Rick will be joined by Ben Sestig of Catawiki as they walk through real working business examples of how a marketplace can handle the upcoming obligations.

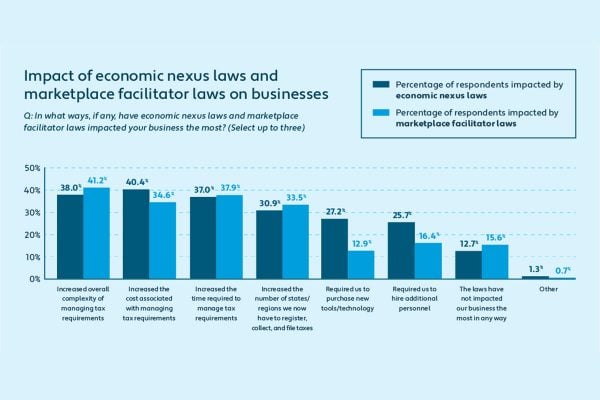

Many countries globally are moving the burden of VAT & Sales Tax compliance from the marketplace seller to the marketplace operator. This session will provide you with the essential information you need as we dive into global ecommerce trends driven by marketplaces & correlating tax obligations facing marketplace operators of all sizes.

With the new EU ecommerce VAT Package just around the corner, these new sweeping reforms will have a significant & direct impact on how online marketplaces manages indirect taxes the EU. Join our session as we cover the key considerations’ a marketplace should make to comply with these changes and other global tax obligations whilst ensuring a great seller & buyer experience is at the heart of your business.