Amazon Air have been making headlines with news of strengthening their logistics capabilities.

Last week Amazon announced the planned launched of new air hub in 2021 as part of their ongoing commitment to accelerated delivery.

Some might even say that Amazon is developing their fulfilment network faster than UPS and FedEx. However, how much competitive risk does Amazon Air pose to UPS-FedEx growth?

What is Amazon Air?

In 2016, Amazon unveiled their first plane to support new Prime Air delivery, says a recent report Amazon Air: Encroaching On UPS & FDX Air Space by Morgan Stanley.

In Jan 2017, Amazon Air announced an air hub in Cincinnati/Northern Kentucky airport. The hub has the capacity to handle over 100 planes and cost roughly $1.5 bn.

As of July 2018, the report says that the US Air Transport Services Group operates 20 planes, while Atlas Air operates 12 planes for Amazon. The analysis predicts that by June 2019 Amazon will have 40 planes in their fleet.

Amazon Air vs UPS and FDX Air

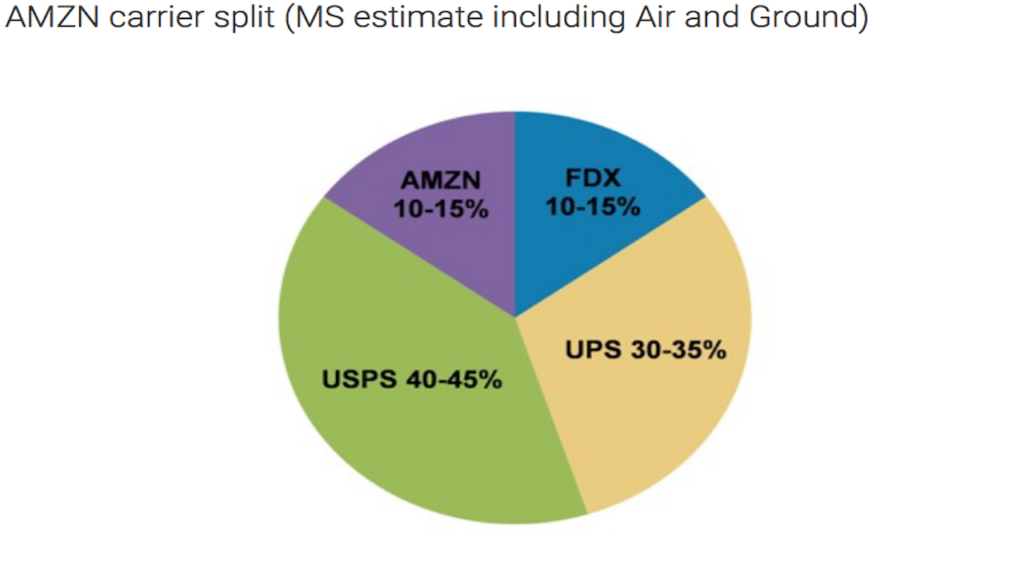

Amazon’s US logistics are handled by four suppliers. Amazon package volumes are split between USPS (40-45%), UPS (30-35%), FedEx (10-15%), says the report. A network of independent service providers (ISPs) forming Amazon’s in-house fulfilment operation of 10-15%.

Since USPS and ISPs do not own planes, the emergence of Amazon Air would be an alternative to existing air delivery providers UPS and FedEx. The analysis compared Amazon against UPS and FedEx Air Express to understand the size and scope of the company’s air delivery capabilities.

Amazon plains are bigger but still behind FedEx and UPS’ capabilities

The report acknowledges that Amazon plains are bigger on average than UPS and FedEx. An average payload for Amazon’s planes of 63 tones is above FedEx 58 tons and UPS’s 55 tons. However, the analysis notes that Amazon’s total payload capacity lags behind the duo’s range. It says that Amazon’s 40 planes utilisation accounts for 23% UPS and 14% of FedEx’ monthly total air capacity.

Amazon is a fraction of the size of UPS and FedEx

It will come as no surprise that Amazon Air is but a fraction of the size of UPS and FedEx. After all, Amazon Air has been around for less than two years while FedEx Express has been about for 45 years and UPS for 30 years. However, there may be signs that Amazon may already be punching above their weight.

The analysis notes that since Amazon Air are exclusively a US domestic operation at this time, all numbers pertaining to FedEx and UPS’s air operations are also US domestic only.

Amazon’s Air fleet of 40 planes only make up 7% of FedEx’ 2018 monthly active domestic fleet of 378 planes – 11% of UPS’s 2018 monthly active domestic fleet of 242 planes. This puts a question mark whether Amazon’s aerial network could catch up with FedEx and UPS’ air fleet?

According to the report, FedEx plan to buy 167 planes by 2023. UPS aims to buy 32 planes by 2022. If Amazon bought 100 B767-F planes to fill up thier KY air hub, they would account for 26% and 41% of FedEx and UPS’ estimated monthly active domestic fleets, respectively.

Old players are standing the test of time against new disruptors

These findings highlight the notion of existing players winning over the new entrants’. It appears that companies with infrastructure that has been built on decades of experience, trial-and-error methods are standing the test of time as the emerging businesses threat to disrupt the landscape. The new players are already increasing the efficiency of operations with innovating tools and services, but they’re not reinventing the wheel.