As Brexit uncertainty continues, online sellers may wish to think about looking further afield for new retail opportunities and selling to Japan may be an ideal market to consider. Foreign exchange experts Currencies Direct today share some insights into the Japanese market and why you might consider it.

An established ecommerce market, Japan came fourth globally for highest e-commerce turnover in 2015, with retail ecommerce sales amounting to around US$ 90bn. The country has a well-developed logistics and telecoms infrastructure and some 91% of the Japanese population use the Internet so it’s ready to exploit.

Japan has the highest digital buyer percentage in the Asia-Pacific region, with 77 million digital buyers in 2015 – expected to surpass 80 million in 2018. Product return rates by consumers tend to be extremely low but Japanese buyers are extremely demanding requiring more in depth product information up front – they’ll research before they buy so your listing description will need to be much more detailed than you are accustomed to in Western markets.

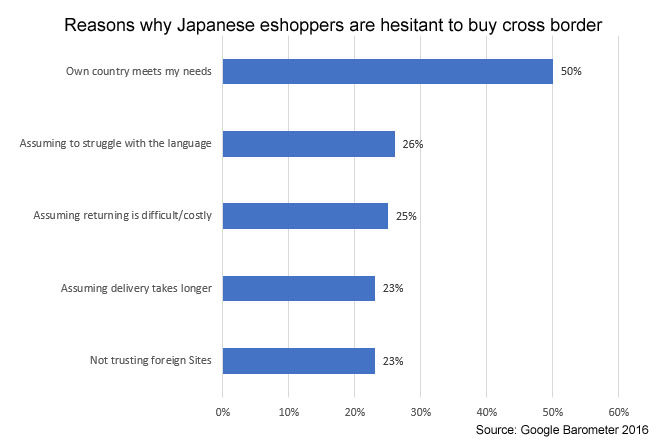

There are a number of challenges to selling into Japan though and it’s important to overcome cross-border reluctance when it comes to buying from international suppliers. Language, delivery, returns and trust are top issues when Japan’s ecommerce network can’t fulfil a buyer’s needs.

Japanese customers have high expectations. You can’t just translate your UK or US website, you have to recognise the requirements of Japanese shoppers and reflect the cultural differences. Having Japanese language capability is a key consideration as is ensuring that you meet Japanese legal and tax requirements.

International brands are popular in Japan and brand capital is all important. Japanese consumers are likely to be loyal to a brand if quality and product features meet their requirements, these considerations drive purchasing decision rather than price.

Finally become familiar with the importance of online marketplaces. They are almost essential for international sellers to enter the Japanese market. Japan has three established marketplaces: Rakuten Ichiba, the largest, with a market share of around 27%, Amazon Japan with 12% and Yahoo Japan with 6%.