Slippers were once the goto gift for Christmas. If you couldn’t answer the question “What shall we get Dad for Christmas?” then “New Slippers…” was a defacto fall back along with “…and a bottle of booze!

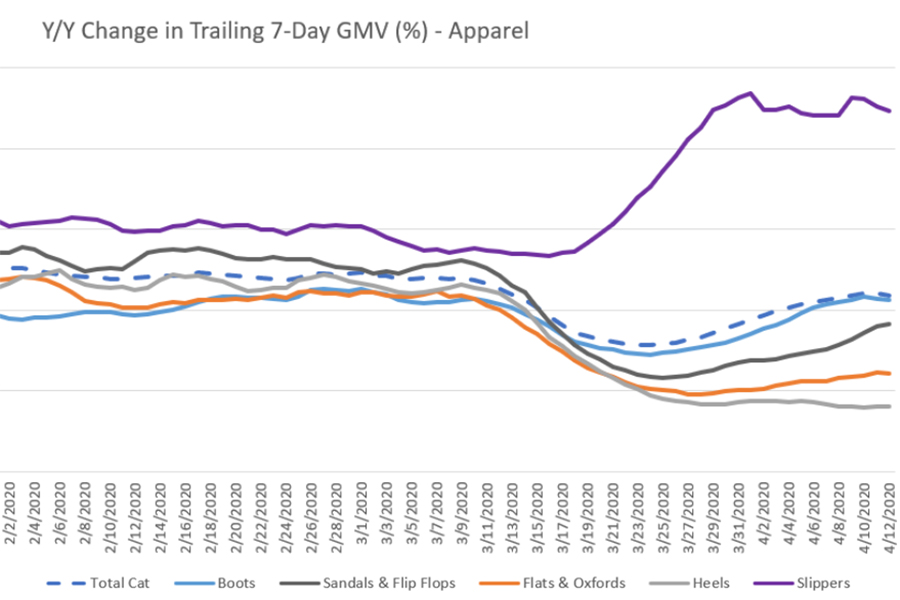

Now, in the middle of the Coronavirus crisis, slippers are one of the hottest selling categories online. With millions working from home and millions more not working but still at home, people are realising that wearing their work shoes around the house all day isn’t that much fun. Forget your heels or brogues, comfort is the order of the day and when you’re on that daily departmental zoom meeting people can only see if you’ve put a shirt and shaved, they can’t tell that under the desk you’ve swapped your heels for you’re new pair fluffy pink ostrich slippers.

This is just one of the insights revealed by ChannelAdvisor in their latest “Impact of COVID-19 on E-Commerce GMV” series which they’ve been publishing weekly since the start of the outbreak. Along with slippers, naturally hand sanitiser is top in healthy and beauty and with home workers quickly getting fed up with their 12″ laptop screens (Great for being lightweight for that commute you no longer do, but no so good when you’re staring at it all day), computer monitor sales are also soaring. As people are setting up their home offices, external hard drives and printers are also seeing a boom in sales.

If you’ve not been following the ChannelAdvisor series, it’s worth going back to the first post and follow the changing trends over the last month to get an insight into how ecommerce has seen massive upswings and downswings as consumers’ priorities have rapidly changed.

While looking back over the last month is revealing as to how ecommerce rapidly changed as the pandemic took hold, following this series in the future will give key insights as to when consumer behaviour starts to return to something like normal. When people fire up their cars for the first time in six weeks there’s a good chance that the auto-parts industry might see a boost and, if the lock down continues for an even longer time than some expect, consumers may yet return to buying luxury goods to treat themselves in the mean time.

You can read the full series of ChannelAdvisor posts on the links below:

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)