The Bank of England has at midday today increased interest rates to 5% from 4.5%. This is the 13th increase in a row and the shock will hit the economy hard as mortgage payment soar, especially for those about to come off ultra low two year fixed price deals from during the pandemic days.

The indications are of a Bank Rate that averages around 5½% so there could be one or two more rises to come in the near future before the rate stablises.

This is all to do with inflation remaining stubbornly high with the bank’s Monetary Policy Committee remit to bring it under control in the medium term to 2%.

The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework. The framework recognises that there will be occasions when inflation will depart from the target as a result of shocks and disturbances. Monetary policy will ensure that CPI inflation returns to the 2% target sustainably in the medium term.

– Monetary Policy Committee

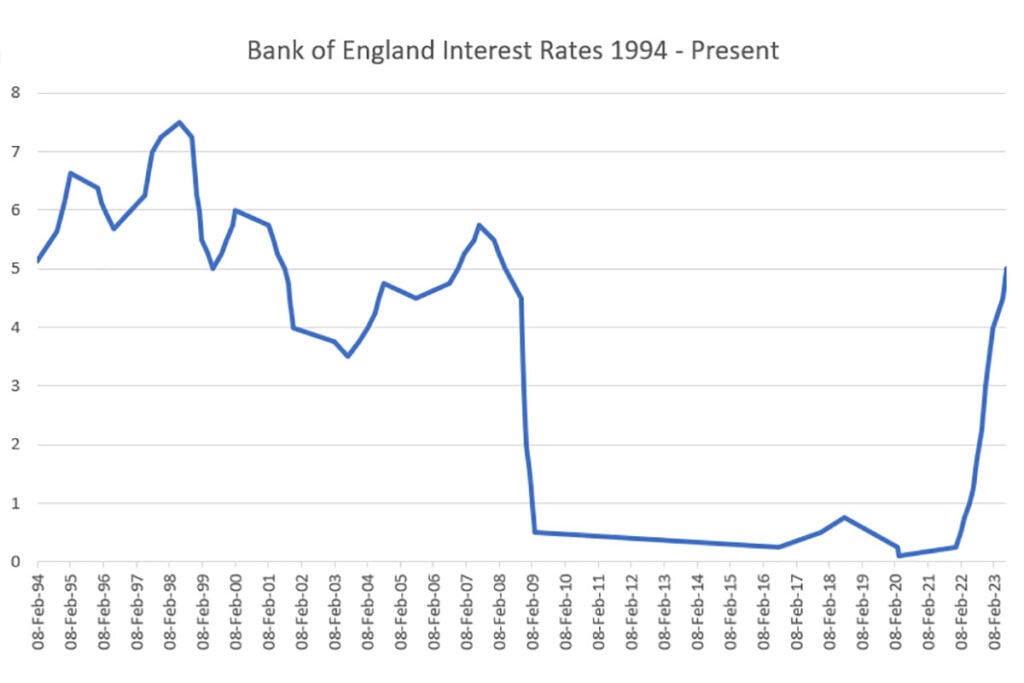

It’s perhaps worth noting that the country has become accustomed to ultra low interest rates in recent years, and that was before the pandemic when they were slashed to unheard of levels. The chart above shows Interest rates from the mid-nineties to today’s rate of 5% and it can be seen that, up until the 2008 crash, a rate of around 5½% was pretty normal. Indeed, if you go further back in time, for much of the ’80s and early 90’s the rate regularly fluctuated above 10%.

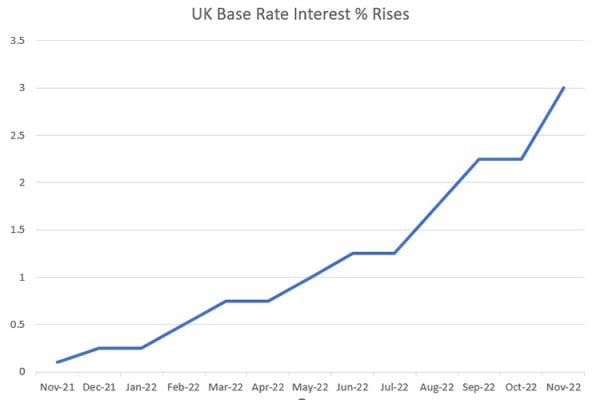

The real problem isn’t the 5% interest rate or the prospect of them averaging around 5½%, it’s the fact that in less than two years they’ve shot up from 0.1% to 5% today and that hasn’t given people time to adjust their spending and budgets to account for the increased levels. It’s been a decade and a half since we’ve seen the level of interest rate to 5% or higher and many with fiscal responsibilities and mortgages today were still under 18 and won’t remember interest rates that high.

Neither businesses nor consumers are ready for these rates and they are going to hurt. Expect muted investment, especially if we do see further rate rises before a drop to the expected 5½% average and expect those with domestic mortgages to be very worried and reduce discretionary spend… indeed most won’t have any discretionary spend left.

It’s not just mortgages that will be impacted, credit card debt just got harder to repay as interest charged will be increased. Interest rates on loans will also rise.

For ecommerce it’s a bleak picture being painted, especially as those on fixed rate mortgages won’t have felt the full brunt of the pain yet – the shock will come as their current deals expire and rather than multiple £30 or £40 pound a month rises that those on variable rates have experienced every couple of months for the past two years, when a fixed rate ends it will result in a monthly mortgage payment increase of many £100s or even £1000s a month.

More money on bills means less money to spend, so consider stock profiles carefully as the next year is not going to be easy.

5 Responses

Putting cash in the bank more profitable than UK eCommerce and less Chinese.

Still lots of dosh out there ,its the poor that this hurts

I get a kick up the backside every every time they do this as I have rentals on variable mortgages ( fortunately low amounts owed) and in Scotland so the Nats have their rent freeze to play popular Politics ( as long as someone else pays with these clowns).

Put your money in bricks and Mortar they said you cannot win in this country.

TBH if it keeps going like this I am going to have to increase eventually but am just trying to hold tight, I don’t want to price out tenants as I am lucky with long term ones.

I had to sign my own house into a new 5 year deal with another kick up the backside.

My wife who runs a property management company is saying sales are dead in the water especially the pricey stuff but rents are in demand. People are running out of spending power unless your rich of course.

Online sales are slow but they always are for me in the summer but it is trickle feed right now.

Everything is overpriced the shopping is outrageous by the time I paid the nursery fees I had £17 left in my current account this month.

Now I do have savings it would be nice if the banks were to give us something on that may effect the greedy sods bonuses.

It’s a mess….it’s a shambles.

We are the lucky ones, most inmates of HMP Great Britain don’t survive 13 years of Toryism

Sounds like you’re relatively asset rich, but cash poor – could be worse, no? If you fell on hard times, I presume you could always sell?

I have a couple of decent long-term rentals, but thankfully I purchased them outright, along with the house I live in, so I’m not affected much by the rates, but even I’m cash poor, and I hardly spend on anything. I don’t know how some people get through the month.