There’s been a lot of talk over the last few days on how the fee changes will impact sellers. There’s also a fair amount of confusion out there as to what the impact will be.

There’s been a lot of talk over the last few days on how the fee changes will impact sellers. There’s also a fair amount of confusion out there as to what the impact will be.

Quite frankly the was fiendishly complicated with many sellers not even realising that there is a difference between the Final Value Fees for an item sold on auction and the fees for selling the same item from a Fixed Price listing.

This was further complicated as the first tranche for auction fees (in most categories) was 8.75% up to £29.99 and yet for fixed price items fees started at 9.9% of the final selling price up to £49.99. Even the break points between fee tranches didn’t match.

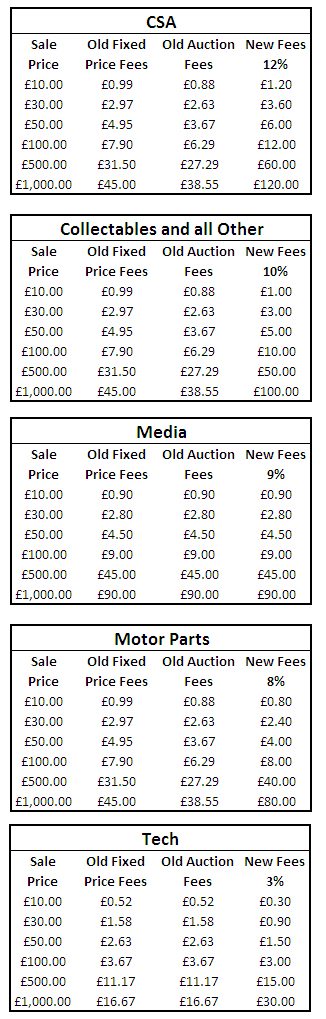

This post is simply a comparison between the Final Value Fee you would pay under the existing fee structure depending on the category you sell in and the listing format you used and the .

There are some pretty steep fee increases in all categories with the exception of Media where the price of selling on eBay is unchanged. However as can be seen from the tables the sellers who are hardest hit are those with the highest average selling prices.

The reason sellers of high value items are affected the most is because under the old fee structure the higher the price of your item the smaller the percentage eBay charged in fees.

Typically for fixed price items this was 9.9% up to £49.99, 5.9% of £50 up to £599.99 and 1.9% of the portion of the final selling price over £600. The new flat Final Value Fees hide the increase from 1.9% which has risen to as much as 12% in CSA and 10% in Home & Garden.

Even in the Tech categories (which on the face of it appear to have had a huge fee reduction to just 3%) will be impacted by the loss of the fee tranches. Sellers of high value items will end up paying more than double under the new fee structure for items in excess of £1000.00.

Whilst no one will be in favour of the fee increases it’s important to understand how it will impact your business and exactly what fees you will be paying once the new structure kicks in. It’s time to re-evaluate your margins and make sure that your sale prices allow you to make a profit once all your costs including eBay fees have been accounted for.

Edited to add: If you’re looking for details of how the new eBay.com fee structure will affect your eBay fees then Scot Wingo of ChannelAdvisor has just published a detailed analysis.

46 Responses

hmmm I am working the old prices out as much more than these…so the difference is still bad, but not quite as bad as this?

as we said on another thread we will be thinking thrice about listing anything with a value above £50,we often sell items of a £1000 or more, with

vat now at 20% which we swallow most of,

ebay 10% listing fees , paypal fees etc ,ebay is becoming much less profitable for high end collectables and antiques

we had £120.000 gross sales on ebay this last quarter I am frightened to do the maths

So why not change the fees to the same for private sellers to the same easy to work out figures, I don’t get it at all, surely these are the people who are confused not business sellers. Seems to me there’s even more incentive to try and trade under the radar as a private seller than ever nowadays.

In your Tech example, your sums are correct, but your graphic is wrong, it shows 10% when it should be 3%. The actual figures are right though 😉

Does anyone think ebay will make any type of U-Turn on this? In my experience once they have made a decision, that is it! They seem very inflexible in that respect. The change that this reminds of the most was when they removed Negatives for sellers. There was all kinds of noise made by sellers at the time but now its more or less accepted and everyone gets on with it.

Would I be right in saying that the old CSA FVF’s were 9% but are now 12% and will include the shipping costs aswell?

Private sellers have a fee cap of £40.

I was wondering if there was anything in the small print with regard to a fee cap for business sellers that has been missed?

we can all squark and moan,

bottom line is if we make money we will all bend over and suffer ebays fees and rules,

ebay is my pimp

Smoke and mirrors for price increase… They could have simply implemented a calculator on the website that works out the fees for you for simplicity sake (keeping the same commission). If you want to see what percentage on average is charged by ebay you take the total fee being paid to ebay and divide it by sale price and multiply by 100…

BIN fee’s were never complicated and eBay calling them ‘Simpler’ is insulting.

You list something, it tells you the cost of the listing, it tells you how much you will pay if it sells, you hit submit.

How could anyone be confused by this?

The new fees are ridiculous, nearing with Amazon now. The main dent is to more expensive produts on eBay.

When you have the monopoly, why not abuse it….!!

eBays not the only plateform to sell on. If you’ve not got a website get one.

Oxford st is not the only street to sell on

though you dont find Harrods anywhere else

there are costs with any form of selling its the net profit that interests us

Is there a workable strategy to start listing on .com to take advantage of their lower fees?

Most of my market will soon be high priced clothes destined for USA and Japan.