Amazon FBA is a fairly simply idea – you ship your products to an Amazon warehouse and they store, pick, pack and ship them on your behalf. However there are many services built around Amazon FBA so today we take a look at some of the most popular Amazon FBA Services that you might not be aware of:

Amazon FBA Services – International Selling

European Fulfilment Network

You ship your products to a domestic fulfilment centre, simplifying inventory management and gaining Prime eligibility for fast delivery. You pay only local fulfilment fees on domestic orders and products can be delivered to Amazon’s other European marketplaces with cross-border fees. Learn more.

Multi-Country Inventory

You choose which countries you want to ship to and store your stock in and only pay local fulfilment fees for sales in the marketplaces where you store products. You can still sell to customers even in marketplaces where you choose not to store products and deliver with cross-border fulfilment services. Learn more.

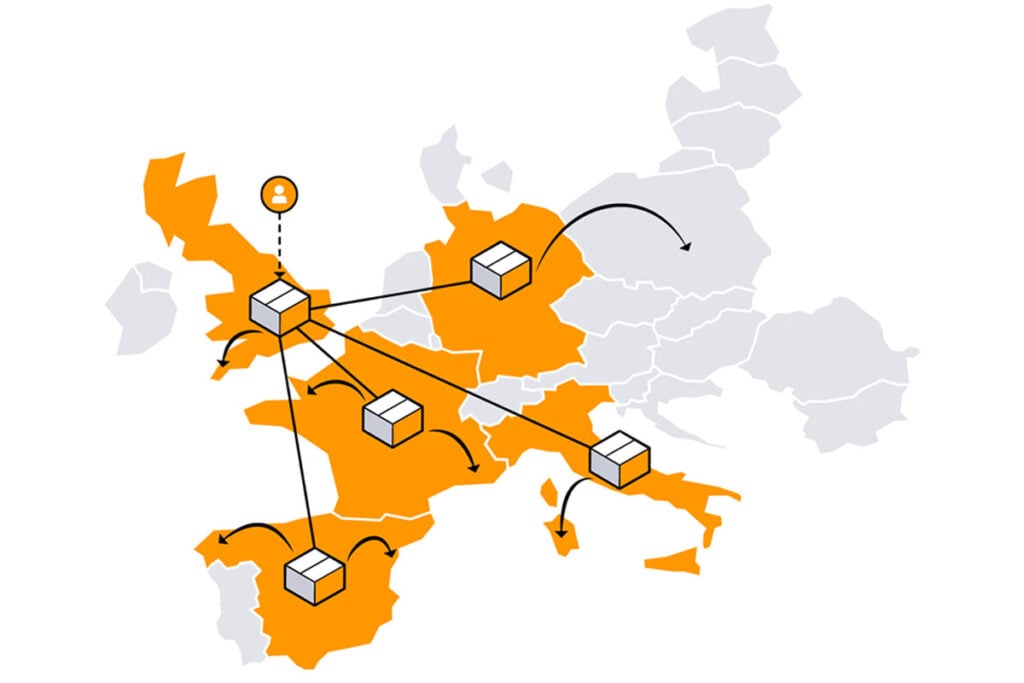

Pan-European FBA

Send your products to an Amazon fulfilment centre in your home marketplace and let Pan-European FBA distribute it throughout Europe, based on anticipated demand. This programme makes it easier for you to grow your business in your home marketplace and sell across Europe by placing your inventory closer to customers, and by fulfilling and delivering orders at lower costs and in less time. More products are now eligible for Pan-European FBA, and you can enable the automatic addition of products to the programme. Learn more.

Amazon FBA Services – Management

FBA Small and Light

With this programme, you can benefit from lower fulfilment fees for your fast-moving, small and light products. Based on the success of this programme in United Kingdom and Germany, we have now expanded the programme to France, Italy and Spain. Learn more.

VAT Services on Amazon

A convenient and cost-effective solution for handling your VAT registration and filing requirements directly from Seller Central. As a special promotion, we are now offering you a free first year of subscription. Learn more.

Inventory management

Inventory tools can help you manage your inventory and maximize sales.

- The Restock Inventory tool provides recommendations on products to restock, suggested order quantities and reorder dates. Learn more.

- The Manage Excess Inventory tool helps you quickly identify listings that may have excess inventory and take actions to improve your inventory performance. Learn more.

Amazon FBA Services – New for 2020

FBA New Selection programme

From April 2020, for new-to-FBA ASINs, Amazon will offer free monthly storage, free removals, and free FBA returns processing for a limited time. For sellers new to FBA, they will also offer an inbound transportation discount. The programme is subject to limitations and eligible sellers must opt in. The new programme will launch on the 1st of April 2020. Learn more.

19 Responses

Pan European FBA is incredibly complicated to set up, and too expensive for me as a small to medium seller. Amazon have been pushing this to me for a few years, but when I looked into it properly it was way too much hassle. Having to register for VAT in each country, the insistence from Amazon that you had to register in ALL six countries, which meant paying for translations into Polish, opening a seperate bank account in Spain, going to the Spanish embassy (nearest one 200 miles away in London) with sworn avodavits, and then having to pay annual fees running into hundreds of pounds to a specalist company to administer it all meant it was not something I wanted to get involved in.

I am a Pan-EU seller and I agree with all Rob writes but I sell more than a €million per year, And I have different Accountants in Spain, France and Italy and I’m currently looking for a German one. It’s cost effective for me and it did increase my t/o.

However, what you must remember if you exceed the distance selling VAT thresholds, which can be from as little as €35k per year, then you have to register for VAT irrespective of whether you participate in any EU fulfillment programme. This was a mistake I made a few years ago and it cost me thousands in late payment penalties and professional and admin fees to get the thing put right.

Oh, the other downside of FBA that I have found was how inefficient Amazon warehouses are . For example, I had goods waiting weeks in the Coventry Amazon warehouse before they were put on line. My supplier told me they had other Clients with exactly the same problem.

When did you need to open a Spanish bank account???

OK ,

But I’ve just looked at Spain’s VAT threshold and it seems it’s now NIL. Therefore it appears if you sell just one item to Spain you need to be registered for VAT. That’s a real pain because Spain is the worst country for VAT registrations for businesses outside Spain. Also, I advise you not to turn a blind eye because it is likely that Amazon will force registration on you to avoid having the liability on itself.

You need to open a Spanish account when you need to pay Spanish VAT i.e. you have exceeded the VAT threshold for the first time – bearing in mind this could be for you very first distance sale! However, it is not possible for anyone who is not a Spanish tax resident to open a Spanish Bank Account. Also, as a non-resident, you cannot yourself register for VAT in Spain – you need a Spanish based Agent to do it. and that Agent must remain the Agent for periodic payment of VAT. That is you can’t even pay your own VAT directly to the Spanish government

The only way that I got around it was to appoint an Agent, who each quarter files the VAT return for me. I then have to transfer it to the Agent’s Spanish Bank Account so that it can be paid. My Agent is an International Accountancy firm and the fees are high e.g. $100 euros each time I use it’s Bank Account facility!

Rob – just another quick point. Brexit has nothing to do with it!

Also, my sales income is NOT paid into the Spanish Bank Account. It is paid directly into my French Bank Account (I am based in France)

What kind of products are you selling guys?

No, not asking for a friend 😉 just curious.

We trade automotive parts and there’s no customer base on amzn for us. Or do I make it wrong?

Hi,

I don’t understand what you mean by “and there’s no customer base on amzn for us”.

I sell only consumer direct products that are international brands and are brand new, with a tiny proportion of exactly the same goods being customer returns and sold as ‘as new’.

It might be down to pricing if thats the case. I sell on both Ebay and Amazon and my ratio is about 10 to 1 in favour of Amazon

There’s no obvious answer. If the goods were popular and the price was market beating, then your stuff should have sold. But it seems to me that ‘niche market’ stuff is always going to be more difficult to sell than mass market stuff because there’s relatively many fewer buyers.

November to January are always the very best months for me but maybe buyers aren’t prioritising automotive products in this period. So, they’re prioritising the hairdryers for the wife/girlfriend etc and Barbie for the daughters. With respect, I don’t think many girlfriends are likely to be buying crankcase seals for their man rather some sexy aftershave – although I could be an unreconstucted sexist!

Chris, why don’t you just use the VAT services on Amazon to do your Spanish VAT and (German.French, Polish, Czech) returns, it cost Eur400 for all Countries??? It’s a pretty good deal. I’m VAT registered in Spain, I don’t have a Spanish bank account and I’ve never had to visit the embassy. Registering for Spain was the biggest pain out of all the VAT’s, you can add to non-Amazon sales to these Countries for sales on eg Ebay or your own website.

Hi Thomas, I’ve just had another look at it (VAT Services).

I believe I looked at it before and for some reason that I do not immediately remember I decided it wasn’t for me. However, one clear reason now that I see is it is being run by Avalara. Speaking from my own experience of them, when I had a ‘free’ deal from Amazon for country VAT registrations, were that they were useless.

Actually, for UK and Germany, I’ve got a ‘free’ deal. I do it myself and it is generally very quick and easy. In France, where I am based, I use an Accountant for my general tax matters including VAT. In Italy, I have a very cost effective (maybe less than Amazon/Avalara) and professional English speaking Accountant, who is very easy to deal with. I must admit in Spain it is relatively expensive, although the service is highly professional and easy to communicate with people.

My own experience with Accountancy services provided ‘free’ or ‘cheaply’ by Amazon is that the service is robotic, almost impossible to communicate with and incredibly slow to respond. I might have another look at Spain again but even though the annual cost is about 5 times higher than the Amazon fee, I might stay with my current arrangement.

Also, I presume, that even if Avalara files for you in Spain, it does not make the payment for you. That is- you must arrange your own payment using a Spanish Bank Account?

Hi, Chris, it is run Avalara, they aren’t easy to get a quick reply from plus, I ‘ve never actually had a tax enquiry from any of the actually tax authorities, regarding my submissions or if I had the question goes directly to Avalara and I never hear about it, so I’m not sure how good they are regarding that. Regarding paying my Spanish tax liabilities, I never really looked at who was receiving the payment, I just assumed it was going directly to the Spainish VAT authority, but I can see it’s “Spanish VAT Services Asesores SL”, who then presumably pay Spain tax authorities directly and partner Avalara on this, thus doing away with the need to hold a Spanish Bank Account. Your think that a Country would make it is as easy as possible to receive VAT payments, rather then stupid rules like that!!!!

Rob,

It is €400 for EACH country or €500 if you wish to add VAT sales on other marketplaces (which you must do to properly declare your VAT)