The torpid dinosaurs of the High Street have cooked up a new way of trying to stifle the upstart ecommerce that has been so troublesome to them and their businesses in the past few years. The British Retail Consortium (BRC) is reportedly researching a proposal for government that will call for a new tax to be levied on online traders.

The BRC is said to think that online traders are at an advantage because they don’t have to pay any of the £7bn that bricks and mortar stores do in business rates for their High Street presence. Among the supporters of the plan are Justin King, chief of Supermarket chain Sainsbury’s. No details of the exact proposal are yet available. In particular, there is nothing to explain how “bricks and clicks” businesses (with both an online business and a physical outlet) will be affected.

The founders of Sofa.com have already hit out at the plans in a letter to the Chief Secretary of the Treasury, Danny Alexander saying that a tax on online retail would be “bad for consumers, business, and the UK”. Pat Reeves and Rohan Blacker said: “A tax, if imposed, could be a barrier to entrepreneurship, negatively impact small business, reduce consumer choice and hit at the heart of the UK’s world-leading online retail industry.”

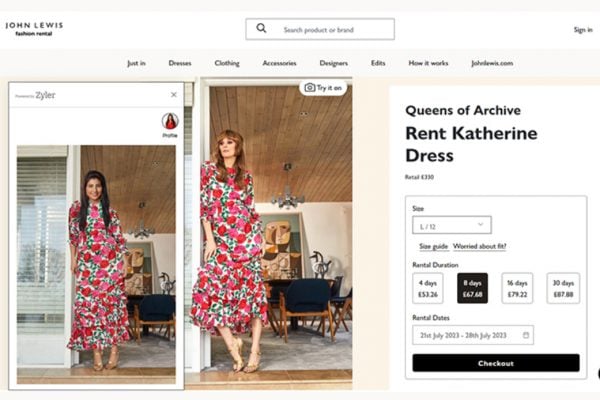

We agree. Let’s be clear. Such a tax would be nothing but protectionism for businesses who have failed to innovate. Retail has changed dramatically in the past fifteen years or so and those who are complaining are likely the ones who have failed to adapt to the brave new world of ecommerce. It’s not as if trading online has come out of nowhere all of a sudden. Some High Street retailers, notably Argos and John Lewis, have surfed the trend and see ecommerce as an opportunity, not a threat.

The idea is also based on a false premise that betrays the primitive view of ecommerce that the crusty old British Retail Consortium clearly holds. Plenty of ecommerce businesses have premises, pay business rates and corporation tax just like High Street chains. Indeed, unlike some on our High Streets, these businesses are unlikely to be off-shored in Luxembourg to avoid VAT at 20% or using other cunning loopholes to avoid paying their fair share. Such business owners owners and staff will likely also be paying income tax and National Insurance.

Tamebay totally oppose a tax on online sales and we hope you’ll join us at the barricades if necessary. The old school retailers want to keep their golden goose for just a little bit longer and it’s up to us to tell them where to stick their tax on online trade.

34 Responses

I’ll be supporting you in opposing it. They choose where to rent premises, and the model of their business.

I’d counter the argument by saying that physical stores have a massive advantage in that once someone walks in their door, they have way better opportunities to show buyers the stock that they want them to see – not something easily done online.

Mark,

You make a good point there. BUT isn’t it funny how few of them do it well? Very few shops these days are pleasurable and engaging places to shop.

Dan

All my clients have WAREHOUSES which require business rates to be paid. I will chain myself to the internet in protest…any day!

This kind of tax will force business out of the UK…and the bricks retail businesses with antiquated models will still fail.

What a daft idea – the UK’s tax rules are complicated enough as it is, without introducing yet another tax!

I will join you at the barricades waving a huge flag!

M

For marketplace traders, we are already paying as much as Bricks and Mortars – we pay business rates on our offices and warehouses, and further to this we pay a hefty fee 15%-50% to the marketplaces.

Perhaps the government could spend its efforts on finding a way to prevent these mega corporations from avoiding the tax that they should pay?

Every retailer has the opportunity to open a ecommerce store – if they elect not to then that is their choice!

Perhaps the ecommerce solution is to ask the government to FORCE all bricks and mortar stores to be open 24/7 365 days of the year? It is unfair that shops are closed when so many of us finish work – I wish they were open? Or perhaps, shopping on line means that this is not a worry?

I do ask the question how some of those suggesting this TAX even got to the level of employment that they are in?

Online retailers support many industries – postal services are one of the big beneficiaries.

Ecommerce rates are – Internet Domain and Hosting fees – Chargebacks – lost mail (difficult for physical stores), storage costs etc.

This is about Amazon. Pure and simple.

If the Government closed all the exploitive tax loopholes and dodges many large retailers are using – and indeed Dave and George’s families – this would be a non-issue.

The BRC really are a bunch of dinosaurs though aren’t they. The issue is they’re sure to have George’s ear because he’s a bigger knob than any of them and he’ll think this is a brilliant idea… :-/

If they think they’ve got it so bad, what’s stopping them from closing shop and joining online retailers?

A similar idea by the National Retail Federation was approved by the US senate in May this year so i’m not surpised that the UK equivalent want to see the same happen here. Anything to ‘kill’ the competition eh?

Is this the same CEO, Justin King, of Sainsbury’s, from one of the big four supermarkets. The very same stores that have done far more damage to small shops and the High Street in the last decade. He should be complaining to the councils for increasing parking charges in town centres, filling the High Streets with bars, estate agents and charity shops which drives shoppers to out of town shopping centres.

I’ve sat on both sides of the fence. I’ve run multi chain retail and now run multi channel e commerce. I prefer e commerce. It’s definitely easier, but that doesn’t mean it’s without costs. The business rates may not be as high as the high street but they are still there. Advertising costs – I never has to advertise in retail. Opening the front door was enough. But online unless you tell people you’re there and regularly remind them, how are they supposed to know. Market place fees – You have to pay eBay/amazon to trade. There are no service charges if you operate on the high street.

One of the things I love about e commerce is I can continuously become more efficient and see results. But this just feels like punishing an industry for being more efficient. How is this even fair. It’s a case of ‘we are the government and we can tax you what we like’! It’s just like the empty business rates charges, doesn’t make sense.

I’m dreading this going further. Tame bay please keep us posted on any developments or actions you may take. Everyone’s words here show that we want to be a part of that.

‘Mind your own business’, Gemma, that should be the campaign headline!

.

I find this quite amazing….

The big PLCs just love to ride rough shot over all in their way.

Out of town shopping mails killed many High streets [accepting Parking. etc’].

Not content with that they move effortlessly into our local neighbourhoods taking over from small family business that they kill in their wake.

Within a 1 square mile radius we have over 23 Tesco stores in my area. Not to mention all the others.

All the main big boys have online presents.

It short of reminds me of the original £ shop. They were all independents working on tight margins.

Along comes. £ Land. £ world. 99p stores etc & many smaller competitors just cannot keep up.

Having said that a local £ shop does very nicely ‘thank you’. Mind you when they [The £lands etc] first opened they struggled but now have opened another shop adjacent to the first shop are OK and this is purely because ‘small’ can adapt & change quickly & effectively outmanoeuvre the big PLCs. The Multi nationals cannot move so quickly.

All the big £ shops are in fact very similar in concept & products sold.

I think one of the BRC grips is that most online sellers are smallish operators who really don’t see the benefits of BRC membership.

I notice someone above said this happened in the US. What was the outcome of that?.

Let me get this straight. The BRC are calling for a specific Sales Tax on Online Traders? Up until now the Taxes such as VAT or indeed Business Rates are for specific things such as selling specific goods or the use of specific assets such as a Building.

If the intention is to tax because of using the internet it would be like taxing us for sitting in an uncomfortable Warehouse etc. Surely what is needed is a specific Sales Tax(on top of such as VAT) that would be paid by ALL Traders whether on the High Street or the Internet. Then there would be no discrimination involved. It would be fair across the board. BRC Members would pay it on their Sales just as we who sell on the Internet would.

Might I suggest that the BRC might not be so keen if they thought that they were calling for a Universal Sales Tax to be paid by their Membership as well.

In regard to the suggestion about High Street Stores being forced to open 24/7 there is the problem with Sunday Opening. Its not that long ago that there was a fight to make Sunday Opening Legal. The big traders all would love to open longer(perhaps not 24/7) on a Sunday but the Law states that Sunday Opening is limited to 10am to 4pm.

If the suggestion was to be made for longer Sunday Opening there would be a great outcry from numerous Religious Groups as well as the Shop Workers Union. The 10am to 4pm is a compromise that works reasonably well. But there are Religious Groups who would like to stop Sunday Opening so that we could all go to Church and then watch TV on a Sunday.

We get away with 7 day a week opening because, for the most part, we are Self Employed and not located in High Street Shops. If we were in High Street Shops and opened our doors to the Public on a Sunday on the hours that we often work then the Local Council would show signs of interest in our activities.

I completely disagree with this tax – and think that the BRC are completely out of touch with regards to bills that E-commerce pay. – We do pay business rates, – including business rates for parking spaces for our staff, we do pay commissions on certain channels, – why they think we have an advantage is unbelievable – we have different costs, (postage etc)- that bricks and mortar do not have. We are servicing the 21st century customer that wants to shop at 3am – how many shops in town centres open at 3am ?

BRC Membership, have a quick look here:

https://goo.gl/IzsWM

The third comment in is from Alan White, Chief Exec., N Brown Group PLC:

“The BRC is the most influential organisation for all home shopping and online retailers where the existing regulations are often inappropriate for this dynamic and fast-growing channel.”

Knickers twisted?

Perhaps Tamebay would like to ask Mr White exactly what he thinks of the ‘reportedly reasearching of the proposal’?

If High Street retails want to go backwards instead of embracing the internet lets go all the way back to 1696 and impose a window tax on the number of windows within a bricks and mortar shop.

They can reduce this tax by bricking up windows as happened in England during the 18th and 19th centuries and if they brick all the windows they will cease to be shops and become warehouses and can then commence to sell on line.

Simples!

tax fees and feedback guaranteed to get the blog page hits up lol

The Internet is the new High Street.

It’s just a digital construct instead of concrete and tarmac. Virtual Real Estate still costs money; sites have to be be built, maintained, managed 24/7, updated, refreshed, stacked with engaging content, displayed to best advantage across multiple platform windows.

To lead the market is no less effort than in physical stores..It takes paid expertise, time, staff, salaries, and management thought. It’s a different set of technicians, builders and experts to establish a successful online business but equal set of pitfalls, hazards, competition, market research, advertising, and sales effort. With online businesses there are no guarantees unless you keep up.

Same issues – new medium.

So lets get this right. They’ve a marketing channel and sales opportunity that online retailers don’t have – a bricks and mortar store with face to face customer service and they want us to pay a tax because we don’t have this channel.

There’s nothing stopping traditional retailers opening a website – why don’t they concentrate on that rather than knocking the competition.

Utter bonkers. Another example of the British disease of giving a success story a good kicking.

With no disrespect, I must say if they want to do it they will do it !

Look at what happened the past and remind me one PLANNED TAX RISE that was stopped.

Which companies own most of the busiest ecommerce websites and the top mobile sites in the country?

Yes that’s right… high street retailers! Enough said!

In a way we do pay for bricks and mortar. As an ebay powerseller working from home and paying a mortgage my loft is my warehouse, the Royal Mail my distribution network and ebay my shop front window. Sounds simplistic but this is how a huge number of ebay businesses work.

What a bunch of rent seekers. Nobody owes them a living.

Ludicrous idea! It would disadvantage British ecommerce in the World. We have suffered enough from the slow broadband speeds in this country over the years. If those BRC members can’t adapt, then they deserve to fail.

We have costs unique to online sales.

This is a backwards step, encouraging more people to shop on the high street it will clog the streets even more, parking would be impossible and the environment would suffer from all those extra car journeys. I think these high street stores should be made to pay an environment/pollution tax.

Guess which supermarket has just lost a customer, permanently!