Amazon have for the first time broken subscriptions out of their financial results which gives an indication of Prime growth. Subscriptions are bringing in a touch under $6.4 billion ($6,394,000,000).

In a note, Morgan Stanley’s Brian Nowak figures about 90% of this income could be attributed to Prime subscriptions which would roughly translate to 65 million Prime members worldwide.

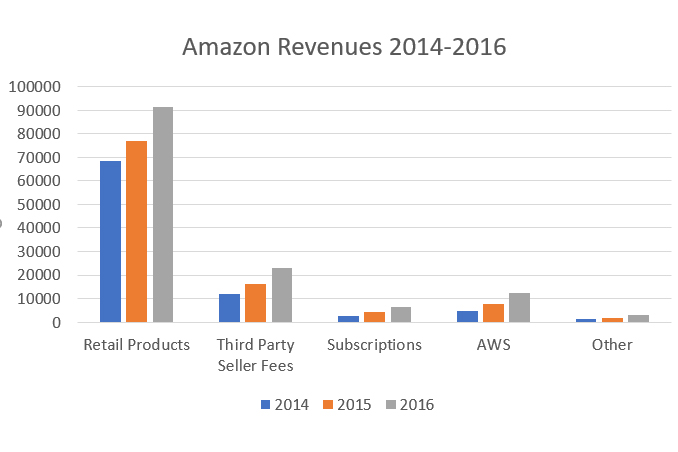

Looking at Amazon’s sales figures, on all reported metrics Amazon are doing well (all figures on charts are in 1,000s)

Amazon Retail Revenue

Amazon’s retail sales include electronics and general merchandise as well as media products available in both a physical and digital format, such as books, music, video, games, and software. Basically pretty much anything that you add to your basket to buy.

Although this is the lions share of Amazon’s inventory, it’s perversely probably the least profitable percentage wise, as they have to actually buy the stock.

Amazon Third Party Seller Fees

Amazon’s income from third party merchants includes sales commissions, related fulfillment and shipping fees, and other third-party seller services.

With revenue from third party merchants growing at around 43% in the last year, it’s reasonable to equate that to sellers turnover on Amazon increasing by the same amount.

Is your Amazon business growth rate at 40% or higher?

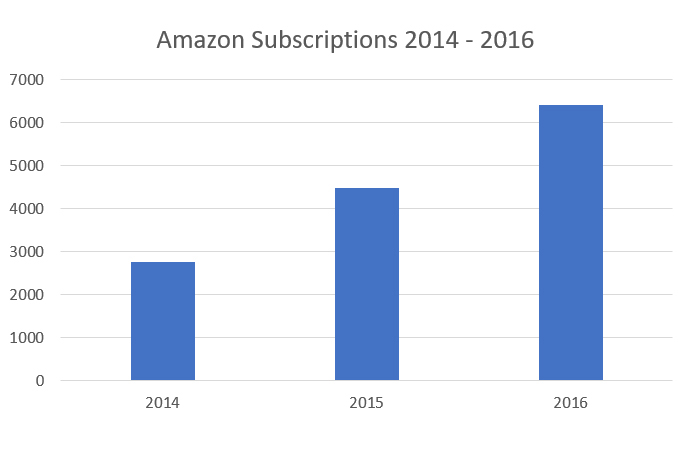

Amazon’s Subscription Services Revenue

These numbers include annual and monthly fees associated with Amazon Prime membership, as well as audiobook, e-book, digital video, digital music, and other subscription services.

Amazon have a problem here, fees from subscriptions are growing, but the growth has slowed from 61.7% in 2014-2015 to 43.1% in 2015-2016. People are still signing up for Amazon services but not as quickly as they have done in the past.

It’s well known that Prime members spend more on Amazon than non-Prime members, so to keep the retail and third party sales velocity moving in the right direction this is a key metric and actually pretty bad news.

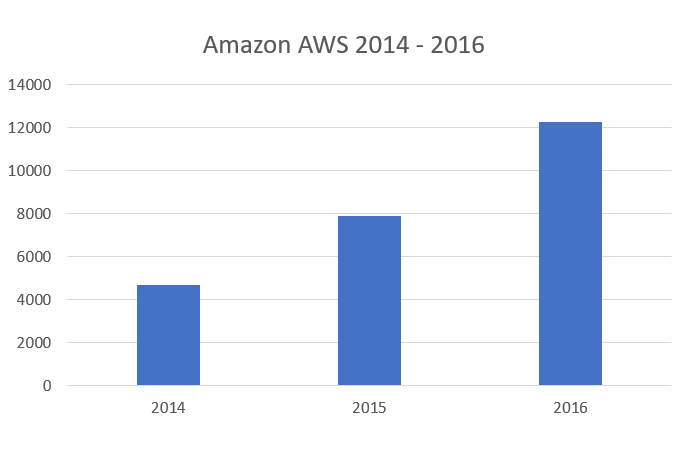

AWS Revenue

AWS offers cloud-computing services that can be purchased as an on-demand computing platform.

It’s interesting to note that AWS is now a $12 billion a year business and turning a profit of between 20% and 25% each year. It’s massively profitable and in reality AWS users are simply subsidising the computing platform Amazon built for their own use.

Amazon are good at building internal tools and then selling them – AWS is one, another is their FBA program which allows third party merchants to store product in Amazon’s warehouses. Also worth noting is Amazon Logistics as a service Amazon are starting to supply to self-fulfil Amazon Prime merchants.

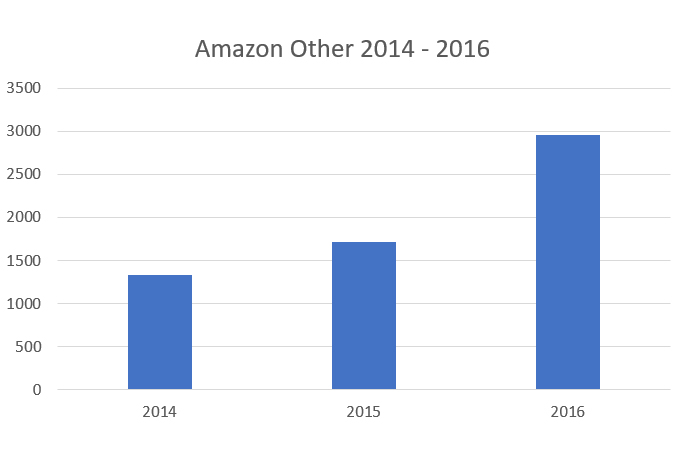

Amazon’s Other Revenue

Amazon’s ‘Other’ revenues include sales not included above, such as certain advertising services and co-branded credit card agreements.

The thing I find most interesting about ‘Other’ is that there’s one other sector of Amazon’s business which is deemed unworthy of mention. Amazon recently announce that 33 million consumers had used Amazon payments on third party (off Amazon) website. Amazon Payments still don’t appear to be generating sufficient revenues to call out individually, although doubtless the costs are in part recouped as a component of the Seller Fees third party merchant’s Amazon sales.

Amazon Total Revenue Growth

Amazon’s total revenues grew 20.2% from 2014 to 2015 and 27.1% from 2015 to 2016. Overall, all business segments are growing, but whilst the world is in awe of Amazon’s subscription revenues which are broken out for the first time, analysts and sellers alike should be more concerned that Prime adoption is slowing.

4 Responses

“$6.4 billion ($6,394,000)”. Suspect that must be “$6.4 billion ($6,394,000,000)”. Interesting that Prime adoption is slowing.

Our growth rate certainly hasn’t been 40%. In our experience the levels of competition on Amazon has also increased dramatically so while Amazon is growing, the share for 3P sellers is spread across many more sellers.

I would be interested to hear if others feel the same or whether it is just our sector. Can also never rule out it is something we are doing wrong.

Thank you Chris. More like this please please please. Tired of sponsored content 🙂