The National Audit Office (NAO) has published the findings from their investigation into whether overseas sellers from outside the EU have been charging VAT on applicable sales in the UK.

This has been an ongoing multi-year challenge for UK sellers facing increased competition from Chinese sellers and around the world. Whilst competing with low cost economies is always a challenge, trying competing against a seller who simply avoids VAT represents an impossible price disadvantage for a UK retailer.

When should an overseas seller be paying VAT?

Online sales accounted for 14.5% of all UK retail sales in 2016, just over half of these were non-store sales, mainly through online marketplaces. VAT rules require that all traders based outside the EU selling goods online to customers in the UK should charge VAT, if their goods are already in the UK at the point of sale. The sellers should also be registered with HMRC, charge VAT, if their goods are already in the UK at the point of sale, pay import VAT and customs duties when the goods are imported, and are required to submit regular VAT returns.

What’s the estimated cost of unpaid VAT?

HMRC estimates that online VAT fraud and error cost between £1 billion and £1.5 billion in lost tax revenue in 2015-16. They recognised online VAT fraud and error as a priority in 2014, although the potential risk from online trading generally was raised before this. In 2013 the NAO reported that HMRC had not yet produced a comprehensive plan to react to the emerging threat to the VAT system posed by online trading. Online sellers claim that online VAT fraud has been a problem as early as 2009, which has got significantly worse in the past five years.

Is it fraud or ignorance?

HMRC’s assessment is that online VAT losses are due to a range of non-compliant behaviours, but has not yet been able to assess how much is due to lack of awareness, error or deliberate fraud. Amazon and eBay consider that lack of awareness of the VAT rules is a major element of the problem. Amazon and eBay have focused on educating overseas sellers and providing tools to assist with VAT reporting and compliance.

HMRC concluded it was highly likely that both organised criminal groups based in the UK and overseas sellers in China were using fulfilment houses to facilitate the transit of undervalued or misclassified goods, or both, from China to the UK for sale online.

What future enforcement action will be taken?

HMRC has decided to focus enforcement actions against online VAT fraud inland rather than at the border, and in particular will be targeting fulfilment houses and leveraging the online marketplaces through the new measures as more effective and efficient measures compared to enforcement activity at the border

To date, there have been no prosecutions for online VAT fraud but HMRC has carried out many civil operations against suspected evaders including 279 investigations of businesses and 373 compliance interventions in 2016-17.

HMRC have new joint and several liability powers to tackle online VAT fraud and error. The new powers include making online marketplaces potentially jointly and severally liable for non-payment of VAT when HMRC has informed them of an issue with a seller, and they do not subsequently take appropriate action.

HMRC has seen an increase in the number of new VAT registrations from non-EU sellers since the legislative changes were announced and came into force. From April 2018, fulfilment houses will need to register with HMRC and carry out due diligence on their overseas customers.

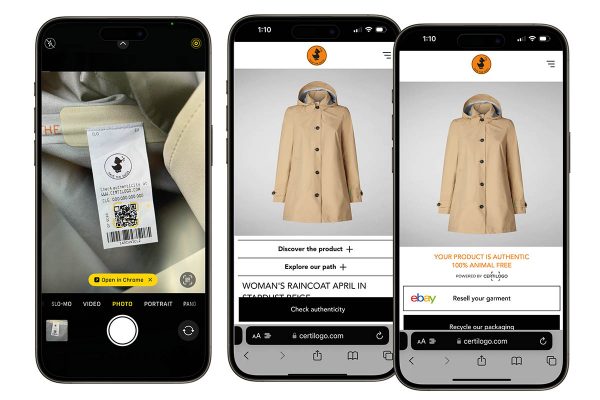

eBay to support HMRC

“eBay has always been committed to making our platform a fair place to buy and sell.

We expect all our sellers to comply fully with their legal obligations including paying the right amount of VAT.

We welcome any efforts to help ensure a level playing field for all sellers and will review the detail of this report with interest.

We will continue to work closely with HMRC to ensure that all sellers on our platform comply with the law.”

– eBay Spokesperson

4 Responses

Even when eBay and HMRC were told of an online seller displaying a VAT number that was valid yet refusing to provide VAT receipts claiming they too busy. They have both done nothing. The seller still operates on eBay and still no doubt pays his fees minus VAT and also HMRC have done nothing as asking for the same purchase 4 months on the seller still says the same thing.

All the goods are stored in the UK.

If we make one error on our VAT return they are all over us like a bad rash.

I am slightly confused why the government are making this so difficult. The government hasn’t got the time or resources to be chasing all these foreign sellers. Change the law so that any company that owns a website / marketplace is classed as the end seller, so they pay the VAT directly. Job done.

So as a seller on the marketplace when you are selling your goods you are selling them to Amazon, eBay rather than the end customer.