When we reported Alibaba’s Singles Day sales for 2016, Tamebay reader Scott commented saying “Do these numbers sound legit? Amazon apparently did 86 items a second in the UK on Black Friday, Alibaba did 175,000? That’s such a huge discrepancy, it doesn’t sound possible. Insane figures if it’s all true.”

Nenad Cetkovic the Chief Operating Officer at Lengow has done a deeper dive into the numbers and the background to the phenomenal sales and yes the figures are insane and dwarf anything we see in the Western world:

11.11: A Chinese record for global ecommerce

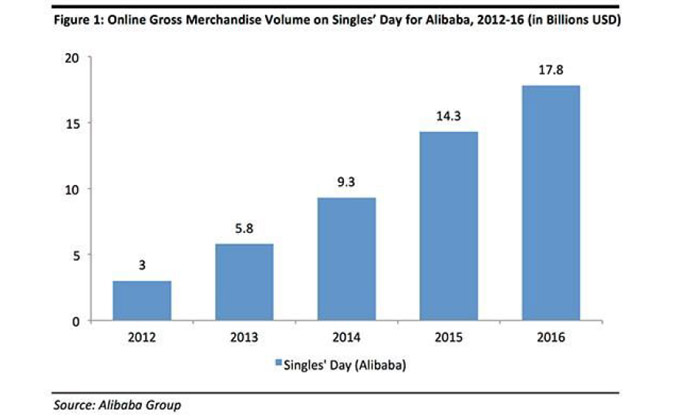

On November 11, 2016, Alibaba held an event that was, quite simply, incredible in its magnitude: for the famous “Double 11” celebrations (also commonly called Single’s Day or Shopping Festival) ecommerce marketplaces Tmall, TaoBao, and AliExpress made more than $17 billion in one day, with more than 657 million orders … Mind blowing!

This year, Alibaba wanted to make a larger impact by throwing a huge countdown gala (held in Shenzhen – the “industrial capital” of Chinese e-commerce), targeting an international audience to launch their famous Double 11 sales day, that first started back in 2009. On the programme was a live stream fashion show, a virtual reality shopping experience, global media coverage with more than 600 journalists from all over the world, speeches from founder Jack Ma and CEO Daniel Zhang, and a guest list of stars worthy of a Hollywood red carpet event.

There’s been an unprecedented amount of social media coverage (on Western networks, such as Twitter, Facebook or Linkedin, and of course on Wechat, the Chinese network), and the magnitude of the show was impressive. Designed to entertain an excited audience for over 4 hours in a kind of American SuperBowl style, celebrities promoted the event on stage, pushing a hungry audience who could, by simply shaking their phones, access a multitude of discounts on live purchases from the runway.

With the likes of Kobe Bryant, Scarlett Johansson, and the Beckhams in attendance, Alibaba brought together an address book full of A listers to launch something that was, just a few years ago, completely ignored in the West, but has now been built up from scratch to develop online sales in China. This year was such a huge success that even Katy Perry’s last minute cancellation (she was supposed to perform in concert to launch the event) went completely unnoticed, and didn’t affect the incredible results.

In terms of the brands, there were more than 11,000 foreign brands taking part in the event this year for the first time, such as Apple (quoted by Alibaba as one of the “winners of the day”, see photo below), Sephora, Victoria’s Secret, and, surprisingly, Maserati – although on reflection, not so surprising as China does have the largest number of millionaires in the world…

In fact, this year was so successful that even Alibaba’s competitors, JD.com, joined the event to try and make the most of it, sharing updates on social media about their performances throughout the day.

Amongst the many highlights of the event, one stand out figure was the 82% total turnover… from mobile devices. Anyone with a good grasp on the Chinese market knows that Chinese consumers have totally and definitively built their digital world around their mobile, with WeChat in particular, but even so, this is a pretty staggering figure to European businesses.

At the peak of sales, Alipay, the group’s very own payment platform, recorded a peak at 120,000 transactions paid per second, with Alibaba at 175,000. In the end, more than 657 million orders were placed on the group’s sites. A volume that, even for Jack Ma himself, will test the limits of logistics capacity in China.

There has been so much media coverage of the event, even more than we would expect for more well-known events like Black Friday and Cyber Monday. By inviting the media, and throwing the gala, Alibaba has hugely boosted the success and popularity of the day.

In terms of sales, the results are out: overall sales have grown by 24% in USD since last year (32% when considering local currency, the RMB). International sales also saw a 47% growth in year-on-year sales, which represents 27% of the total amount.

If these numbers seem dizzying, it’s worth noting that we still don’t know precisely the amount of sales that will be officially confirmed. This year, the international president of Alibaba promised these figures will be audited by consultancy specialists. This should be interesting to follow as it will also reveal more information beyond the gross number of sales – the rate of packages that have actually been delivered, and the rate of returns, after a large number of purchases that are likely to have been impulse buys.

This amount will also probably be quite high amongst certain product categories due to “fictitious purchases”, which are common among some Chinese retailers, to boost their visibility by rising in the rankings of marketplaces that their competitors sell on.

This growth is, of course, an indicator of the success of sales in China. However, it is unfortunate that it is not likely to take on a more international dimension. Indeed, even if the Chinese group is accessible abroad for a marketplace such as Aliexpress, it is clear that it remains, above all, a Chinese record for the Chinese market.

Then – and this is where Europe comes into it – it’s unfortunate for us that the event remains centralised on the promoting of business in China. It makes it a bit more difficult to reach a wider, more international audience, when the focus is only on one country.

At the moment, there is no particular method of allowing local retailers, producers, and manufacturers, around the world to join the event easily. In fact, it is actually quite a complex and expensive integration process, and one that, in Tmall’s case, requires you to be physically present with a subsidiary in China to sell. It’s either that or going through a local provider (Tmall Partner) to sell on the international version, Tmall Global. This is actually the Hong Kong version of Tmall, and only has access to a very limited audience compared to the original marketplace.

At the moment, there is no particular method of allowing local retailers, producers, and manufacturers, around the world to join the event easily. In fact, it is actually quite a complex and expensive integration process, and one that, in Tmall’s case, requires you to be physically present with a subsidiary in China to sell. It’s either that or going through a local provider (Tmall Partner) to sell on the international version, Tmall Global. This is actually the Hong Kong version of Tmall, and only has access to a very limited audience compared to the original marketplace.

AliExpress is an international and successful marketplace but it’s exclusively reserved for Chinese producers. It’s website is in more than 17 languages, and it offers more than 100 million SKUs (product references), available in over 243 countries and regions. Its mobile app is also very popular in certain countries, such as Russia, which is one of the main target markets of AliExpress. We’re eagerly anticipating the day when Alibaba will decide to open it up to producers from around the world!

As for TaoBao, (essentially the Chinese version of eBay) it has recently allowed international producers / manufacturers to sell to middlemen who will then resell via this marketplace to end users. However, the initiative is too recent to have a significant effect on the European market.

With this year’s Single’s Day, Alibaba has definitely established this shopping festival as an important global event. Driven by an ever-increasing Chinese consumer market, it demonstrates the fundamental dynamics of e-commerce in China. The only down side is the delay in opening this Chinese giant to the rest of the world market, both for customers and for the economic canvas of ecommerce.

For the moment, Alibaba remains in line with their roots, with director Jack Ma wishing to focus on developing the company in China. To compete with Amazon worldwide, Alibaba will have to show that they can open up to additional markets. However, this isn’t completely impossible – we will have to wait and see how the industry progresses in future, at such a pivotal point for Europe. The recent US elections, and the arrival of Donald Trump in the White House, will completely re-shape the ecommerce market. If he puts his electoral plans in place, the introduction of protectionist barriers via import taxes for ecommerce will undoubtedly have a negative impact on the US market. As a result, Chinese retailers will then look towards the second largest world market: Europe. Something to anticipate in the future…