A new age of retail has emerged over the last decade – ecommerce. This age is characterised by a richly textured digital landscape, buzzing with new technologies, devices and online communities which has gradually overshadowed analogue consumerism.

Seismic shifts have fundamentally changed how consumers research, purchase and

consume products from retailers of all sizes, types and across all channels.

An array of varied touch-points influence, enhance and intelligently ‘nudge’ shoppers through an ever-expanding number of paths to purchase, from increasingly personalised social media campaigns to stockless stores where merchandise are viewed through augmented reality apps.

Successful sellers have always had to reinvent themselves throughout history; the most successful listen to their customers, embrace change and invest wisely for the future.

However, the race to digital transformation is occurring at such apace; many merchants are struggling to keep up with disruptive frontrunners.

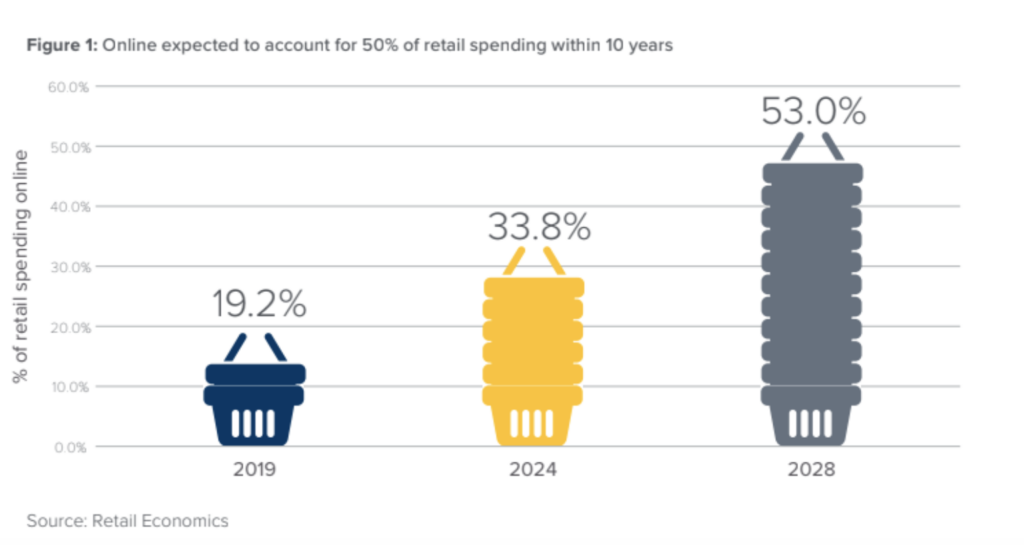

Online to drive 53% of the total retail sales

Today’s customer journey is truly unrecognisable from the analogue path observed just a decade ago.

According to The Digital Tipping Point report by RetailEconomics, the next decade will shift the balance of power in favour of the consumer.

Powered by technology, changes in the property market, improvements in connectivity, new business models and generational shifts, the physical and online channels will meld together. However, online will drive the majority of retail sales in the next 10 years.

The report forecasts that online sales will overtake store-based sales within 8-10 years, with online accounting for 53% of total retail sales by 2028.

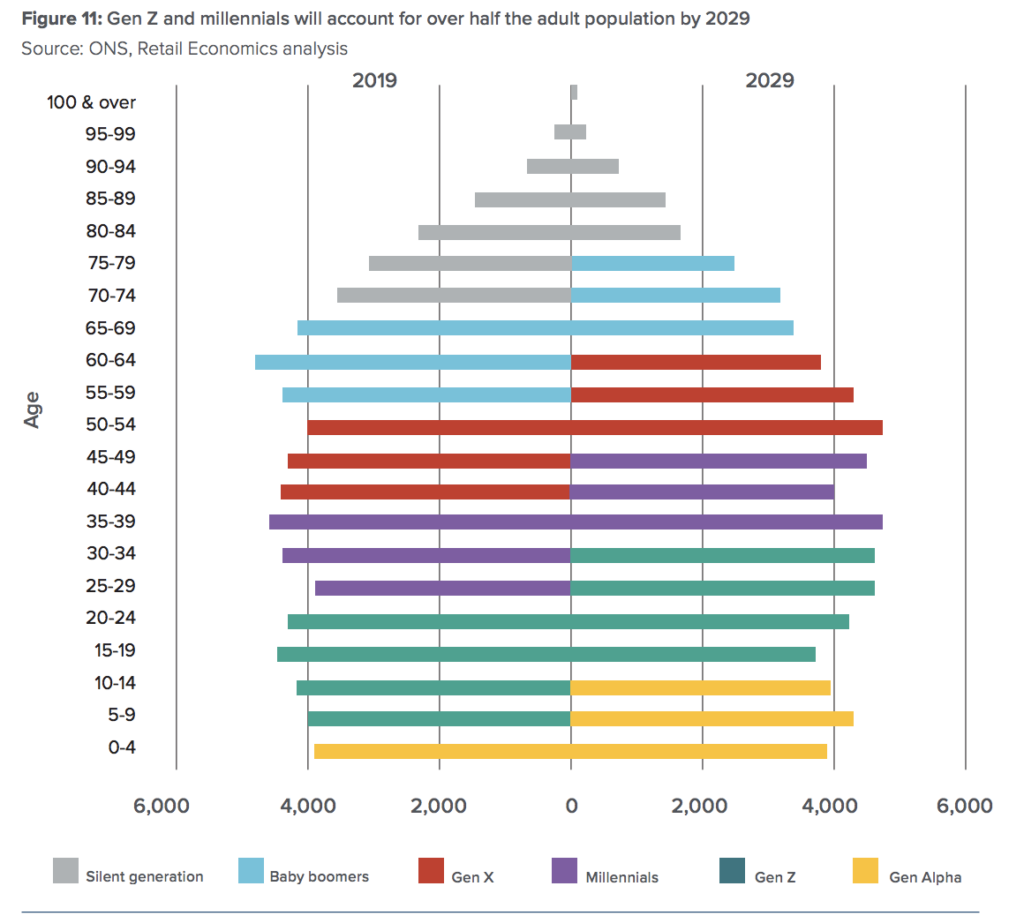

Increasing significance of Gen Z and Millennials

As we observe another decade pass, our current eight-year-olds will transition into adulthood, becoming commercially more significant.

As digital natives, this generation will have expectations that shamelessly exceed their predecessors. Instant gratification, seamless ‘everything’ and ‘do it for me’ attitudes will be serviced by AI-fuelled solutions that today we can only get a glimpse of at Silicon Valley tech shows.

Even now, Gen Zs and Millennials demand near-instant gratification, and the expectations placed on sellers are higher than ever. By 2029, these generations will account for over half of the adult population, compared to 39% in 2019.

Having been born into digital environments, their online spending behaviour and use of technology are thoroughly ingrained. Over the course of the next 10 years, they will account for a much a greater proportion of spending as Millennials attain more senior positions and Gen Zs continue to enter the workforce and ascend the pay ladder.

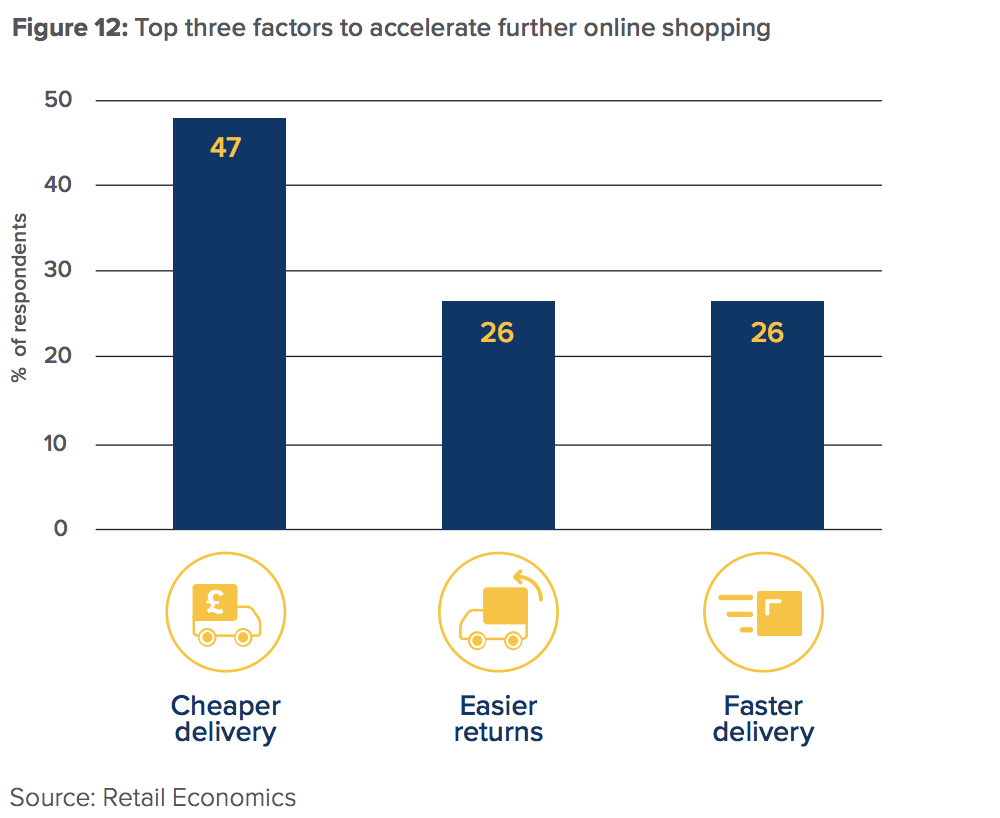

Faster, cheaper in-home deliveries

It comes as no surprise that increased online penetration rates are heavily reliant on fulfilment success.

Through the Amazon Prime offer, shoppers expect that deliveries should be the next day or even the same day, and for free. Furthermore, should they wish, they now expect to be able to stream the latest box set, order a taxi, or receive a meal almost instantaneously and to make their choices through streamlined and easy-to-use interfaces, the same interfaces shared by sellers.

The research shows that delivery issues feature in the second and fourth place overall when asking consumers about their most important factors for shopping online.

Consumers point to the cost of delivery (47%), ease of returns (26%) and faster deliveries (26%) as the three main areas that inhibit further online spending. These areas already experience rapid improvement through technology.

A decade ago, it would be almost inconceivable that a UK supermarket chain would let themselves into customer’s homes and put away groceries in their fridge – while they were out.

Now, Amazon Key gives delivery drivers monitored access to customer’s homes to safely deliver online orders when customers are out. Around one in six consumers are comfortable with this type of in-home delivery option which rises to around one in five for consumers aged between 18-34.

These findings suggest that, in this given context, confidence in human behaviour, when paired with AI, may well have a promising future.

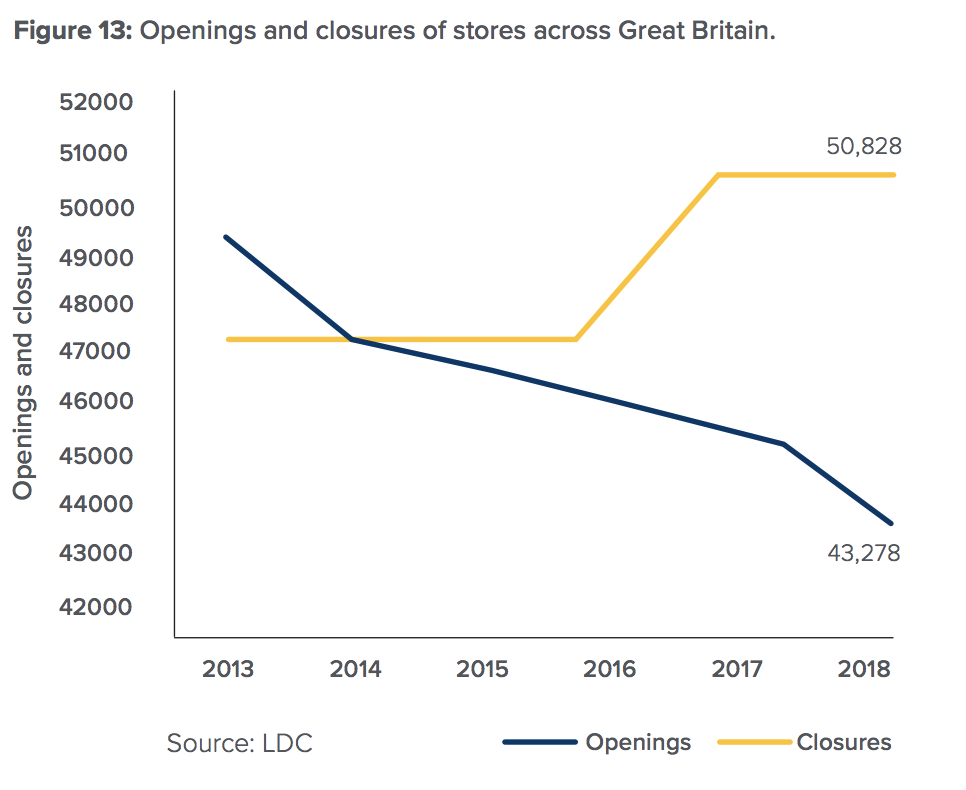

Fewer stores to drive consumers online

Falling numbers of physical outlets, exemplified by a flurry of CVAs, means consumers are increasingly turning towards online – not only for specialist items but increasingly for the more mundane, low-emotional purchases.

In 2018, there was a net closure of 7,550 retail units across Great Britain and retail vacancy levels rose to its highest rate (12.7%) since 2015.

The total number of vacant units that were demolished, split, merged or converted for another use in 2018 was 3,577 up from 2,706 in 2017 and 2,646 in 2016. Shopping centres saw the biggest net decline over the period.

Given this challenging outlook, some estimates suggest there is as much as 30% too much physical space in the retail industry.

The industry is undergoing a painful readjustment period. The acceleration of further store closures will eventually lead to a more ‘inconvenient’ experience for some groups of consumers across many parts of the UK. Inevitably, this frustration will be a catalyst for further online shopping with consumers turning to online as an alternative to in-store purchases.

Commuter commerce to rise to £4.6 billion by 2023

Consumers are already comfortable with purchasing on their smartphones while on the move.

Some 51% of commuters said they use their smartphones to purchase retail products while travelling to work. The research found that a quarter of commuters said that they would purchase more on their journeys as smartphone connectivity improves and devices become more powerful.

Commuter commerce already contributes £2.6 billion each year (2018) to online retailing which is expected to rise to £4.6 billion by 2023.

New retail business models

A new retail era has required new business models – which have been forthcoming.

The music and entertainment sector is a standout example, evidenced by streaming services such as Netflix, Spotify, Amazon Music and others. Such models, with enhanced features and capabilities in the future, will no doubt proliferate to other sectors.

With advanced AI teetering on the horizon, it will be the imagination itself that limits the ingenuity, creativity and slickness of adaptive business models in 2028.

The rise of innovations

Artificial Intelligence (AI) and machine learning (ML) has been the ‘silver bullet’ that astute online sellers have been waiting for. Its application will touch each and every part of the retail value chain, with the potential of transforming the customer journey through an array of disruptive

technologies. This will likely include the emergence of:

- Auto-replenishment models

- Automated delivery vehicles

- AI-driven marketing, payments, delivery, customer service, data and insight mining

- Personalisation at scale

- Predictive sales

- Chatbots

- AR/VR – virtual stores

With AI-related industries estimated to add an additional £630 billion to the UK economy by 2035, it’s no surprise that data is now being touted as the ‘new gold’. It is everywhere and all-pervading.