The importance of complete, accurate and compliant high quality data in meeting the requirements of global ecommerce has been highlighted in a new report.

The so-called Wise Persons Group (WPG) has produced the report, entitled “Putting more union in the European Customs” for the European Commission. The document contains 10 proposals to make the EU Customs Union fit for a Geopolitical Europe, providing a glimpse of how imports and exports may look in the future.

In its introduction, the report states: “The last decade has witnessed major changes in trade and technology, which have exacerbated pre-existing difficulties. The volumes of trade have significantly increased, and the nature of trade has changed with the expansion of ecommerce in the form of millions of small packages to be processed at the EU borders. The expectations on Customs’ role have evolved from those related to revenue collection to include citizens demands to ensure that the values that they cherish – sustainability, safety, human rights, health – as well as security concerns are upheld, and in recent years this trend has been accelerating.”

It goes on to say: “The poor availability and quality of the data submitted to Customs and the insufficient level of data sharing across Customs and with other administrations has led to fragmentation and makes it extremely difficult to properly manage risks at both national and EU level.”

Calling for “urgent structural change”, the document goes on to make its 10 recommendations.

The second proposal calls for a “new approach to data”. It says that rather than relying principally on customs declarations, there is a need for a new approach to data, focussed on obtaining better quality data based on commercial sources, ensuring it is cross validated along the chain, better shared among administrations, and better used for EU risk management.

It further states that there is an urgent need to “clarify which private actors – including ecommerce platforms – must provide data, with costs for non-compliance.”

Businesses should also be provided with “a single data entry point for customs formalities and a single window/portal.”

Potential removal of the customs duty exemption threshold

Another major proposal would see “the removal of the customs duty exemption threshold of EUR 150 for ecommerce and provide some simplification for the application of Customs duties rates for low value shipments.” This is seen as a key step in enabling the EU member states to collect all the revenues, they are due and reduce the problem of fraud. It would also align with the changes in July 2021 which saw the EU remove the VAT exemption on low value items and the introduction of the Import One-Stop Shop (IOSS).

Other recommendations in the report include the setting up of a European Customs Agency, a comprehensive framework for cooperation, a package of measures to “green” EU Customs and a requirement to properly “resource, skill and equip” Customs to ensure the capacity to fulfil their missions.

The WPG goes on to urge the European Commission to table a package of reform proposals, including of the Union Customs Code, implementing the recommendations contained in this report, by the end of 2022.

The Group is an independent high-level group, comprised of members from politics, industry, trade and academia. It is headed by the former Minister of Foreign Affairs, European Union and Cooperation of Spain, Arancha González Laya.

“This is a highly significant report which sets out the recommended EU Customs roadmap between now and 2030. Central to the report’s proposals is the recognition that the exponential growth in cross-border eCommerce has been a game-changer. Of critical importance is the need for all parcels to have complete, accurate and compliant data as data has become the currency of international trade.

This is vital for so many different reasons including the correct calculation of duties and VAT that is payable and to ensure that prohibited and restricted items are not being shipped or that goods are not being sent to denied parties.”

– Martin Palmer, Chief Content & Compliance Officer, Hurricane Commerce

From July to December 2021 – the first six months of compulsory customs declaration for all goods imported into the EU irrespective of their value – traditional trade in goods represented over 220million import declarations for a value of EUR 1,250 billion.

By contrast, it is estimated that ecommerce represented 490million customs declarations for a total value of EUR 4.8 billion – ecommerce therefore represents more than twice the number of traditional transactions for only 0.4% of the value.

The WPG report highlights the scale of the challenge facing Customs authorities trying to meet the unprecedented growth in B2C trade. The upshot, it states, is an “unmanageable flow of millions of small individual consignments to be controlled and checked for fiscal and non-fiscal requirements.”

The document also pinpoints the need for high quality data to meet the ever-growing requirements surrounding prohibited and restricted goods.

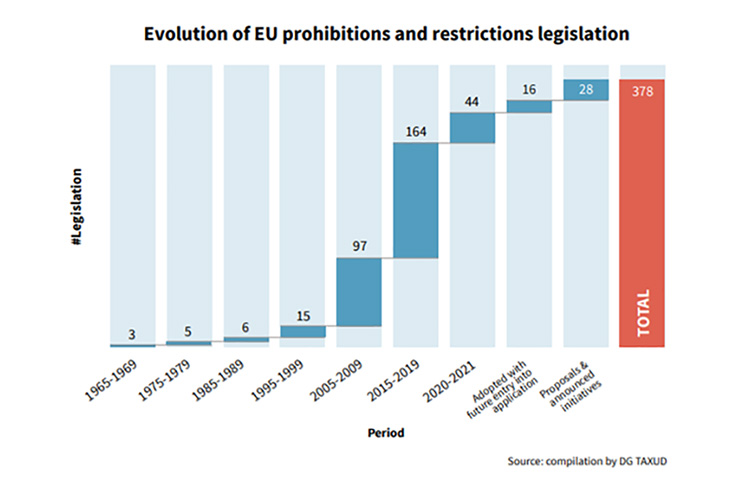

Unlike in the 1990s, “nowadays, there are more than 350 pieces of EU legislation dealing with prohibitions and restrictions and covering a wide range of diverse policy areas.”

The chart above demonstrates the increasing number of sustainability, security, safety and health requirements which have led to an ever-greater number of prohibited and restricted items.

The Wise Persons Group has laid bare the true scale of the challenge facing Customs in the EU, but the same challenges are confronting customs authorities across the globe.

“They have made clear that the future lies in being able to trust the data. This means better primary data, better validation of data, better data sharing and better data tracking.

– Martin Palmer, Chief Content & Compliance Officer, Hurricane Commerce

Hurricane Commerce is the only cross-border data specialist with a true global customer footprint including Emirates Post, SEKO eCommerce, Australia Post, An Post, Royal Mail, EVRi, Yanwen and One World Express.

The company’s suite of AI-driven, real-time data solutions cover the critical cross-border areas of data enhancement, duty and tax calculation, prohibited and restricted goods screening and denied parties screening.

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)