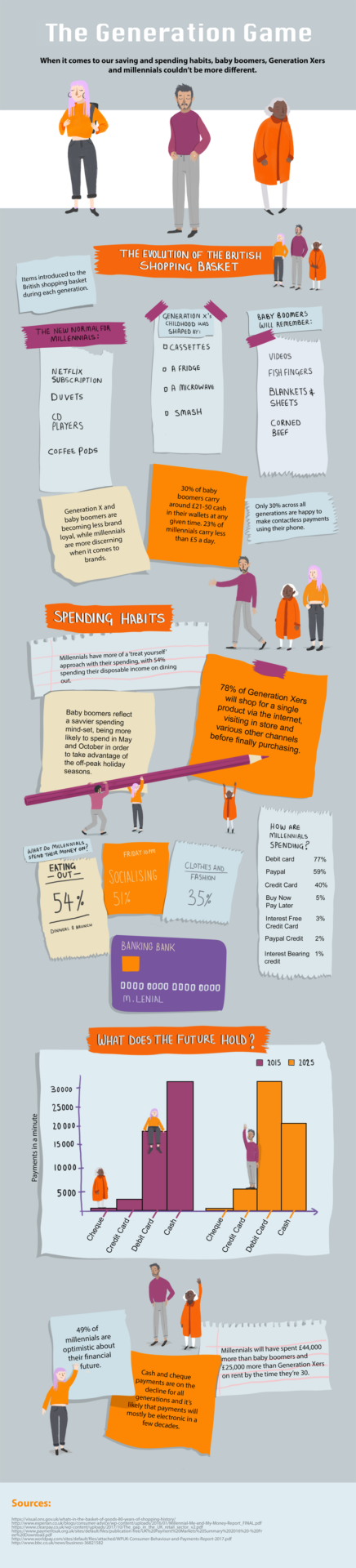

Sainsbury’s Bank Money Matters have examined how the financial habits of different generations compare, with some interesting findings which they have presented in their Generation Game infographic and plastic appears to be king.

The most interesting finding in The Generation Game is that cash is slowly losing ground, not as you might expect to contactless mobile payments, but to debit cards. It’s most likely that payments will be mostly electronic for all generations within a decade.

What is surprising is that only 30% across all generations are happy to make contactless payments using their phone. This may be in part due to the fragmented market for mobile payments – Barclays refuse to pay nicely and don’t support Google Pay, Vodofone recently scrapped their mobile payments offering (which included a PayPal integration).

PayPal have mobile payment solutions to enable Small Businesses to accept payments on the go in the shape of their PayPal Here card reader, but you would have thought by now that they would have made the PayPal app a contactless enabled wallet if they’re serious about getting consumers to pay with PayPal in their daily lives as opposed to online. Whilst Small Businesses can accept payments, the majority of consumers making those payments will be using debit cards.

With the exception of the move away from cheques, and to some extent cash, to debit card payments, offline consumer spending hasn’t really changed much in the two and a half decades that main stream ecommerce has existed. Online there are a plethora of payment methods but offline, although cards have gone to Chip and Pin and then to contactless for smaller sub £30 payments, we’re still living in the plastic fantastic age.