Following last week’s news that eBay are to reduce reliance on PayPal and introduce their own eBay Payments Platform, as their joint Operating Agreement nears it’s end we ask what benefits will buyers and sellers see?

There are many clauses which mean for the next few years eBay will still have to put the majority of payments through PayPal but by the mid 2020s there’s little reason that eBay couldn’t be totally free to have rolled out their own internal payments worldwide.

Perhaps the most interesting part of eBay’s announcement is also the biggest slap in the face for PayPal. eBay say that for both buyers and sellers greater choice is the big selling point of the new eBay Payments Platform. PayPal has always prided itself on making payments easy so suggesting they offer limited choice has got to hurt.

For sellers:

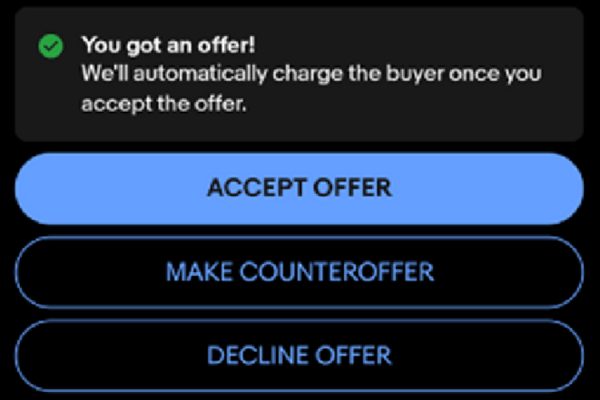

- Greater Buyer Reach and Improved Conversion. By offering buyers more choice in how they pay and expanding payment options into more geographies, eBay believes sellers will be able to reach more buyers and improve conversion.

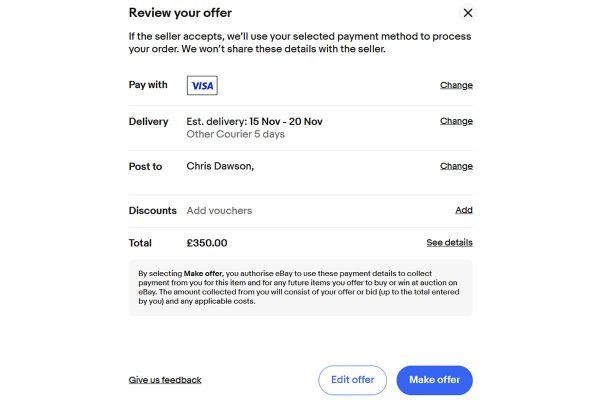

For buyers:

- More Payment Options at Checkout. eBay is focused on providing consumers greater choice in payment options at checkout.

– eBay Payments Announcement

Greater payments choice should and sellers alike – whilst in the UK paying by card is customary that’s not the same around the world. Even in our neighbouring European countries other payment options would be the buyer’s first choice, for instance in Germany they prefer payment on invoice or online banking. Offering local payment choices which buyers prefer should reduce barriers to selling.

On the plus side eBay have indicated that payment processing fees will be lower once the eBay Payments Platform replaces PayPal although they’ve not confirmed the actual rates yet. This should also please investors as undoubtedly eBay will take a cut of the profits which currently end up in PayPal’s coffers.

eBay Payments Platform – What to expect

To discover what types of payments may be offered around the world we only have to look at the options supported by Adyen who will be eBay’s primary partner for payments processing globally.

Payment methods supported by Adyen in major territories

Europe

The UK

Visa, Mastercard, BACS Direct Debit, Paypal, American Express.

The interesting payment method here is that for the first time eBay payments could be pulled directly from the buyer’s bank account on a variable direct debit. This would also mean payments were backed by the Direct Debit guarantee adding additional security for buyers.

Germany

Sofort, SEPA direct debit, Giropay, Paypal, Klarna, Visa, Mastercard, RatePay.

Two particular payment methods that Adyen offer in Germany stand out – Giropay which has real-time transaction confirmation and Klarna which will be loved by Germans who like to pay on invoice after delivery.

Klarna is also available through Adyen in Denmark, Finland, The Netherlands, Norway and Sweden.

France

Cartes Bancaires, Visa, Paypal, Mastercard, American Express.

Cartes Bancaires is the French local card scheme and the most widely used payment method in France, used by some 94% of the French population. More than 95% of French cards are Cartes Bancaires cards co-branded with Visa and Mastercard.

Russia

Visa, Qiwi, Yandex Money, Paypal.

Russia is a prime example of a major market in which credit cards are not dominant. In fact cards represent only a small share of the online transactions. Instead, the most popular local payment methods are cash-on delivery, online banking and e-wallets. Yandex.Money isthe most popular e-wallet with top-up options including prepaid scratch cards, plastic cards, online banking and cash.

North America

US

Visa, Mastercard, American Express, Paypal, Discover.

The US has a relatively straightforward payments environment, dominated by cards.

Canada

Visa, Mastercard, Interac Online, American Express.

Cards are the preferred payment method and Interac is a local direct debit scheme which also supports online banking, which can also be used for online purchases.

Asia Pacific

Australia

Visa, Mastercard, American Express, Paypal, POLi.

Cards dominate in Australia and Adyen also offer POLi, an online banking method offered in Australia and New Zealand.

China

Alipay, UnionPay, WeChat Pay, Visa, Mastercard.

The top 3 payment methods are Alipay, UnionPay and WeChat Pay.

India

Visa, Mastercard, Online Banking, American Express.

India has traditionally been a cash-dominated economy, with cash and cheque accounting for 85% of payments. Cash on delivery still accounts for 60% of ecommerce payments.

Japan

Visa, Mastercard, Konbini, JCB, American Express.

Cash on delivery is popular and made possible with Konbini, which allows customers to pay for online purchases in 24/7 convenience stores. Local credit card JCB is also popular, as are international credit cards.

South Korea

Visa, Mastercard, Bank transfer, Korean Cards.

The average South Korean shopper holds an average of four credit cards, and around 80% of online transactions are card-based.

Latin America

Brazil

Visa, Mastercard, Boleto, Elo.

Credit Cards representing around 45% of 200 million active cards in Brazil. Boleto Bancário, a cash-based payment method, is also popular, especially with customers who do not have a bank account. Up to 80% of all ecommerce payments are made in installments.

Mexico

Oxxo, Visa, Mastercard, Paypal, American Express.

Installments for card payments are also popular but a domestic entity is required to support this type of payment.

One Response

Litepay?