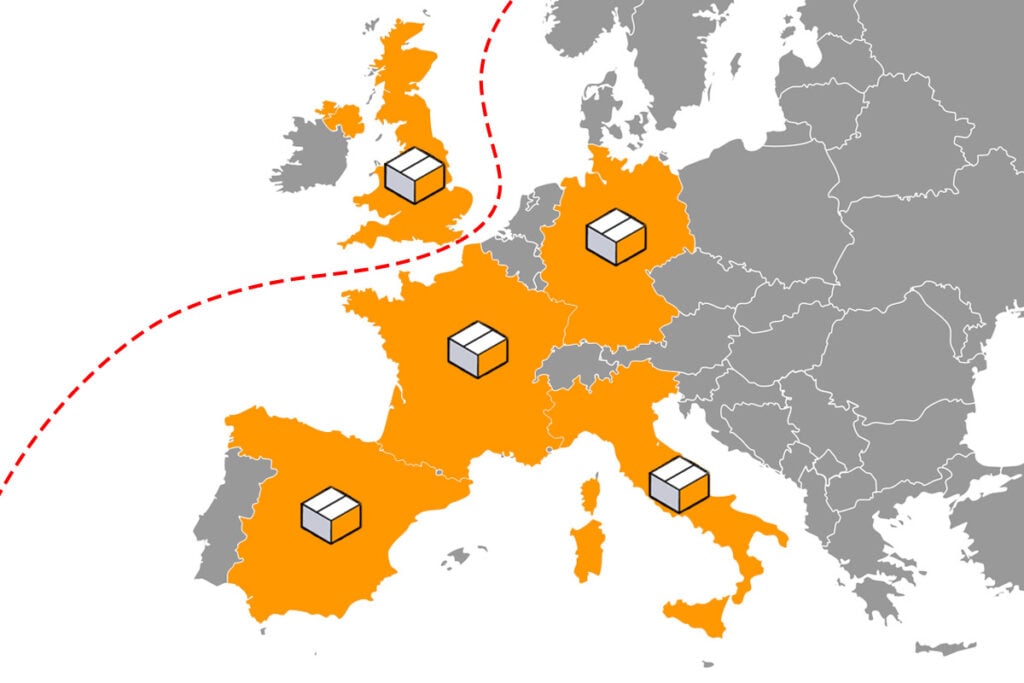

The UK is due to formally leave the EU’s Single Market and Customs Union from the 1st of January 2021. While UK-EU negotiations are ongoing (including determining what tariffs, if any, will apply), from the 1st of January 2021 there will be a customs border between the UK and EU which will have an impact on businesses working across this border and that includes your Amazon UK and EU FBA inventory pools.

From the 1st of January 2021, Amazon will cease moving inventory across the UK/EU border. This means for some, make sure you have sufficient inventory in EU FCs to cover any period where you may find it difficult to replenish stock until any new customs and shipping arrangements become clear. For others it will mean depleting inventory in mainland Europe FCs before the 1st of January 2021 as after then it will become more difficult to repatriate your stock back to the UK.

Good news – You can continue using the same FBA SKU for your UK and EU listing, however your FBA inventory pools will be split to reflect the different quantities in each. For a listing to be active (i.e. in stock) in UK, it must have stock in a UK FC and vice versa for EU.

For example, if you send 60 units to a UK FC and 40 to a German FC, then you will two FBA inventory pools – You’ll have 60 units available on your UK offers and 40 will become available for any of the EU marketplaces (provided you have enabled EFN or Pan-EU in EU4). Amazon will be sharing more specific information and timelines over the coming months.

As Amazon will not be moving items across the customs border, you will be unable to create removal orders for inventory in Germany, France, Italy, Spain, Poland or the Czech Republic to be returned to a UK address (and vice-versa). To have inventory returned, you will have following restrictions while creating a removal order:

- Input valid UK address to remove inventory from UK FCs

- Input valid EU (excluding UK) address to remove inventory from German, France, Italian, Spainish, Polish or Czech FCs.

To have inventory returned, you will need to create a removal order to an address that is local to where the inventory is stored. You can then arrange for a courier to collect your inventory from that address and ship these items back across the border.

If you have auto-removals enabled, these returns will only be processed if your auto-removal address is local to where the inventory is stored.

To keep up to date on Amazon news regarding the UK’s final parting from the EU, visit their Prepare your Amazon Business for Brexit Help page.

15 Responses

Amazon have been REALLY pushing Pan EU lately Chris. They are using scare tactics (you wont be able to sell in the EU without it).

There are many balls in the air ATM.

Do you sell into the EU via MFN only?

Do you go Pan EU if always been under the distance selling thresholds?

Is Pan EU cost effective?

Do you trust Amazon’s VAT filing?

Lastly, is it not better to wait until next July (see below link):

https://www.avalara.com/vatlive/en/vat-news/eu-2021-one-stop-shop-vat-return-for-e-commerce.html

At this stage you can send stock into one EU country and have 1 EU VAT number. Then Pan EU as it stands today would be redundant. In theory Amazon should pool your EU stock across the EU FC’s. I guess they know that…..hence the pushing of Pan EU now.

Pan EU FBA is just not worth the hassle for me as a relatively small seller in Europe. Amazon has been trying for years to get me enrolled on it, but all the hoops there are to jump through (having to register in Poland and Czech republic as well as DE, IT, ES and FR, especially ES which seems the biggest hassle) means I will probably not bother. I watched Amazons webinar the other day on merchant sales to Europe, will see if the FBA webinar in October holds out any hope!

Also as a seller of items mainly in the £15-£20 bracket, the extra costs of import/export duties and the fact Amazon won’t return anything from Euro Fulfillment centres is a downer. And how on earth is it viable to set up somewhere local in say Germany to have items returned to?

It will be bad enough on any returns where the goods have got damaged in transit etc but when the customer has simply changed their mind or doesn’t like it, which does happen a fair bit, that will be a nightmare. Amazon were saying on the webinar that you will need to send them an international fully paid label, pay the neccessary duties, and if it was a no fault return “negotiate” with the buyer about them covering some of the costs. Yeah right.

the second option Amazon were pushing was “returnless refunds” where you just give in, let the customer keep the item whatever the reason for them not wanting it is, and give them a full refund.

Virtually all my Euro sales at the moment are done through FBA, all stock held in UK centres and shipped by Amazon from there when sold.

Unless I am wrong, to go Pan European entailed having to open VAT accounts in all 6 countries, having to submit translated and signed by a notary affadavit for Poland, and for Spain having to visit the nearest Spanish embassy in person (200 miles away from me) and open a bank account in Spain. As my sales to Spain are approx £2k a year just not worth it. Germany biggest market by far, but still well under VAT thresholld there.

Does anyone know what Ebays stance is yet? Currently we just send any items to their International centre in Derby and they take care of everything else, though I am sure that will have to change.