iwoca have announced the integration of its B2B payment solution iwocaPay with Quickbooks’ leading accounting software package – this makes it the first invoice checkout integration with a QuickBooks BNPL (Buy Now Pay Later) option for businesses that integrate with the accounting solution

Quickbooks supports UK businesses with their accounting needs via a cloud-first approach that allows them to run their finances on the go from mobile devices. iwocaPay makes invoice checkout seamless, with the QuickBooks BNPL integration allowing buyers to settle via either Pay Now or Pay Later.

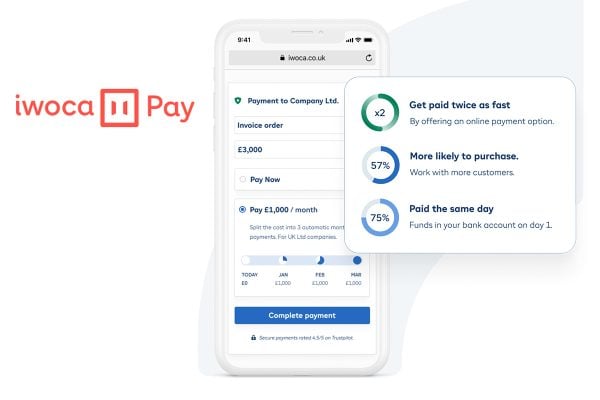

Integrating iwocaPay into the QuickBooks platform will enable hundreds of thousands of businesses to get paid faster, have better control of their cash flow, and grow revenues; industry research showed that customers are 57% more likely to purchase when interest-free buy now, pay later options were offered, and that’s exactly what QuickBooks BNPL offers.

First B2B buy now, pay later solution for cloud accounting products

This new integration follows on from the success of iwocaPay’s Xero integration, first rolled out in February 2021. Holding integrations with both accounting software giants makes iwocaPay the first B2B buy now, pay later solution for cloud accounting software across the UK.

The fintech also recently announced its extension with ecommerce platform WooCommerce. The new API behind both of these integrations makes iwoca the only UK-based B2B BNPL provider that’s fully omni-channel: available wherever businesses take payments, whether that’s invoices (like QuickBooks), ecommerce checkouts (like WooCommerce), or in person.

Business owners who link iwocaPay to their QuickBooks account will be providing a frictionless invoice payment experience with buy now, pay later options for their customers, whilst they get paid instantly. Customers can pay on the go, by scanning QR codes on their invoices that direct them to a slick checkout journey.

We’re delighted that QuickBooks users now have the option to include iwocaPay on their invoices, so that they can offer business customers buy now, pay later, without carrying the credit or late payment risk themselves. The ability for them to offer this flexibility to customers during today’s turbulent economic times will help B2B businesses attract more customers and make more money, whilst having better control of their own cash flow.

iwocaPay welcomes more integrations of this kind. Our aim is for our digital B2B BNPL payment solution to be accessible to the entire business ecosystem, whether that’s through accounting platforms, ecommerce sites or somewhere else.

– Lara Gilman, Co-lead of iwocaPay

Businesses owners can add iwocaPay as an invoice payment method to their Quickbooks invoices by signing up to iwocaPay and integrating it from their iwocaPay dashboard, offering their B2B customers more flexibility in how they manage their finances and powering transactions with scheduled payments but still receiving their funds up front to keep their own cash flow running smoothly.