The success of an Amazon business is influenced by a combination of factors that uniquely make up a company. That is, whether a seller is trading competitive or private label products, product categories they’re selling in, their revenue figures, and the ability to scale, says new report The State of the Amazon Marketplace 2019.

The report aims to provide a comprehensive view into the state of the Amazon marketplace — their growth, shifting nature, and new initiatives — as well as how sellers react and restructure their strategies as a result.

It serves as a useful guide for new entrants aiming to join the marketplace with an insight up their sleeve. The developing nature of Amazon may shift merchants’ focus with the rise of new trends, tools and services. However, sellers must remain agile to adjust their strategy according to Amazon’s movements. This way they will be more efficient in identifying a room for improvement and uncovering new ways to scale.

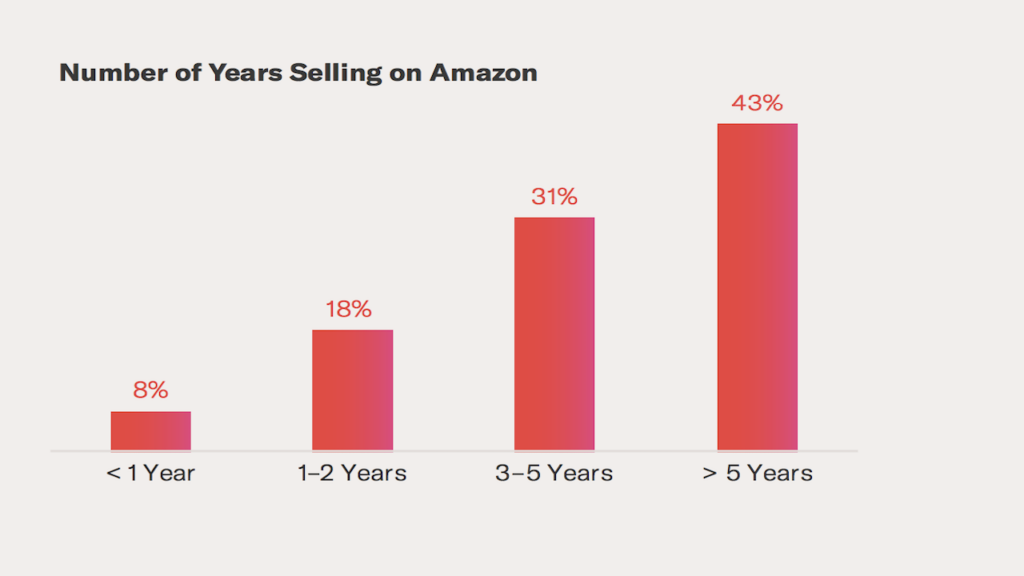

An Amazon business requires long-term investment

According to the report, selling on Amazon requires extensive bandwidth.

Last year saw 73% of the surveyed Amazon businesses employ one to five staff members. However, that number dropped to 52% this year and the number of businesses with over 50 employees increased by 13%. In addition, nearly three-quarters (74%) of respondents have been selling on Amazon for over three years, with over two-fifths (43%) selling for over five years.

62% of merchants sell private label products

Private label products offer sellers profit potential and the ability to sell items made by other manufacturers under their own, unique brand name.

The report says that 38% of the polled Amazon sellers have no private label products, compared to 62% of private label sellers. This means that their catalogue is fully comprised of items that compete for the Amazon Buy Box. For example, private labels have unique Amazon Standard Identification Numbers (ASINs) and therefore always win the Buy Box, while their counterparts have competitive ASINs and are not guaranteed the Buy Box.

Private label sellers need to understand how to navigate indirect competition, promote product discovery, and generate demand, while competitive sellers place a deep emphasis on the importance of a real-time price optimisation strategy.

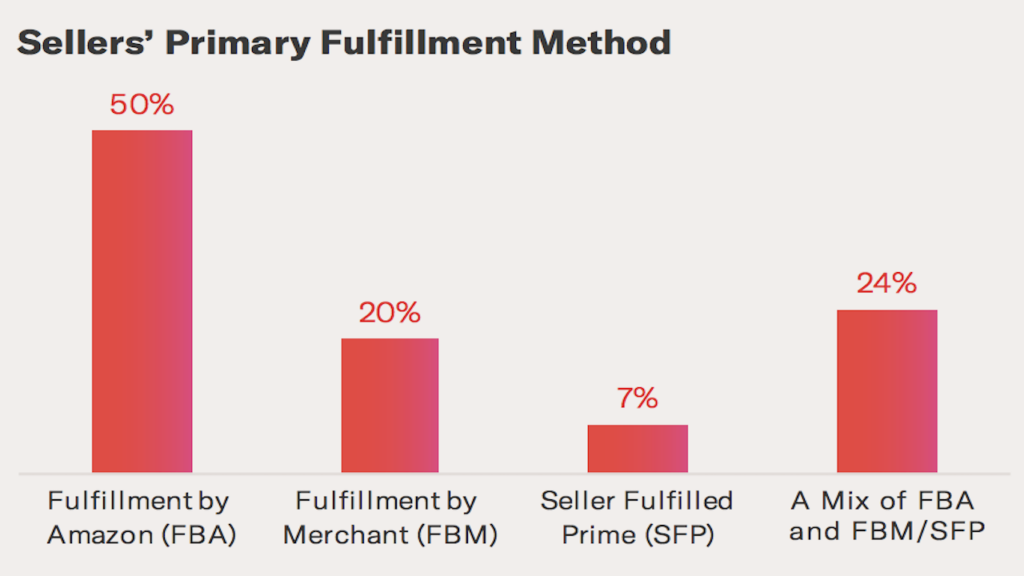

FBA is a primary fulfilment method

Half of the polled Amazon sellers (50%) use Fulfilment by Amazon (FBA) as their primary last mile service. FBA requires sellers to ship their products to Amazon fulfilment centres, and when an order is placed for one of those products, Amazon then fulfils the order by picking, packing, and shipping it and providing any necessary customer support.

Nearly a quarter of sellers (24%) use a combination of FBA and a merchant-fulfilled method such as Fulfillment by Merchant (FBM) or Seller Fulfilled Prime (SFP).

The report highlights the shift away from SFP to an increasing number of sellers opting to use an FBA strategy. Due to an SFP reporting nuance, it may be recorded that sellers are getting a smaller percentage of the Buy Box than they actually are, while with FBA, sellers have a higher chance of winning the Buy Box, therefore driving incremental sales.

Given that FBA and merchant-fulfilled business models differ highly, the route that is optimal for a seller’s Amazon operation will depend on the size of their business, the items in their catalogue, and their goals and strategies.

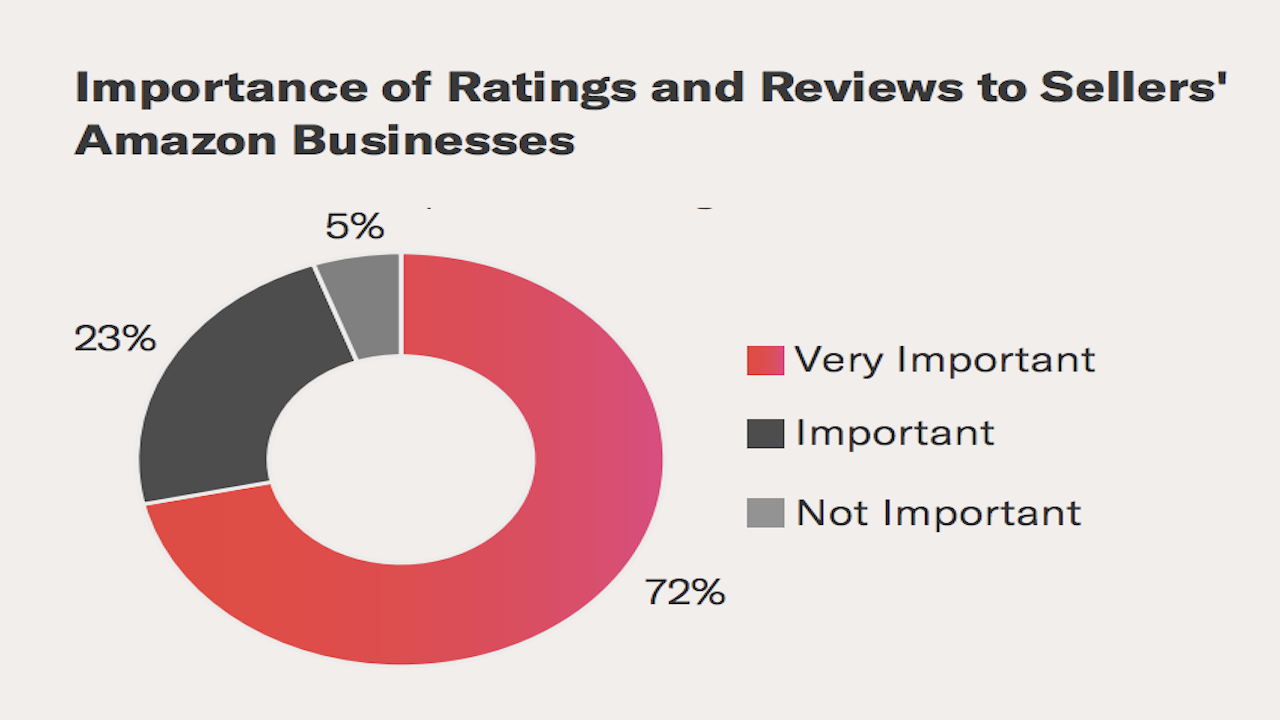

Customer feedback is vital to success on Amazon

Customers have 90 days to leave feedback once they have ordered from an Amazon merchant. Feedback represents a seller’s — professionalism, customer service and whether or not the buyer would purchase from the seller again, work quality, as well as shipping and packaging. Reviews, on the other hand, are simply reviews of the product, not the seller or the purchase experience.

The report’s findings say that a significant 95% of the surveyed Amazon merchants consider ratings and reviews “important” and 72% say they are “very important“.

Through reviews and ratings, sellers can receive insights into customer satisfaction on how their order was packaged and shipped, as well as their impression of the entire experience from start to finish. Do they wish the item was available in a different colour? Is there a potential quality issue that sellers can take action to resolve in the manufacturing process?

Monitoring product reviews and seller feedback can help sellers stay apprised of potential product improvements and consumer trends, inform their stock keeping unit (SKU)-specific analyses, enable them to benchmark against the competition, and provide a strong understanding of their overall seller reputation.

Repricing catalyses performance on Amazon

Some 94% of Amazon merchants using a re-pricer found their account health score to be above average compared to their competitors. The majority (87%) also found their shipping and fulfilment to be above average compared to their competitors, and 71% found their inventory management to also be above average.

The flywheel effect is at play here. Once price optimisation is enabled, sellers can drive incremental sales and provide on-time delivery, which in turn prompt customer loyalty and repeat purchases. If customers are satisfied with the purchase, they are likely to leave a positive rating and review, which benefits the seller’s overall account health and performance metrics. With an increase in demand, sellers can utilise the re-pricer — which syncs with their inventory levels — so they are notified when they need to reorder and can constantly maintain a precise inventory position.

The rules and opportunities on the Amazon marketplaces are complex and ever-changing. To navigate the dynamic ecommerce landscape and keep pace with Amazon, sellers need technology and deep expertise to differentiate themselves, accurately measure their end-to-end performance, and engage with new and repeat customers.