With Amazon Prime Day day 2 2019 in full swing, it’s estimated that some 70% of Prime Members will be shopping on Amazon today and tomorrow. With that in mind, it’s worth considering how learning more about Prime members, brands and retailers can better hone their own strategies for selling and advertising on the Amazon platform — and emulate Amazon’s best practices to improve their own loyalty programs.

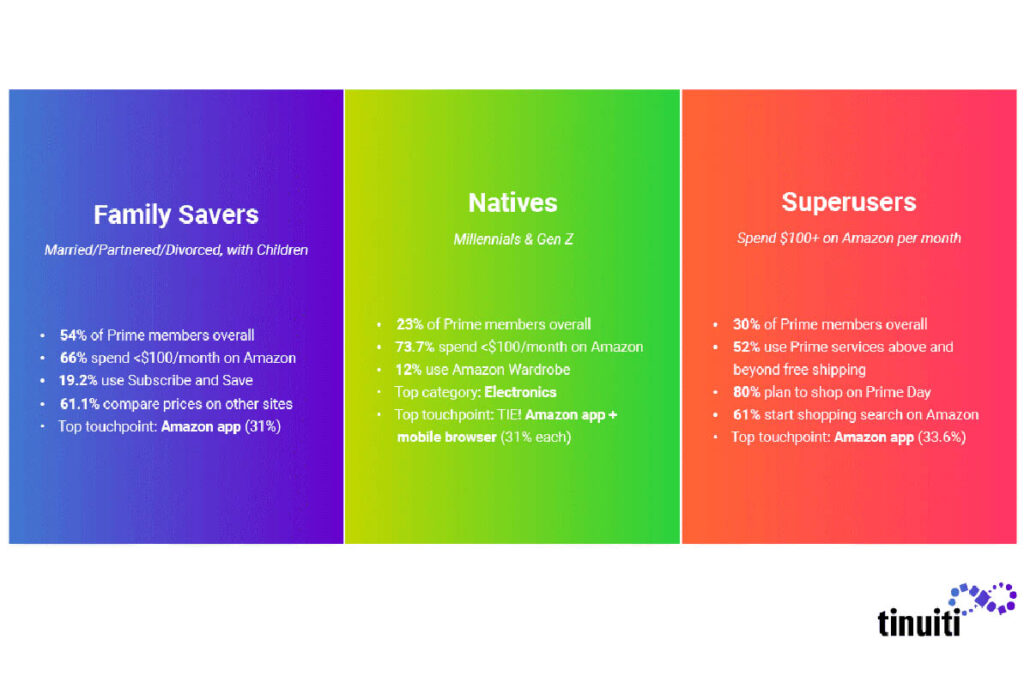

In a new US study of 1,985 Prime Members and their shopping habits on Amazon, Tinuiti identified three groups whose shopping behaviours and spending habits are distinct: Family Savers, Amazon Natives, and Prime Superusers.

The majority of Prime members are motivated by savings for the family. Prime households are typically married or partnered couples with children, and they rely on Prime for its convenience and savings — taking advantage of services such as “Subscribe and Save” even as they price-check other sites regularly. Savings on shipping are also crucial: some 70.3% of Prime members rank it as the top perk.

By knowing what type of Amazon persona is likely to purchase your product will give you an idea of how to market it such as when it’s essential you have your products in FBA to qualify for Subscribe and Save as opposed to merchant fulfilled orders or Seller Fulfilled Prime.

Amazon Prime Members Personas

Family Savers

Married, partnered, or divorced parents comprise the majority of Prime users. Their income tends to skew toward the higher end: 70% earn $50,000 or more, and more than 41% earn over $90,000. But thrift and convenience are strong priorities: one in five use Amazon’s “Subscribe and Save” service, and other discount offerings for members see higher-than-average use.

Amazon Natives

Twenty-three percent of Prime users belong to Generation Z (defined as ages 18 to 24) or the Millennial generation (ages 25 to 34). The majority of Amazon Natives are single, have no children, and earn less than $50,000 annually — making a stark contrast with Family Savers. These shoppers have grown up knowing Amazon as a dominant force in retail and tend to view it as a go-to mass merchant, in the same way their parents may have relied on Sears or Walmart; as such, they’re more comfortable than average using newer Prime benefits such as the apparel try-on service Wardrobe.

Prime Superusers

Some 30% of Prime members spend more than $100 on Amazon.com each month. These members are more loyal to Amazon than average and tend to be the heaviest users of Prime benefits above and beyond free shipping. Not surprisingly, their income skews higher than average, too, with 83% earning over $50,000 per year and 12% earning $211,000 and up.

There is a ton more information in the Prime Day Guide to help you identify the Amazon personas you’re trying to target and what will appeal to them.