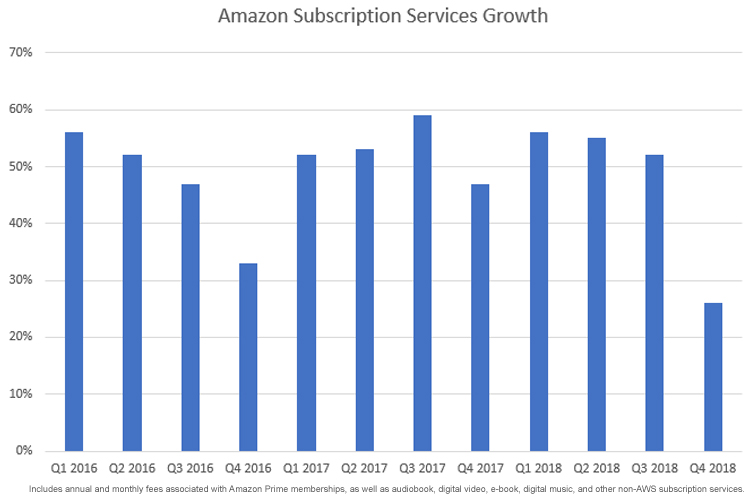

Amazon subscription services growth slowed in Q4 2018 so this is one to watch when Amazon announce their quarterly earnings on the 25th of April. The graph shows Amazon Subscription Services quarterly year on year growth.

Amazon subscription services include annual and monthly fees associated with Amazon Prime memberships, as well as audiobook, digital video, e-book, digital music, and other non-AWS subscription services. It would be fair to assume that the bulk of these subscription fees consist of earnings from Prime membership fees.

Currently it’s estimated that there are around 103 million Prime Subscribers in the US and it would appear likely that domestic US growth will slow in the future. Amazon have probably signed up just about every one who wants a Prime subscription and to attract those that haven’t starkly different new services will be needed. If free shipping, Prime video, photo storage, Kindle benefits and grocery discounts aren’t enough then more of the same doesn’t appear likely to be a big enough incentive to attract new subscribers.

The US population is a touch over 327 million but if you exclude those least likely (the oldest generation) or who can’t (children) sign up for membership then the addressable population is likely to be in the region of 190 million. Bearing in mind that Prime membership can be shared with family members the true addressable population will be significantly less and so taking into account the 103 existing Prime members there simply aren’t many people left to tempt into signing up.

Internationally the picture is very different and as Amazon open up new territories around the world new Prime Subscribers will come online. What matters to merchants however are the Prime members in countries that they target for sales.

Significantly fewer merchants sell in the new Amazon countries, let alone have their products in FBA meaning that Prime subscribers are more likely to purchase from them, than in the European and US Amazon marketplaces. This means that the most highly engaged Amazon customers that merchants can sell to will grow more slowly in the future.

In Q4 2018, Amazon Subscription Services growth slowed to 26% – the lowest since Amazon started reporting numbers in 2016. If this trend continues it could signal that Amazon marketplace sales growth could also slow in their developed territories and that’s bad news for merchants. However don’t write Amazon off, just because growth in Prime membership and potentially growth in sales slows, they are still growing fast and 26% growth is not bad… it’s just less than we’ve been used to in the past.