In less than five days eBay and PayPal will be separate and independent companies. Here’s how the split is going to work. It’s expected that the separation will be complete on July 17th at 11:59:59pm EST.

The final hurdle has been jumped: the European Central Bank (ECB) gave its approval for the split earlier today.

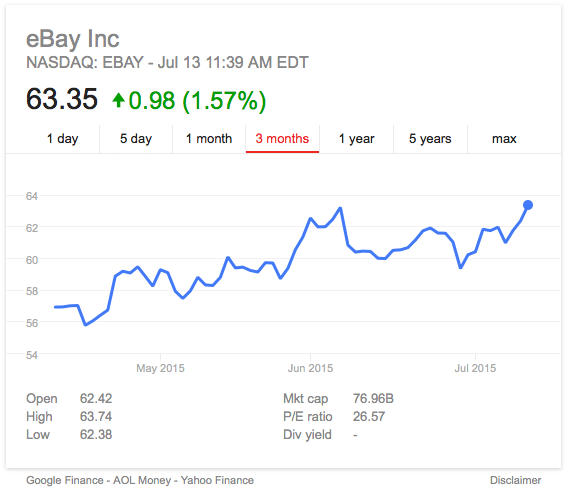

eBay’s stock continues to do well. (It’s been on the up since the split was announced.)

That’s partly because of how the split will be administered. To be in on the deal you need to be an eBay stock holder at the point of split. Then, for every eBay share you hold, you will be given a PayPal share.

Monday 20th July will see the first day of trading of the stock of both companies. PayPal will once again use its PYPL ticker sign on the market.

It’s when trading starts that we’ll get some sense of whether the the architect of the split, Carl Icahn, is right in his belief that eBay and PayPal are cumulatively worth more when traded separately. He has significant holdings in eBay and stands to make a very tidy sum if he’s right.

From a buyer and seller perspective, there shouldn’t be any noticeable change in operations at this point. AS eBay Inc. President and CEO John Donahoe said earlier today: “eBay and PayPal are two great businesses with extremely bright futures — as independent companies, their sharper focus and increased flexibility will improve their ability to pursue their respective market opportunities and strategic priorities.”