Today, Rory O’Connor, CEO & Founder of Scurri, asks what the Coronavirus impact will be later down the line when things start to return to normal. There is already uncertainty around Amazon Prime Day, normally held in July, but unless retailers and brands start to revise their plans now they’ll be opening up shop with a load of Spring and Summer stock in the Autumn and no in-season winter stock at the busiest time of year as Black Friday hits and consumers start their Christmas shopping:

Coronavirus impact on Amazon Prime Day and Black Friday

While China is almost back in business, the rest of the world is still lagging by many weeks and this gap is only set to widen. This week, the implications of the crisis are becoming more apparent – many companies feeling the heat from less in-store spending – not just the retailers, but the payment processors, landlords etc.

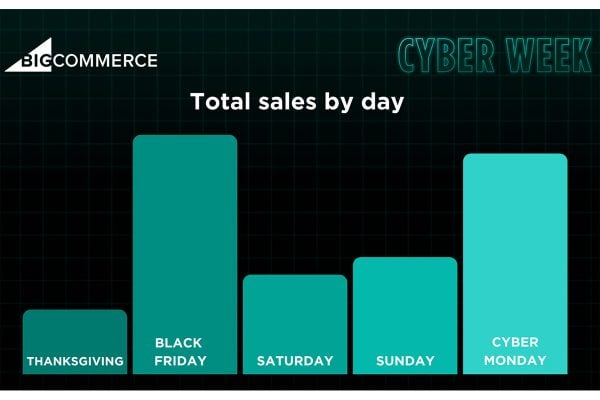

The conversation on supply is however about to very quickly shift to Q3/Q4 concerns, with disruptions already starting to impact the shipment of goods to retailers for the back-to-school season and if the situation persists, it could end up hitting Black Friday/Cyber Monday and the December holidays, when many retailers make the bulk of their profits.

What should retailers be doing to mitigate some risk?

First port of call is always making sure your delivery partner is appropriate – crisis or not. Secondly, ensuring stock levels are accurate. Retailers should also have a contingency plan, offering different delivery options, or having multiple carriers available so they can flex carriers quickly and easily if needed.

Amazon Prime Day

Amazon now faces an important conundrum on whether to push ahead with their biggest day of the year. For the retailer, the big issue is that they have stopped shipping, or delayed non core items. So if 50% of your business is on Amazon and they turn you down or turn you off, you have no control of that. I would imagine a lot of retailers are looking for other options right now (for example, going back to selling themselves and not listing on Amazon) because they had no control of their destiny when the crisis occured.

Prime Day is about value & discounts – it will probably be more successful this year if Amazon can pitch it with a savings theme attached to key essentials or focus areas. I’m sure many retailers will be interested in a way to liquidate stock and get cash.

Aside from this, is there a potential that Prime Day could disrupt the flow of essential goods? I don’t think so – Amazon is already managing this – diverting capacity to core / more important items – so I think this issue is well covered.

While there may be general consternation over Prime Day going ahead – if the situation improves by then, this could serve as a much-needed boost for suffering merchants.

Is there enough demand for less essential items, when consumers are tightening their belts? While online shopping is going up, consumers are not just spending out of necessity. At Scurri we have seen a 35% increase in delivery volumes from March 1 in the UK. Some of the specific areas of non-essential spending we have seen include:

- While consumers are stashing cash, they are also spending in ways which make isolation easier – we have seen increases in entertainment, toys & hobbies, but also fashion.

- Other areas such as DIY and home improvement have seen greater online sales volumes as the house-bound use the time for home improvement projects.

3 Responses

I honestly don’t think that Amazon is doing too hot, right now. I had to buy a thumb drive today and immediately went to Amazon, but instead of getting it the next day, their delivery time was for mid-next week. I almost gave up on buying the thumb drive until I remembered I could go to target across the street.

If Amazon falls short to cover our sense of urgency of getting things fast, then the offline retail world will gladly and quickly take that market share!

I see no reason why they would need to actually cancel prime day.

Sure it might be the first year in a while when it wasnt “the biggest ever”, but who cares? go back to biggest ever next year.

it’s not like there’s really a huge need for investment and foresight, contrary to what you’ve said here – “Prime Day is about value & discounts”, we’ve seen plenty articles on this very site showing that prime day is really about shifting old, unsold junk, often for more than you could any other day.