Chris Turton is an ecommerce and marketplace consultant passionate about understanding how online businesses tick. He writes from experience and tries to answer questions from sellers to improve and share his knowledge Today he discusses how to forecast marketplace sales based on competitor analysis:

Chris Turton is an ecommerce and marketplace consultant passionate about understanding how online businesses tick. He writes from experience and tries to answer questions from sellers to improve and share his knowledge Today he discusses how to forecast marketplace sales based on competitor analysis:

Estimate competitor’s sales by understanding your own review to sale ratio

Peak is just around the corner, and for you retailers I am sure your order books and PO’s for the period will be nearly ready.

The problem many new and experienced sellers have on marketplaces is they over or under buy, and the key reason stock planning is so difficult is because of the fluid nature of the algorithms built by Amazon and eBay. One week your product is running two a week and then for no apparent reason you’re doing 40 in three days and this happens outside of peak!!

So how can we combat this? The simple answer is to look over a much longer period and use competitive probing to understand potential size of markets and retail costs.

Calculating weekly run rates on Amazon

If you are not competing for the buy box

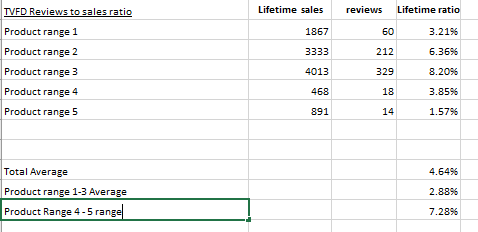

Do your homework and understand your sales versus review rate.

This is a great cornerstone to understand roughly how many reviews you get in comparison to your sales. Our main category of products runs at about 6%, we have done various A/B tests on our feedback emails and have used various feedback packages.

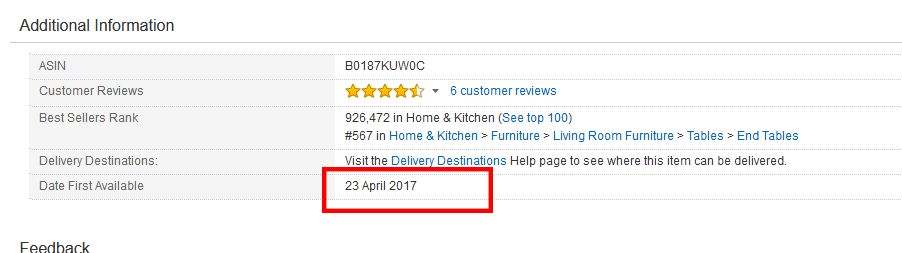

We can then use this information to roughly calculate competitor’s sales as Amazon doesn’t make this information public, we can use this information plus the ASIN release date.

You can now review the feedback versus the date the product was first available to estimate sell through rates.

If you ARE competing for the buy box.

You can still use the above method to calculate average sales for the overall ASIN, however you need to then attribute what frequency you achieve the buy box this should then help you calculate an estimate run rate per week.

You can calculate the sales potential by reviewing reviews versus release date and then using your own review to sales ratio.

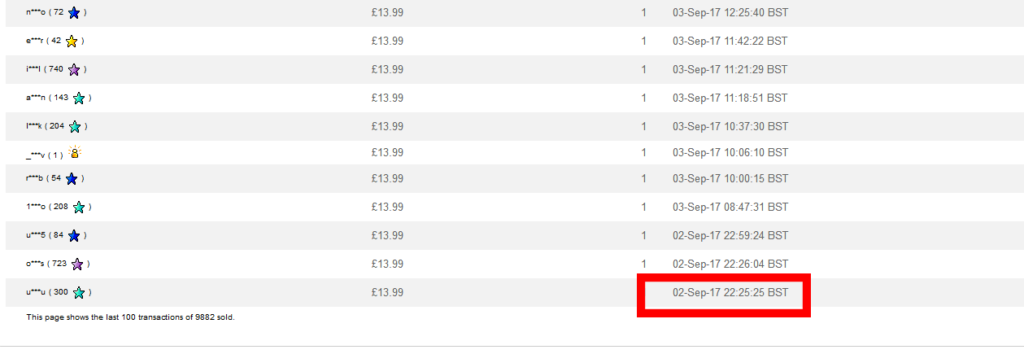

Calculating Weekly Run Rates on eBay.

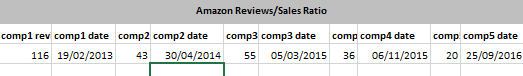

This is much easier to calculate than on Amazon, simply look at your competitors start date and sales volume to give you the last dataset – which is up to 100 sales or approximately 90 days whichever is bigger, this should give you the weekly run rate you need you can then average these datasets.

Checking when the eBay sales data goes back too enable you to calculate a sales velocity number.

Feedback and repricing strategists Xsellco see varied sales to review rate conversion but it is possible to achieve up to 20%, although this can vary quite drastically on your market and audience. Try and maximise your review to sales ratios before using this as a guideline.

Targeting the right products

I recommend looking at the top 10 products competing for your main products keyword or product category, this will give you a best-case scenario for your products run rate. You can always choose to be more conservative by looking more mid table.

Be careful with variant products as product reviews will commingle.

You can then estimate sales since the ASIN began and calculate a weekly average run rate, also using a tool such as KEEPA (which is a fantastic Google plugin) you can see price swings from your competitive ASINS.

Changes at Peak

In peak 2015 and 2016 we saw a 70% uplift on the previous period which starts for us at week 40 so bear this in mind when calculating your stock strategy.

Don’t forget you can also review your average retail price and implement this into your spreadsheet. The calculation I look at is stock level – current stock movement at current retail price- future stock movement at competitor’s average retail price.

Here’s how I present this data.

The last two column sets under “potential new margin versus week’s cover” allow us to see how much we would make based on competitor’s average retail and how many weeks cover this SKU gives us. It allows us to make judgements based on whether we adjust our pricing to potentially move more stock or indeed may even need to increase our retail prices to balance stock movements.

I hope this information was helpful and always welcome your questions or understanding how your business deals with stock changes!

Best wishes,

Chris Turton

3 Responses

Thank you for sharing Chris. I wish I had more hours in the day to work on strategy instead of being absorbed by the nuts and bolts. Its difficult to get balance.

Dont we all! If you need any help or anything clearer please let me know Bernard

Much obliged