Back to school is the third biggest peak in the UK after Black Friday and Christmas, presenting merchant an early opportunity to cash-in on the increased shopping demand, says new Back to school report by MIQ.

According to the report, total UK spending on back-to-school shopping topped £1.63 billion last year. That’s up by 11% in 2017 as consumers spend reached an average of £533 per household.

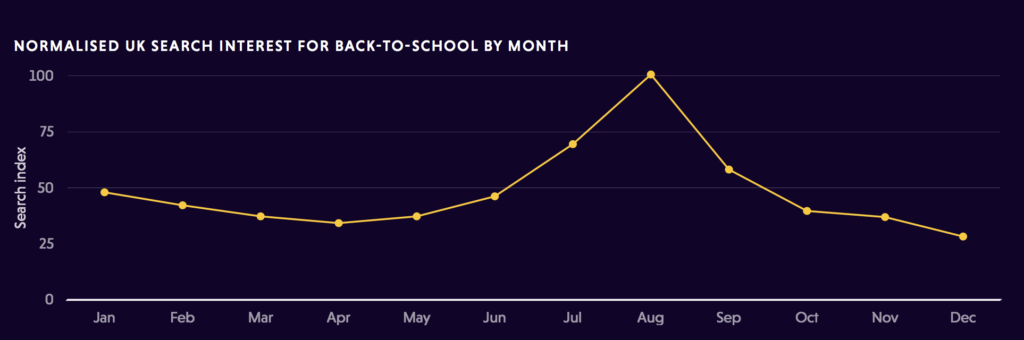

UK consumer spread back-to-school shopping over August

The majority of UK schools will start in the first week of September this year, with the exception of schools in Scotland, which are likely to start 10-12 days earlier to accommodate a longer break during the winter holidays. When conducting their back-to-school shopping, UK parents are similar to their American counterparts, in that they are likely to begin their shopping

Most UK back-to-school shopping takes place in-store

Although just as price-conscious as US consumers, UK parents are less likely to conduct their back-to-school shopping online. Supermarkets and big-box retailers see the bulk of back-to-school shopping activity during the season, and only 14% of UK back-to-school shoppers will shop at an online-only retailer, despite more than one-third of UK households having Amazon Prime subscriptions.

While the bulk of purchases may still happen of in-store, online remains a vital part of the equation for retailers. The majority of consumer research around deals, offers, sales, and prices will still occur online.

Last year, the report captured more than 32 million opportunities in July alone to reach parents searching for back-to-school deals, both prior to visiting a retailer and while they were in a physical store location. Marketplace sellers with an online presence need a strong online strategy and a way to reach parents conducting this research to ensure they don’t lose a sale to a competitor at the point of purchase.

The UK back-to-school audience: What will they buy?

Early shoppers

Among the 52% of back-to-school shoppers who plan to wrap up most or all of their shopping by the end of July, early shoppers are looking to stretch their budgets and capitalise on early deals and sales.

They believe that the best deals will happen before the season even starts, but don’t necessarily conduct thorough research prior to making their purchases. Early shoppers are likely to spend twice as much as research shoppers on clothing and apparel.

Women outnumber men two to one in the early shoppers’ segment, and younger shoppers in this category are 1.7 times more likely to make a purchase early and without researching the product. While shoppers in this segment will spend more over the entire season than a research buyer, they’ll make more trips to stores, both online and of offline, and spend less in each individual transaction.

Capturing early shoppers

The challenge is to reach early shoppers before they’ve made their first shopping trip. Sellers can start promoting back to school products early. They can also look at building predictive models that will identify consumers with a high likelihood of being early shoppers based on their online activity and demographic profiles.

Research shoppers

Research shoppers spend significant cant time and effort before making a purchase, browsing multiple sites, comparing features and prices, and hunting for the best deals.

Compared to early shoppers, research shoppers skew more male and will make more than twice as many visits to a retailer’s website before making a purchase. Two thirds (68%) of shoppers in this category have a household income between £40k and £75, and 63% will conduct some of their back-to-school shopping at supermarkets, with Tesco being the most common (43%).

Attracting research consumers

Because of their online activity, research shoppers are easier to identify and target online than early shoppers. However, it can be more difficult to capture as they are more likely to be swayed or conquested by competitors offering better prices or deals.

Sellers who want to capture research shoppers will need to go beyond targeting and provide compelling reasons for them to shop, which may include personalised deals or offers. One way to do this is with dynamic creative that presents personalised products to the consumer, ideally those that have already been researched or viewed.