When you’re so busy selling and making money sometimes you forget to look at your business and figure out just how much you’re making. It’s not easy when you have costs such as warehousing, gas, electric, phones and Internet bills to figure out just how much overhead you have per transaction.

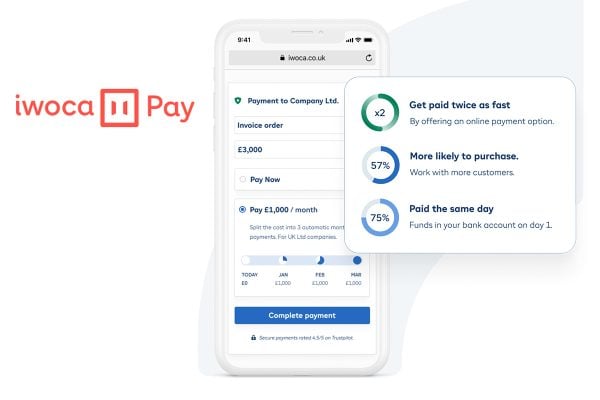

The guys at iwoca have analysed the data from thousands of their customers to generate the breakdown of a typical ecommerce transaction.

Of course the costs will vary, for instance are you VAT registered as that’ll affect the percentage of tax that you pay. If you still work from home then your warehousing costs might be negligible.

There were two things that stood out for me – the first being how low the iwoca loan fees are compared to the overall cost of doing business. One reason for this is that the loan is to cover the cost of acquiring stock and isn’t a percentage of the sales price. If you’re looking to expand and invest wisely however, the cost of finance shouldn’t be prohibitive.

The other standout item is the cost of goods. Although iwoca point out that margins vary enormously between businesses it’s still over half of most businesses total expenses. This should be emphasising that anything you can do to cut down on your purchase prices is the quickest way to increase profits.

Whether you negotiate for discounts for faster payment, use finance (from iwoca or elsewhere) to increase order size in exchange for discount, or look to buy end of season or slow moving stock in bulk, any savings you make will have a big impact on your bottom line.

Don’t forget that just placing an order at the end of a month or end of a quarter could help your wholesale supplier hit target – they might be more willing to offer a discount that at the start of a financial period.

You can read iwoca’s full analysis on their blog. In the mean time how do your number stack up against the averages in the chart above? Do you have much larger expenses in certain areas or are your costs below average. Most important of all, are you beating the average circa 18% overall profit margins?

![! Social Web Template [Recovered] Amazon Future Engineer Scholarship recipients](https://channelx.world/wp-content/uploads/elementor/thumbs/Amazon-Future-Engineer-Scholarship-recipients-qx1k9h8ihd702da3gf56eb3zfdgmqby55wi2ln5bq8.jpg)

5 Responses

Great post Chris,

Sadly, I’ve come across far too many busy fools during my career in ecommerce and online marketing. It might be a cliche – but profit is most certainly sanity.

patronising promo blurb

iowca fees are the smallest percentage cost LOL

It’s an interesting chart but somewhat simplistic. If I could sell every inventory item in a single day I would be over the moon, but the reality is that this just doesn’t happen. Anybody borrowing money from any source needs to remember that you make repayments on the total amount borrowed and not just on those items that sell. In this respect the chart is slightly misleading, because it shows the repayment on a successful sale, and doesn’t factoring all the stock not selling.

The fees and P&P on stock that don’t sell are zero compared to the Iowa charges for money owed on dead stock… shall I do a graph illustrating that? 😀

Whils I do not use IWOCA or similar, I do see them as making financial sense for some people in some situations. After all, if that finance gives you an opportunity to purchase, sell and make extra profit on stock that you would not be able to purchase otherwise, then despite the cost it probably makes sense. If after paying interest and borrowing fees the numbers make sense, then it makes sense!!

I’m not sure 18% margin would work for many people but then I would be suprised if most small businesses operate on such low margins. Massive large and medium sized perhaps but for most small businesses the margin has to be greater. With 18% margin a “one man show” (probably working his socks off) would need to sell £200k p/year to make £36k!!

A big issue is alway stock not selling and sitting on the shelf for ages. Until then it is dead money so I am very careful about what I buy. My rule of thumb is always recouping my investment as quick as possible and the amount of sales required to recoup my investment, combined with how long I expect it to take, is the way I decide what to invest in. Once I have my money back whatever is left is potential profit and it generally does not matter how long the rest takes to sell – providing of course I get my investment back quickly.

Like most small businesses I only have a limited kitty to buy stock with so I have to be careful. If I don’t get my investment back quickly then I may not be able to buy more stock (or possibly have to turn down something better that unexpectedly comes up) so I always weigh up time to recoup investment in stock combined with what the likely final profit will be once all (or nearly all) is sold, against what else I could buy at that moment. My priority is always quickly selling enough to cover the initial investment.

I can’t afford dead money so for me stock is basically worthless until it sells!!