I was with my accountant yesterday to finalise my tax return for the 2009-2010 tax period and had an interesting conversation about the economy in general and how that would affect my business over the next year.

There are several factors that will impact me, not least of which is the VAT rise. Increased VAT will impact profits – on stock purchases, on costs such as packaging supplies, and most of all will significantly increase delivery costs as VAT is now applied to many Royal Mail and to Parcelforce services.

What was more interesting was to talk to someone who has a much broader insight to the economy than I do. Whilst I speak to many companies who trade in the ecommerce space, either as online retailer or as service companies, my accountant deals with a much broader array of businesses covering the entire economy.

Without exception he agreed that broadly speaking there isn’t a single market sector that isn’t struggling financially. Most of his clients are at best seeing modest increases in business and profits, but many are seeing profits decreasing and in many cases their entire business contracting.

At the same time as rising costs and VAT increases there are increasing price pressures as consumers and businesses alike push for better deals and the best possible prices. In recent years further pressures from eBay, competition and from the consumers themselves, have driven down carriage costs, in many cases retailers have been forced to offer free or subsidised postage rates.

It’s encouraging to know that it’s not just myself being impacted by the economy. Although external factors are affecting my business I am taking steps to minimise the impact, am not totally reliant on a single income stream, and most importantly am fully aware of the parts of my business that need monitoring closely.

For many businesses however the economy is having a much more serious effect. It’s likely that online retail will continue to outpace high street retail and so eBay and Amazon sellers are at least trading in one of the most resilient market sectors.

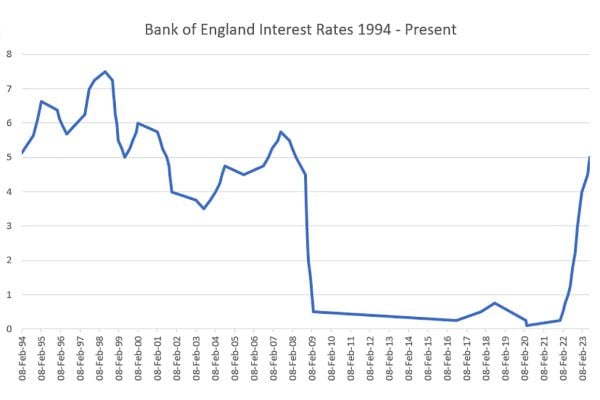

It’s likely that Interest rates won’t stay at their current low rates indefinitely, in fact some are saying that they’re already too low and need to rise. You need to be prepared for both an increased cost in borrowing coupled with less disposable income from consumers who have become accustomed to exceptionally low mortgage payments.

What factors do you see affecting your business over the course of the next 12 months and what steps are you taking to minimise the impact of the economy on your business?

Are you changing your stock profile and if so have you changed the depth or breadth of inventory you hold? Is virtual stock )where you order on demand or drop ship) a part of your business plans? Have you changed couriers or suppliers? Are you implementing software or processes to automate your business to save money.

14 Responses

“I was with my accountant yesterday to finalise my tax return for the 2009-2010 tax period”. Nothing like a bit of planning ahead!

“It’s encouraging to know that it’s not just myself being impacted by the economy.” Why is nobody having any spare cash better than a localised business problem that you might be able to solve?

I am in the services sector and not directly retailing but I am finding that any clients with bricks and mortar retail outlets are moving everything online this year as they can make so much more profit. Clients have for the past year or so being moving to a ‘no company debts’ position as this seems to be a toxic and unstable area for most. OK, it might slow growth, but they won’t have the rug pulled from under them.

Joking aside, ebay are not doing any seller any favours by trying so hard to squeeze all the profit margin out.

My sales on eBay have plummeted so I fail to see how eBay have increased sales. If I can conitue to trade throught this year and survive I’ll adapt my business plan to include trading throught tuff times and keep a lot more cash in the bank as I’m really struggling at the moment and I don’t what to be going through a similar siutuation in the future.

As my sales on eBay have dried up, the quicker my website becomes my main business the better. This year will be a good learning curve and the lessons learnt won’t be forgotten. If I survive my business will be re-modeled for the future, which I’m really optimistic about. The worlds changing and if you want your business to servive, you’ve got to change with it.

The worst thing about the current situation is the negative press which has knocked consumer confidance and stopped people spending their money. Any down turn will be the media’s fault as its the way they like to scare the averange person in the street, which seems to be the only way they can get people to take any notice of them.

I think it is tough out there, but I always think if you can survive this or even start a business in this, you will last longer. If you start a business in the good times you more likely to go under.

We have been working hard to sooth the effects of the VAT rise etc, we have put in place early payment discounts with suppliers, looked for cheaper packaging, stopped free delivery worldwide and just made it the UK and any small changes that will add up across the year.

In a way the VAT rise has been good for us to make us look at all these things.

I also just found out our Paypal fees should of been less as we were over a threshold with them, but thought this was automatic rather than having to apply for it…cheeky Paypal!

Stu

It’s going to be a tough year for sure but not the end of the world unless your badly financed / clueless.

I’m launching a new business on eBay this year even though I loath eBay, the $ is crap and it’s a luxury product but I’m not holding back, I never have and never will listen to all the doom mongers who get paraded in front of the TV.

P.S What John said at 3.1.2 couldn’t agree more.

money to be made when folk are desperate

folk will work harder for less and take less payment for goods, and you dont need to flog your staff half as often to keep them rowing

Our businesses have been debt free since the last economic downturn in the mid 90’s. We learned our lesson well. If it is on the website I own it.

We saw a 30% contraction in 2010 from 2009 which effectively returned us to 2008 levels. I am in the USA so do not have to contend with VAT, we have very inexpensive delivery options.

I think I am going to have to cancel an order for summer season stock with one of my suppliers – not looking forward to that phone call! I suppose we are just all going to have to squeeze our suppliers harder. I wonder whether they would do a sale or return rather than have their order cancelled?