until the time comes to pay a bill in a foreign currency or repatriate funds from sales and you discover that the exchange rate has changed and suddenly it’s costing you more than you had planned for.

We sat down with David Nicholls from OFX to discuss the risks and how, with advance planning, you can get some surety of costs regardless of exchange rate changes. Forward planning is the key and OFX have launched a new Global Currency Account, already live in North America, Asia and Australia, and coming to UK merchants this summer.

Protecting your business from currency risk

OFX Global Currency Account

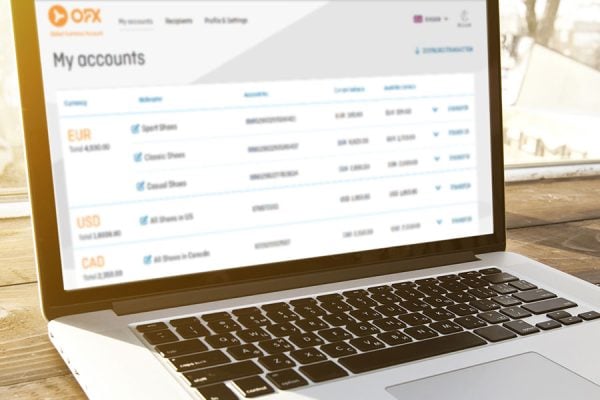

With the new Global Currency Account from OFX, ecommerce merchants can manage Sterling, Euros, US Dollars, Hong Kong Dollars, Australian Dollars, and Canadian Dollars all in a single dashboard to save money on exchange rates and free up time.

It can be difficult to open up a local bank account in many countries, especially for an SME business who may not have a physical presence in that territory, but OFX makes managing currencies simple removing the need to set up business entities overseas with local currency accounts ready for you to use.

To keep track of your finances, in your Global Currency Account OFX enable you to give each of accounts a nick name to correspond with each marketplace you trade on. You can opt to have payments automatically paid to your domestic bank account but you can also hold multi-crrency balances in your OFX Global Currency Account to make secure payments to suppliers and, if you’re liable for taxes overseas you can pay these direct in the local currency from your sales revenues, saving on exchange rates.

“OFX has been committed to growing ecommerce business for online sellers with local currency accounts. We asked our customers what would help them better manage their global revenue and, based on their feedback, responded with a product that efficiently manages every account, balance and transfer from multiple marketplaces, in multiple currencies, simply and easily.”

– David Nicholls, Director of Enterprise Development at OFX

Many sellers only worry about currency risk when bills become due and they need to pay an invoice. Planning ahead could save you facing higher than expected costs and give certainty to your business, especially if you’re currently placing orders for the busy Q4 season for which invoice will become due later in the year.

You can find our more about OFX on their website and watch our discussion with David Nicholls in the video above.