Amazon have issued some key Amazon FBA BREXIT updates and some additional information to help you transition your business through the changes coming up by the 1st of January.

Dates for key Amazon FBA BREXIT updates and changes

- The first of the Amazon FBA BREXIT updates to be aware of is that inventory removal orders for cross-border inventory were stopped on the 14th of November. Any removal orders created before the 14th of November will be processed.

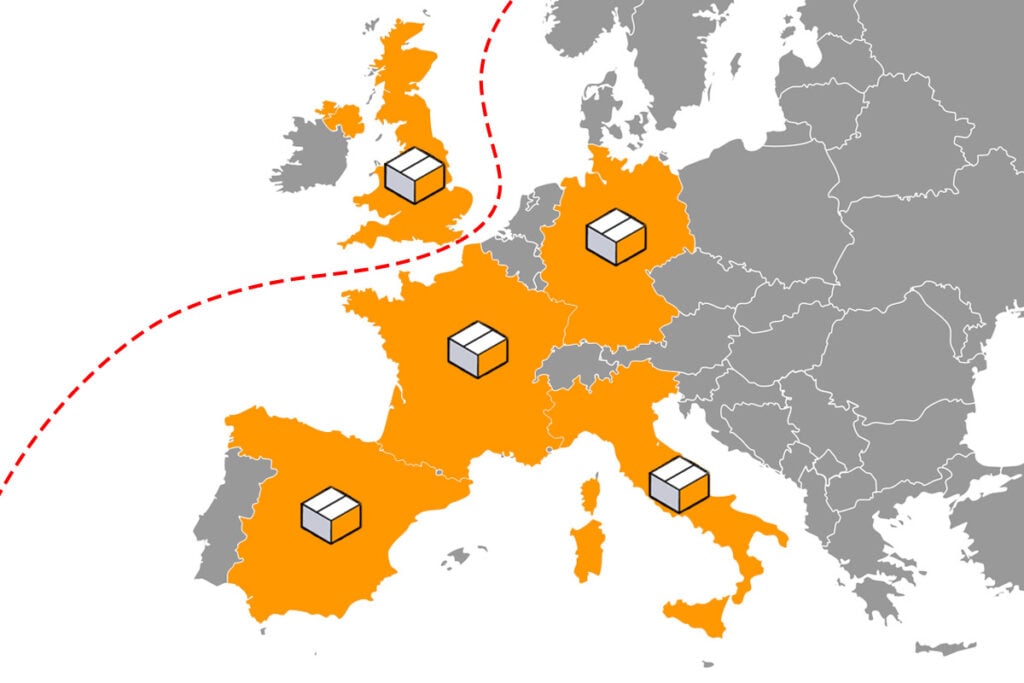

- Pan-European FBA inventory transfers will stop on the 18th of December.

- Cross-border fulfilment via Amazon FBA EFN will wind down between the 21st and 28th of December.

This means that if you do nothing, UK sellers will cease to attract sales from the EU and vice versa. From these dates, if you wish to continue to sell cross border then you will need to send inventory to fulfilment centres in the UK and the EU in order to maintain your stock levels and sales.

Cross-border shipping promotion with the Amazon Partnered Carrier Programme

To support FBA merchants with managing upcoming changes and with inbounding across the new customs border, Amazon have launched a cross-border shipping promotion which offers a 30-65% average saving off transportation for deliveries between the UK and the EU, using the Amazon Partnered Carrier Programme.

The UK to EU and EU to UK rates will be reduced so that they are the same rate as local PCP rates (for example, rates for UK to Germany will be the same as the rates for shipping from a UK address to a UK fulfilment centre). This promotion will run from the 19th of November to the 18th of December, enabling you to send inventory to the UK or the EU at a lower cost prior to the EU-UK customs border that will be in place from the 1st of January 2021.

Amazon are working to ensure that the Amazon Partnered Carrier Programme can continue to support all existing shipping lanes in 2021, including lanes impacted by Brexit with more information coming in December 2020.

Temporary Pan-European FBA eligibility criteria relaxation

Amazon are temporarily updating their Pan-European FBA eligibility criteria by removing the requirement to have an active UK offer. As of the 18th of December 2020, products will continue to be eligible for enrolment in Pan-European FBA, even if there is not an active offer in the UK. This is a temporary measure to support our sellers with adjusting to the customs border that will be in place from the 1st of January 2021.

Amazon will reinstate the UK offer requirement in the near future, and we recommend that sellers maintain their UK offer by sending inventory directly to UK fulfilment centres and will provide a minimum notice period of 60 days prior to reinstating the UK offer requirement.

Don’t forget that Amazon have a Brexit help page where you can keep up to date with all the Amazon FBA BREXIT updates and other changes. Amazon also have a Brexit Selling Partner Guide to support you with your preparations.

4 Responses

Amazon will do EVERYTHING they can to attract people to sign up for Pan EU and are conveniently failing to inform them at from July 1 next year the EU will be adopting a One Stop Shop for physical goods, so in theory UK sellers should send to one EU Amazon FC and sign up for 1 EU VAT number:

https://www.pwc.lu/en/newsletter/2020/new-eu-vat-rules-2021.html

What’s new?

An extension of the optional declarative system to both B2C suppliers of services and goods, avoiding multiple VAT registrations and reporting obligations in the EU (called the One-Stop-Shop or “OSS”);

The abolition of the “distance sales threshold” and the creation of a unique and common threshold of EUR 10,000 throughout the EU up to which B2C EU cross-border supplies remain subject to the VAT rules of the Member State of dispatch, and above which supplies become subject to the VAT rules of the Member State of destination;

The abolition of the exemption for imported goods with a negligible value not exceeding €22;

A single report scheme covering sales of imported goods to EU consumers up to a value of €150 and for which a VAT exemption upon import will apply if the trader declares and pays the VAT at the time of the sale using this declarative system (called the Import One-Stop-Shop, or “IOSS”);

The possibility to make Customs declarants (e.g. postal operators or courier firms) liable to collect import VAT from consumers via a monthly payment;

The shift of EU VAT liability to marketplaces when they facilitate the delivery of goods to the EU consumers.

I watched the Webinar with Chris in it yesterday, and it just re-confirmed to myself that as a small seller in terms of European sales, it’s just not worth it to continue and I will concentrate purely on UK sales. Most of my items are around the £20 mark, and the time and cost involved in shipping to Euro Fulfillment centres, filling in customs forms, finding the correct codes, import duty, possibly having to also pay an agent, the virtual imposibility of being able to handle returns, and the hassle of having to register for VAT over there and file seperate returns makes it a non starter for small fish like me.

If anyone missed the webinar, you can watch it here

Hi Julius! Is this 100% confirmed?

I know that this has been in talks, but I haven’t seen any official announcements yet in media.

I think that Amazon will actually be very happy about this – it’s not their intention to deal with all the extra hassle all those VAT numbers bring to the table. The easier it is for sellers to sell on all Amazon marketplaces, the better it is for Amazon business.