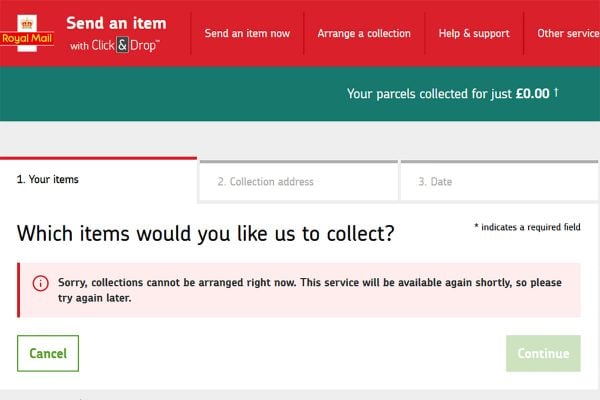

I noticed this evening in my local boozer that people weren’t able to pay with their cards. It soon became clear that it was just Natwest and Royal Bank of Scotland customers who were blocked and I realised we’d been here before. The same bank has had trouble in the past.

It seems that last night, from approximately 6pm until some time after midnight (exact timings haven’t been revealed), customers with RBS/Natwest couldn’t pay using their cards or withdraw money from cash machines.

That means on a dull Cyber Monday night that many shoppers won’t have been able to pay for their online orders with the speed and ease successful ecommerce requires. And that’s a huge blow.

In lots of ways. Cyber Monday is just a PR construct, a media hook for stories and coverage on how this Christmas will be the biggest blah blah ever, selling the most wotsits since whenever using a new technology etc. It’s not really real in the same way Black Friday stateside is.

But it does serve a useful purpose: it’s about getting everyone in the mood for spending that Christmas wedge on presents. The November pay cheque has cleared, and it’s now or never to start stockpiling those gifts.

So whilst Natwest/RBS might try and excuse themselves by saying their technical difficulties only lasted a few hours, they would be missing the point. Who knows how many transactions were aborted? How many sales weren’t made? How many online shopping carts were discarded?

On a big shopping day like today, and with many millions using Natwest/RBS services, it’s not hard to tot up an estimate of lost sales in the tens of millions of pounds. Maybe even more. That’s bad news.

And in any case, that a big bank should leave customer accounts crippled (again!) because of a tech error in this day and age is utterly shameful.

We can only imagine that bonuses won’t be paid to the relevant executives after yet another tech cock-up at Natwest/RBS… after all, Christmas is the time of year when we can all wish for miracles.