Global ecommerce and marketplace specialist Pattern has polled UK online shoppers to understand how lockdown shopping habits have changed and consumer’s expectations for 2021, as well as their attitudes to Amazon.

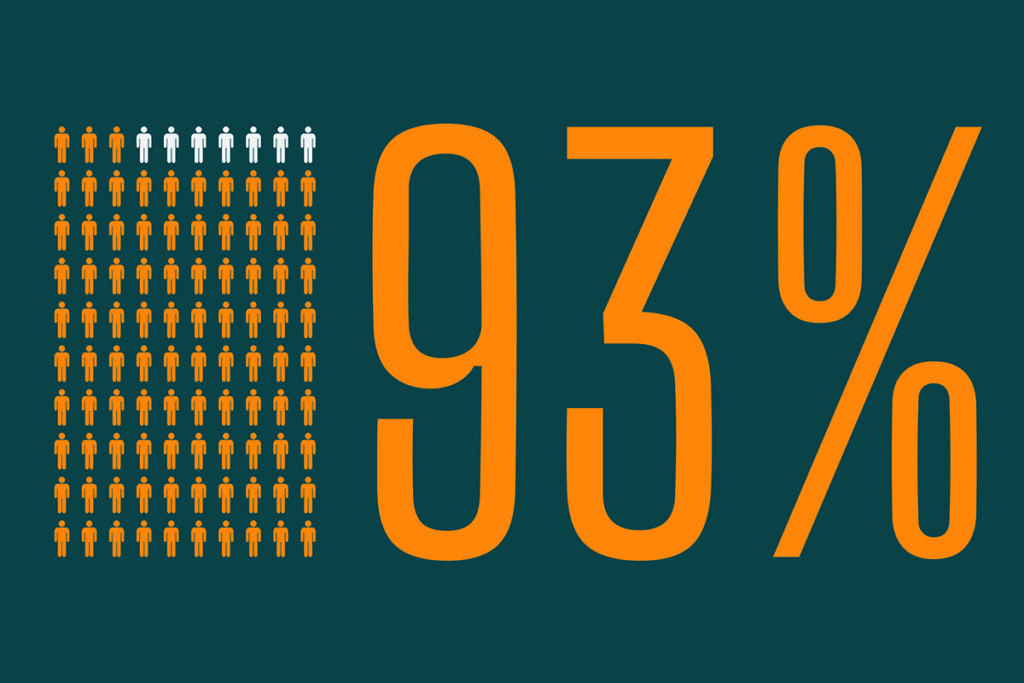

The percentage of UK online shoppers who bought from Amazon in the past 12 months stands at 93%, with 86% specifically reporting that they bought from Amazon’s UK site. This means that out of the entire UK online shoppers, Pattern could only find 7 in a 100 people who didn’t shop on Amazon, a pretty staggering statistic! These lockdown shopping habits numbers are bang up-to-date as the poll was conducted in early February 2021.

43% of Amazon shoppers gave the closure of non-essential stores during lockdown as a reason why they had made purchases from the marketplace in the past year. Further to this, 54% said they have bought more online in 2020 than previous years, and 39% said they bought more from Amazon than previously. 40% said they bought products online that previously they would buy in stores; showing how the closure of non-essential stores has pushed consumers online.

Pattern’s UK Shopper Report 2021 also highlights how the impact of lockdown will continue to play out this year. 39% expect to spend more online on non-food items this year than in 2020, and a further 50% expect to spend about the same. 30% expect to purchase more with Amazon in 2021 than 2020, and 58% expect to spend about the same as last year.

More lockdown shopping habits

- Online retailers have acquired new customers

Only 9% said they bought from different physical stores to previously because of the pandemic, but 28% said it had changed the online retailers they have bought from in the past year. 14% expect to buy from different physical stores in 2021, but 29% expect to buy from different online retailers in 2021 to previously.

- Omnichannel retailers retain their online lead in fashion and food categories

Clothing, shoes & accessories, and food & pantry were the two categories where omnichannel retailers are far preferred over pureplay etailers and Amazon.

48% of online shoppers said they had bought clothing, shoes & accessories online from omnichannel retailers in 2020, and 56% expect to buy this category online from omnichannel retailers in 2021. Only 32% of shoppers had bought clothing, shoes & accessories online from pureplay etailers in 2020, and 33% expect to do so in the year ahead.

46% of online shoppers said they had bought food & pantry items online from omnichannel retailers in 2020, compared to 19% who bought from food etailers such as Ocado and 16% who bought from Amazon. In 2021, 48% expect to buy food items online from omnichannel retailers, 19% from etailers and 14% from Amazon.

- Prime membership

More than half of UK online shoppers will have access to a Prime account in 2021. 40% have their own account now, 10% use someone else’s account and a further 6% are likely to subscribe during the year. 34% of Amazon customers cited Prime as a reason for choosing Amazon to purchase from ahead of other retailers in 2020.

- Amazon’s strength lies in its broad range and availability

57% of online shoppers visited Amazon in the past year to look for products they couldn’t find in stores, and 40% visited to look for products they couldn’t find elsewhere online. In addition, last year 41% of those who shopped with Amazon bought a product from a brand that they had never purchased on Amazon previously. 25% of Amazon shoppers bought a product from the marketplace in a category that they had never purchased on Amazon previously.

“Online sales were of course going to rise while many physical stores have been closed, but our research gives credence to the theory that some of this switch to online shopping is permanent. Amazon has been one of the biggest beneficiaries of lockdown, and we don’t expect it to lose ground even when all stores open again in April.

Amazon makes no secret of the fact that selection is crucial to its appeal. Our research shows that consumers particularly appreciated its wide range during lockdown, and have broadened the type of products they are willing to buy from the marketplace in the future as a result.”

– Nicola Hollow, General Manager for Europe, Pattern