Around 18% of US households have shopped at Temu since its launch according to Earnest credit card data. Nevertheless, Temu has yet to make meaningful inroads with the largest online brands, according to an Earnest Analytics case study on the marketplace. But that hasn’t stopped phenomenal growth and growing Temu customer loyalty – Temu sales grew 840% between January 2023 and 2024, topping 1100% during the holiday 2023 season.

Temu customer loyalty

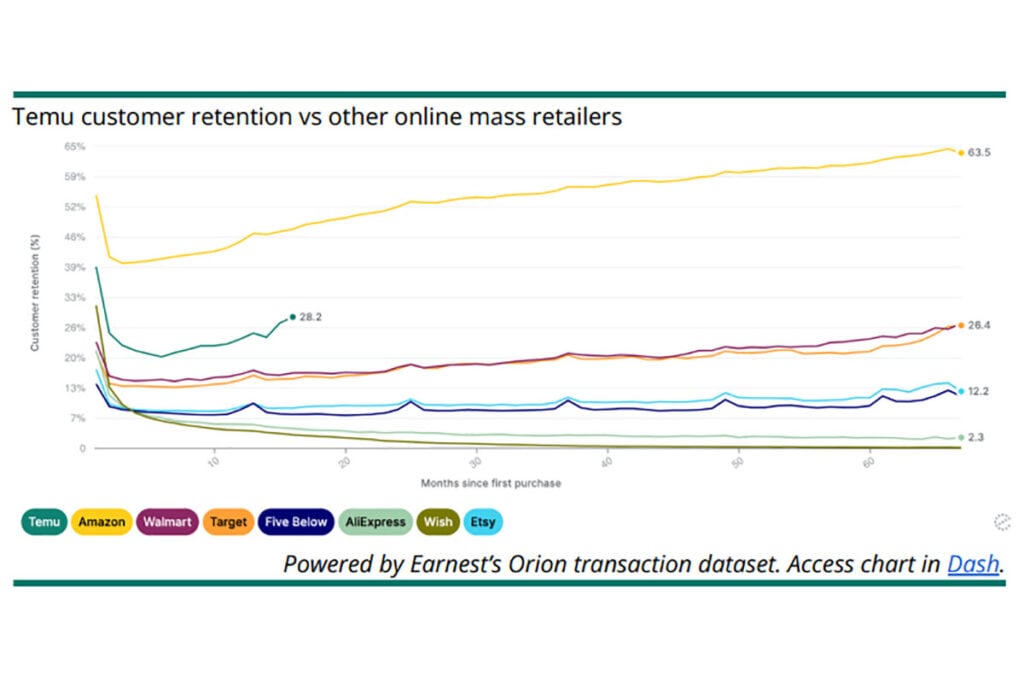

Where things become interesting is when we look at Temu’s customer loyalty and retention rates. Earnest report that over 28% of Temu customers made a transaction on the platform 16 months after their first purchase, and that’s nearly double the rate of Walmart and Target customers, and around half the rate of Amazon.

Temu customer loyalty and retention is key for the marketplace – while they’ve spent millions (billions?) on customer acquisition with deep discounts for a new shopper’s first purchase, eventually they will hit a finite limit on new customers – either everyone has already shopped at Temu or those that haven’t never will, being unattracted to the gamified marketplace and cut price goods on offer. Having well over a quarter of customers still purchasing more than a year since their first Temu spend bodes well for the future.

Where Temu is still lacking is Western brands – the low ASP low quality products that you would once have purchased on eBay or Amazon is where Temu currently excel. If you are buying your gift tags and ribbon for Christmas 2024, you know exactly when it will fall and so the slower shipping times Temu offer aren’t a disincentive, especially when you might pay as little as half the price for the exact same product on Amazon.

With the announcement that Temu will open up to brands in the US and Europe over the next few months, we’ll be watching to see how many Western brands and retailers the marketplace can attract, and whether shoppers will be prepared to pay perhaps higher prices in exchange for local fulfilment which should mean speedier deliveries.

Temu is still in their very early days, and having built up a customer base, which to all intents and purposes a large proportion of already look relatively loyal, the stage is set for Temu to swallow up a larger share of ecommerce in the West and start making inroads into the established brands’, retailers’ and marketplaces’ market share.

To learn more about Temu’s impact on US ecommerce, we highly recommend reading the full Earnest Analytics case study – Analyzing Temu’s Market Impact with Credit Card Transaction Data