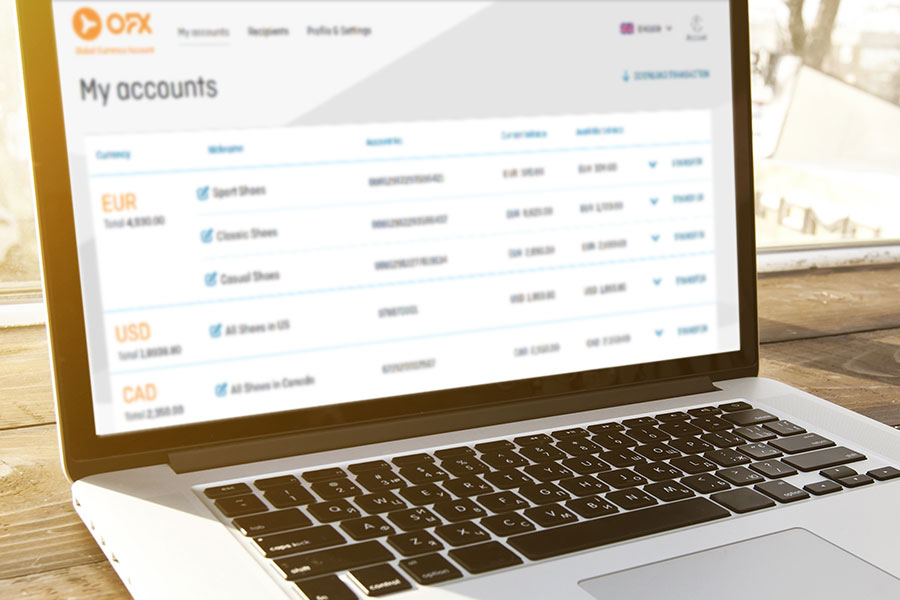

OFX has launched its Global Currency Account in the UK. Available to importers and exporters, the Global Currency Account is designed to simplify cash flow management for online merchants trading on international marketplaces.

With the Global Currency Account, ecommerce merchants in the UK can now manage marketplace payments in multiple currencies using the service.

We spoke to OFX to find out more about their Global Currency Account and how they can make managing your finances fast, secure and as easy as possible:

What is the Global Currency Account?

The Global Currency Account is OFX’s newest offering for e-tailers; where we provide eCommerce merchants with local ‘virtual’ bank accounts. These local accounts are available in USD, EUR, CAD, GBP, AUD and HKD, allowing clients to save significantly on transactions fees & rates when they are bringing revenue home from international marketplaces.

What will the GCA do for my business?

The Global Currency Account can save e-tailer merchants up to $2,500 on every $100,000 transferred. Designed to reduce foreign exchange costs and international wiring fees so merchants take home more of their revenue, it can help e-tailers manage their cash flows and allows them to take advantage of forward contracts and other products and services OFX offers to help businesses save money and plan ahead with confidence

What is the cost of the GCA

- Free to sign up and no monthly fees

- OFX charge a small margin on the transaction

As an example, if a marketplace is charging an ecommerce merchant 3% to transfer from their US marketplace back to GBP for a $100,000 transaction, they are being charged $3,000 for that transaction. If the OFX fee is 1%, we are charging $1,000 saving the client $2,000 in the foreign exchange margin. We would also pay the GBP from a local UK account reducing the chances of a receiving fee.

Why should I use the OFX GCA compared to competitors

OFX allow clients to pay suppliers directly from our new online portal. We also allow clients to do same currency transfers (GBP to GBP) all online as well as having a vast range of currency accounts and ability to offer competitive rates.

Why should I sign up for a Global Currency Account?

Providing clients with a GCA means they don’t have to worry about setting up a business bank account in the country where they are doing business (UK client selling in the USA won’t have to fly to the USA and open a bank account with a bank here).

You can do this all online with us and save money in the process. The Global Currency Account saves you money, time, and a lot of headache.

How do I get started

Visit our website at ofx.com/en-gb/online-sellers

Email us at [email protected] or call 02076144195 or get in touch with us at ofx.com