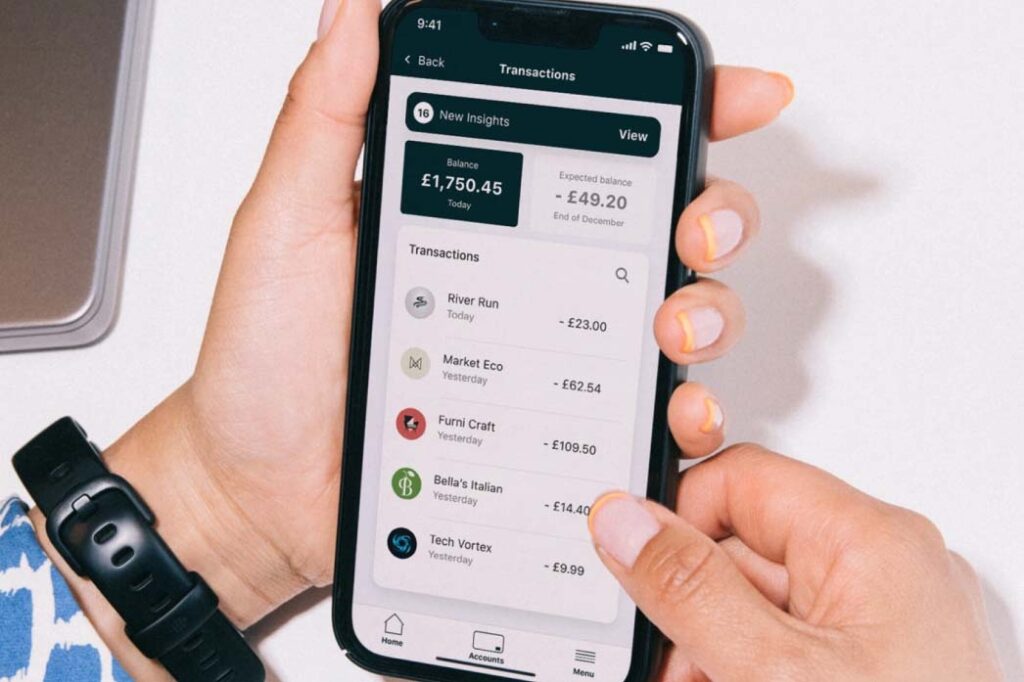

Have you ever looked at your bank account and wondered what the heck a particular transaction was for? I know I have and the culprit is often ecommerce…. when you buy from a website, the merchant you’re purchasing from might have a quite different name on their banking details and there’s nothing to prompt you to remember that late night transaction you made a week ago. Now, Tink is about to revolutionise banking transaction overviews with today’s launch of ‘Merchant Information’.

Merchant Information, a solution within Tink’s Consumer Engagement offering, means banking app transactions are shown with a clear brand name, logo, location, and merchant contact details – reducing the need for consumers to contact their bank to enquire about transactions they don’t recognise.

Merchant Information will enrich card and non-card transactions, providing consumers with a thorough understanding of their spend. Merchant Information will complement Tink’s existing data enrichment capabilities, including categorisation, recurring transaction prediction, and CO2 emissions.

As part of Visa,Tink’s Merchant Information leverages Visa’s global data network of 130m+ merchants as well as other third-party data sources for scaled coverage in 200+ markets. As a result, Tink’s capabilities enable banks to display clear, visually appealing transaction data in their app to drive consumer engagement. This is important as it includes many independent businesses that are part of the Visa network.

Tink’s research shows that 45% of adults in the UK already want their bank to show them more details about their individual payments, such as logo, location and retailer name. With this greater visibility, people can identify their transactions and better understand their finances.

For banks, this means cost savings from reduced call centre enquiries and transaction chargebacks. Tink’s analysis indicates that large issuers can save as much as €22m annually by providing greater clarity to their customers.

Merchant Information includes a series of benefits for consumers and banks:

- Reduce cardholder enquiries: the information simplifies transaction reconciliation, reducing transaction enquiry call volumes

- Fraud prevention: greater ability to deter friendly fraud and improve fraud models through granular transaction information

- A better digital user interface: the structured and clear transaction data drives in-app engagement and helps consumers to better understand and manage their finances

- Increase customer loyalty: clearer information on customer spend enables greater personalisation of services to drive customer engagement

The solution will be available in seven European markets in 2024 with a full European roll out to follow by spring 2025.

By providing a clear and understandable way of presenting bank account transactions, Tink’s new Merchant Information solution is a win-win for all parties. Consumers can easily recognise their transactions, reducing the need to contact their bank for additional information or to request a refund. While for banks, this opens up large potential cost savings, through fewer enquiries.

Banks and merchants are increasingly interconnected in their digital transformation journeys. Tapping into Visa’s extensive merchant data network, we can enhance the customer experience to give consumers the 360-degree understanding of their spend they deserve.

– Jack Spiers, Banking & Lending Director, Tink