The European homeware sector is a €40bn industry, which saw strong growth across the lockdowns of 2020 and 2021 as consumers invested in renovations and home offices. As the world has returned to normal, markets have consolidated and growth in many areas has slowed due to inflation and rising house prices.

In the RetailX European homeware sector report, we examine Europe’s online homeware consumers who are young, increasingly digital and driven as much by fashion as they are necessity and use online, mobile and social media as part of an increasingly complex path to purchase. As younger customers become homemakers, speedy delivery, ethical sourcing, sustainable production and delivery are becoming key drivers of this once thought of “staid” sector.

In this report you’ll find insights into:

- Why the homeware market shrank in 2022?

- Why homeware has the lowest ecommerce uptake compared to all the other retail sectors

- How Ikea attracts ten times more traffic to its website than its nearest rival?

- Homeware spending across Europe is strongest in Italy, Spain and Romania

- Sustainability is a keen driver of online homeware shoppers

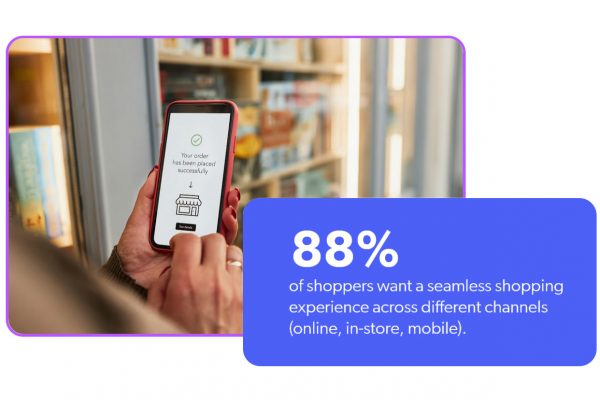

- 72% of homeware shoppers use their smartphones to buy all or most of the time

- Amazon’s successful push into homeware during the pandemic and the growth of marketplaces in this sector

- How this sector is already leading the way in terms of AR uptake and approval

Ikea

In terms of brands and retailers, Ikea, which attracts as much as ten times more traffic to its website than its nearest rival, dominates the European homeware sector. By combining affordability with a wide range and low prices – a combination made possibly by much of its inventory being self-assembly – plays well in the European markets in which it operates and has giving the company a near-universal appeal to all homeware buyers.

Turning over in excess of €40bn, the company accounts for 14% of the region’s total homeware sales – a feat all the more impressive since its next nearest rival, Hornbach, takes just 3%.

While the retailer is active worldwide, Germany is tied with the US as its largest single market, accounting for 14% of its sales. France, the UK and Italy take 8.3%, 6% and 5% respectively, making the retailer a truly European powerhouse in homeware.

Much of its success comes from its low-cost, self-assembly model that allows for lower production and shipping costs to be passed onto the consumers as lower prices.

Amazon

While Ikea may dominate the list of Largest 50 online homeware sellers in Europe as a brand, Amazon is the retailer that most people look at to buy their homeware online. Ikea is impressive with 14% market share, but Amazon comes in at almost three times the size with 39% share of online homeware sales in Europe.

The multi-sector marketplace takes an impressive 39% share of the sector, which is more than double that of Ikea (14%) and way ahead of all other players in the sector. The reason is simple and is the same one why Amazon has come to dominate so many retail sectors: it can offer wide choice, excellent delivery options and very competitive pricing.

Amazon made a particular push into homeware during the pandemic, seeing the sector as a massive growth opportunity. Becoming an effective search engine for homeware – as well as opening up the European region to cheaper, non-branded homewares from China and other regions further afield – has cemented it as a leader in the sector.

The company’s ability to build-in and commoditise cutting-edge technology such as AR-overlays into its general online presence has helped elevate the site to a key player in the sector. This, in turn, has attracted many brands and OEMs in the homeware and furniture market to use the site in order to reach a European audience.

Amazon has led the recent charge of marketplaces entering the homeware sector in Europe. Others on the list of main players are Cdiscount, OTTO and Wildberries – all of which are multi-category marketplaces with significant presence in Europe.

If we were ever in doubt of the importance of Amazon, this report seals the deal and explains why many of the retailers appearing as case studies in this report sell on Amazon as well as their own website.

You can download the full RetailX European homeware sector 2023 report here.

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)