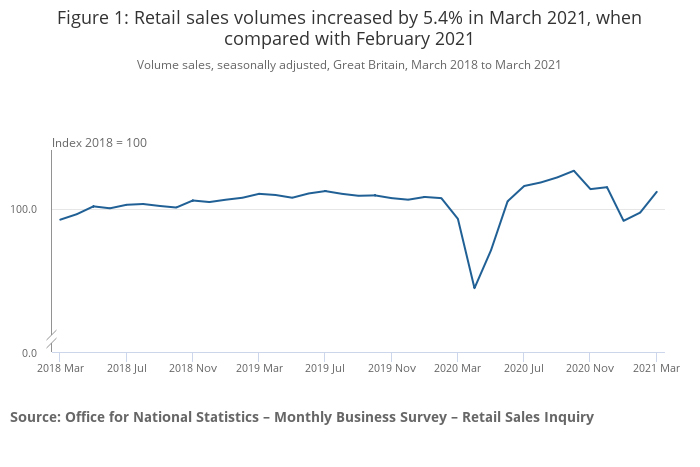

Latest ONS figures out today reveal that retail sales volumes continued to recover in March 2021, with an increase of 5.4% when compared with the previous month reflecting the effect of the easing of coronavirus (COVID-19) restrictions on consumer spending; sales were 1.6% higher than February 2020 before the impact of the coronavirus pandemic.

Non-food stores provided the largest positive contribution to the monthly growth in March 2021 sales volumes, aided by strong increases of 17.5% and 13.4% in clothing stores and other non-food stores respectively.

The proportion spent online decreased to 34.7% in March 2021, down from 36.2% in February 2021 but still above the 23.1% reported in March 2020; the value of online spending did increase in March, but spending in-store increased at a faster rate. If you exclude food, online non-food sales captured 39.5% of total retail sales volumes.

Online spending increased in March 2021, up 0.6% when compared with February 2021, with strong growth in textile, clothing and footwear stores of 10.9%. This was the largest monthly growth in the sector since June 2020 with feedback from retailers suggesting that the upcoming easing of coronavirus restrictions had prompted consumers to update their wardrobes in preparation for being able to meet friends and family outdoors again.

“Our analysis shows that we’re not going to see a full-scale return from online shopping back to bricks and mortar stores. In fact, 92% of consumers said they plan to continue spending online post-pandemic, showing strong intent to continue buying vitamins, OTC medicines, published content and clothing online. Retailers are busy adapting to this transformation in consumer behaviour. Those that get the balance between online and in-store experience right will emerge stronger.”

– Gizem Günday, Partner, McKinsey & Company

The net result is that online retail remains strong, but consumers once again have a choice of whether to shop online or shop in store. Service will be key to keeping those consumers that intend to continue to buy online.

The net result is that online retail remains strong, but consumers once again have a choice of whether to shop online or shop in store. Service will be key to keeping those consumers that intend to continue to buy online.

To make sure you are meeting consumer expectations in 2021, sign up for our webinar with GFS which is being held on the 29th March. In the webinar we will examine the gap between consumers’ delivery & returns experiences compared to their expectations.