If you are enrolled in the Amazon Business program, so that your products on Amazon are offered to businesses, you can increase your chances of winning the Buy Box for business customers by activating the free Amazon VAT Calculation Service.

After activation, VAT-exclusive prices will be displayed to business customers on eligible offers. Businesses tend to base their buying decisions on VAT-exclusive prices. To provide a good shopping experience, Amazon are comparing the VAT-exclusive prices for business customers, where available.

If you already have a professional Amazon account then it’s free to sell on Amazon Business. It enables you to reach new business customers using Amazon Business – largely businesses that have already chosen Amazon as an approved supplier and who will already be making purchases. For these purchases to be directed to your offers you just need to enrol. Amazon say that on average, badged Business Sellers grew their B2B sales on Amazon by an additional 50% within the first month.

Amazon business enables you to tailor your business offers for free and increase your sales conversion as well as benefit from higher visibility of your business offers and lower fees on high volume transactions.

As many businesses will be reclaiming VAT, by enabling the Amazon VAT Calculation Service businesses will see lower (ex-VAT) prices which will be the true cost to them.

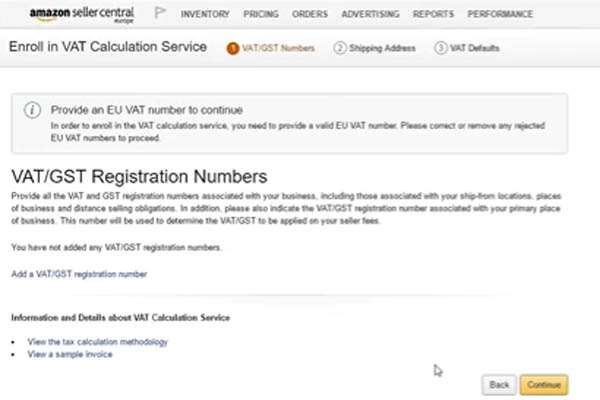

Enabling Amazon VAT Calculation Service

-

VAT registration number(s)

Provide all the VAT registration numbers associated with your business, including numbers for the countries where you ship-from, where your business is registered and where you have distance selling obligations.

-

Default ship from address

Provide your primary place of business or the address that you fulfill from most frequently.This is the location where you dispatch your orders from. This address will be used in VAT calculations.

-

Default product tax code

Select the Product Tax Code that works for most of your listings. If needed you can add exceptions for some of your listings via flat file. A Product Tax Code is an Amazon-defined code that uses the correct set of VAT rates across the EU for a specific product category.

https://www.youtube.com/watch?v=VjOEhQhherQ

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)