eBay shares shot up around 5% immediately they released their third quarter earnings. Despite previous best friend PayPal citing a ‘softness’ in their eBay business and suggesting eBay revenues only grew 3%, eBay unveiled a 6% revenue growth to $2.649 billion and net income of $554 million.

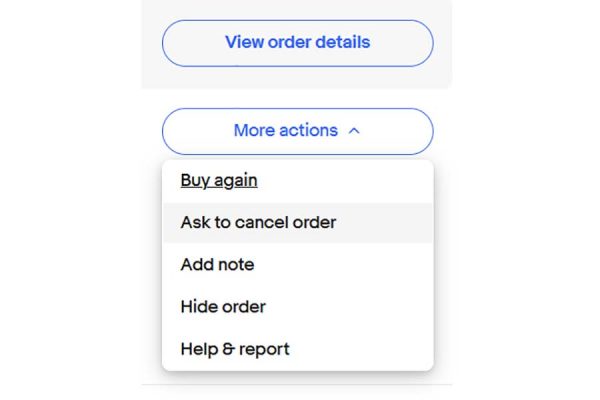

Unlike Amazon, eBay also forecast a better than expected fourth quarter reassuring investors which is being reflected in the rise in eBay shares – especially after recent losses due to PayPal’s comments which now could appear to be sour grapes as eBay prepare to roll out their own eBay managed payments solution.

eBay revealed that they have now intermediated $38 million of GMV through eBay Payments – still a tiny amount but an additional $18 million since the last reported number.

eBay also completed the sale of its equity investment in Flipkart, representing net proceeds of nearly $1.0 billion and flipped the money by repurchasing approximately $1.0 billion of eBay common stock in the quarter.

“This quarter we continued to make foundational investments to improve the long-term competitiveness of our marketplace while setting the stage for significant growth opportunities. We will continue to innovate the customer experience while executing our growth initiatives in Payments and Advertising to position eBay for future success.”

– Devin Wenig, President and CEO, eBay Inc

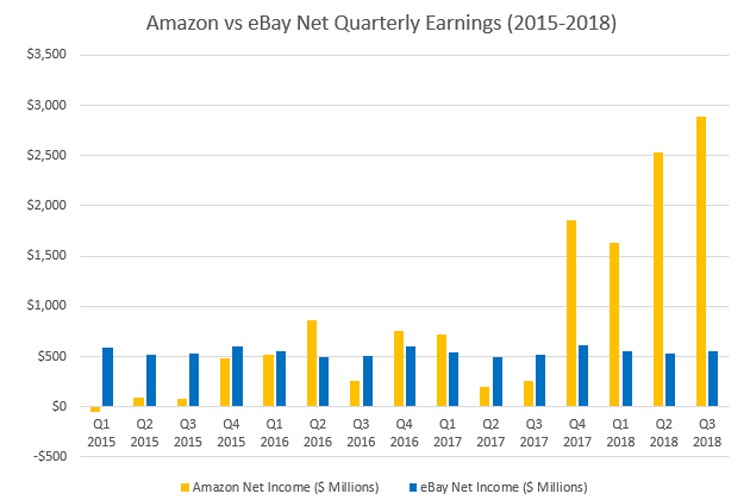

In real terms, eBay’s revenues are up about half a billion on the same time three years ago whilst net income has barely shifted (up $35 million).

”

Comparing eBay’s net income with Amazon‘s reveals that eBay’s is still relatively flat whilst Amazon continue to grow profits which are now over 5 times as large as eBay’s.