eBay‘s Global Selling Programme (GSP), is a nifty service that eBay UK has in place to help sellers export items to buyers overseas without many of the headaches related to international trade.

What is the eBay Global Selling programme?

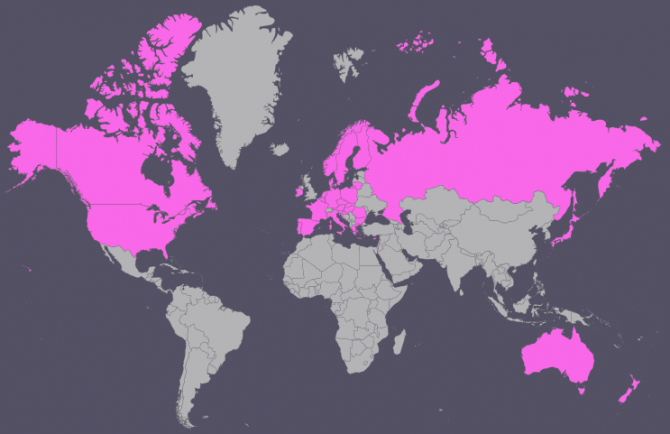

Here’s how it works. You opt in to the GSP and then your items are displayed to shoppers in other countries. eBay will display the costs of shipping to that location and buyers can take a view on whether that’s something they want to pay. If they do, and they buy, you despatch the item to a UK location using a domestic shipping service. eBay then take it from there and the fee covers international shipping to the customer. There’s a lot to like about it from a seller perspective, especially if you are new to exporting or want to take some of the stress out of it.

Not least because it is a service offered to sellers at no extra cost. And also eBay limits you exposure to defects. All you need to do it get the goods to the GSP fulfilment centre in the Midlands.

This video from eBay explains the service more fully.

https://youtu.be/aoBjgAYSK44

But what about VAT?

But what about accounting for VAT with your GSP sales. Obviously as a private seller, selling a few bits and bobs, it’s not a concern but business sellers will want to make sure they are on the right side of the tax man.

If you’re not VAT registered, then don’t charge VAT. And, as the eBay Ts & Cs say, for exports out side the EU: “The items sold under the Programme are considered supplied in the UK, and may therefore be subject to UK VAT, until such a time that you have obtained proof of export documentation in which case your sale may qualify for zero rating if the item is shipped outside of the EU. Please also refer to section 12(b) in cases where items are undeliverable.”

And for sales within the EU: “The items sold under the Programme are considered supplied in the UK, and may therefore be subject to UK VAT, until such a time that you have obtained proof of dispatch or arrival documentation of the item in another EU Member State. For shipments to other EU Member States it is your obligation to comply with the relevant EU distance selling rules.”

So what does that mean practically? eBay Anorak – Jane Bell wrote in a recent blog post at SimplyVat.com: “Please be aware of your responsibility to monitor your sales to other EU countries, as these sales are governed by the EU VAT distance selling rules. You should charge local VAT on any sales you make to EU private customers, until you hit set thresholds – €35,000 in most EU countries, except Germany, Luxembourg and Netherlands where it is €100,000. If you are not VAT registered in the UK, don’t charge VAT, however, you still need to monitor your sales to other EU countries as these rules will still apply.”

13 Responses

Does ebay charge us commission on the vat thats included in the selling price ,always wondered how that works

not quite as simple as charging vat or not charging vat depending on location or threshold

there are countless vat schemes and deals with HMRC alone never mind that lot over there,

in addition we reckon the way the global shipping terms and conditions are worded with the way the program is marketed there is a strong case that

ebay or pitney bowes could be libel for any vat that may be levied

will things change after Brexit as far as VAT is concerned in Germany?

From the T&Cs, my understanding is that all sales are deemed personal use therefore an EU VAT registered business buyer cannot claim back the VAT is that right?

Surely if you ship to a UK address (GSP) then Pitney Bowes charge the customer for shipping onwards as the goods once they arrive at GSP become the property of Pitney Bowes then doesn’t the seller report all as a UK domestic sale to HMRC as the shipping comes under a separate contract between the buyer and Pitney Bowes? Whether the end buyer is EU or not surely all sales are VAT reported in the UK as delivery to UK address? as you’re technically selling the goods ownership to Pitney Bowes as they won’t ever give you the goods back etc they claim the ownership of them when they arrive with them?

The problem we’ve ran into with the HMRC, they want documented PROOF its left the UK & hasn’t been interfered with at the Freight Forwarding Centre.

Didn’t Tamebay post a VAT article about 2 week ago which contradicts this?

What about France? Everytime I sell to France on Amazon (both FBA and MF) I get this message ” If you operate from France or carry out transactions with customers in France, your Selling on Amazon activity could be subject to French taxes and social security contributions.

For more information, visit Impots.gouv.fr and Securite-sociale.fr. Learn more.” I did some research on EU VAT on digital products and seem to remember that is NO threshold in France so your obligation starts with a 99p sale. Has anyone any clues?

its all in the lap of the gods

surely ebay could consult HRMC and give clear and definitive answers with guidelines and direction in this matter

rather than our hypothetical guesswork

Hi Andrew, if your stock is held in FBA France, you have an immediate obligation to VAT register there. If you are sending goods from the UK to French consumers, your sales will come under the distance selling rules as stated above. I hope this helps

Hi Andrew, no you don’t have to pay tax and social security in France if you are based in the UK. Your sales will get reported in the UK, the VAT will have to be reported in France if your sales reach the Euros 35,000 distance sales threshold, OR, you will need a VAT registration only (not liable for other taxes in France) if your stock is held in FBA France.

When we leave the EU we can all register as companies in Hong Kong,

Problem solved and as a bonus we dont need to pay VAT in the UK either.