I first met Christoph, CEO and co-founder of iwoca, in 2011 over a coffee at Euston station. It was an unusual place to meet but he didn’t have an office yet. As an ex VP at Goldman Sachs he explained to Dan and myself the idea his vision of a finance solution that would be easy and accessible to all small businesses.

Dan and I left the meeting saying to each other “It sounds like a good idea, but can this guy really do it?” Now, six years after our initial meeting the answer is a resounding “yes”.

Christoph went on to establish iwoca, an innovative platform that helped pave the path for a whole new business finance market in the UK, together with co-founder James Dear. Many eagle-eyed Tamebay readers may recognise Christoph from one of the many Meetups iwoca arranged for online sellers in their early days.

Christoph went on to establish iwoca, an innovative platform that helped pave the path for a whole new business finance market in the UK, together with co-founder James Dear. Many eagle-eyed Tamebay readers may recognise Christoph from one of the many Meetups iwoca arranged for online sellers in their early days.

Christoph and I sat back down last week, and discussed iwoca’s accomplishments, how they are helping small businesses, and what’s changed since they first launched iwoca:

Who are iwoca?

We set up iwoca to break down the barriers small businesses face when accessing finance. Traditional lenders make it very hard to get a business loan, and many businesses get discouraged by the cumbersome application forms and the long wait for a decision, whose outcome is all but certain. We wanted to change all that. So we designed a short, simple online application and built a risk engine based on thousands of data points from Amazon, eBay and bank integrations, making credit decisions much faster and fairer.

Our first customers were e-sellers who used iwoca to buy stock for busy periods or take advantage of a discounted rate on a bulk purchase. We still serve more e-commerce businesses than any other sector, but in 2014 we opened up our lending platform to all industries. We’ve lent more than £250m to over 12,000 small businesses across the UK, Germany and Poland.

We now have a team of 150 iwocans based in London, and are working hard to make our product ever more helpful for business owners. I’m proud of what we achieved so far and excited about the road ahead – to reach our goal of funding one million small businesses.

What does iwoca do?

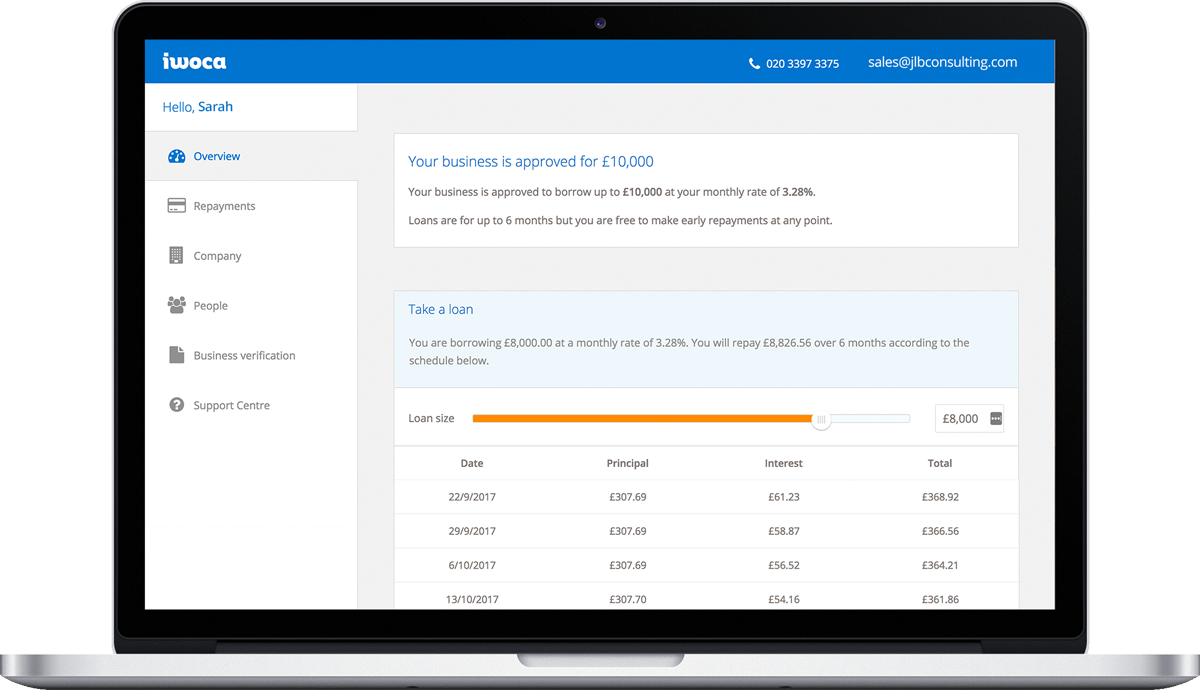

We provide businesses with the finance they need to run and grow their business. We offer a flexible credit line of £1,000 to £150,000, which you can draw down within 24 hours of applying. There are no hidden fees or long term commitments – you can repay the funds over 12 months, repay early or top up.

Our aim is to provide helpful business finance, so we work hard to make everything fast and simple. Applying takes only five minutes, and credit decisions are made within hours or instantly, thanks to our integrations with the likes of eBay, Amazon and Xero.

Innovation in technology and great customer service enabled us to support many e-sellers under served by banks. Don’t take my word for it – check out around 2,000 reviews on Trustpilot where iwoca is rated 9.7/10.

Why should I be interested in iwoca?

If you’re buying and selling, iwoca’s flexible finance can give you a competitive advantage. Many e-sellers use iwoca to purchase stock at the best terms, hire seasonal help for busy periods or boost their marketing investment.

It’s a simple answer really – with Black Friday and the holiday season right around the corner you should be interested in iwoca, because iwoca can can help you sell more.

Exclusive Memorabilia

Thomas Rollett and David Holland, met while they working for a footballer website. Self-professed football junkies, they loved the work but noticed that signed merchandise brought in the most profits. In 2011, they launched their own company – Exclusive Memorabilia, and started out selling signed football merchandise on eBay.

Exclusive Memorabilia is now the largest signed merchandise website in the UK, selling through eBay, Amazon and their own website. It’s home to authentic merchandise signed by the likes of Anthony Joshua and Cristiano Ronaldo.

To obtain a signed piece of merchandise, Tom and David needed to cover significant upfront costs, often at very short notice (you don’t say no when Pele is in London for the day!) .

“Obviously we discussed things with a bank first, but it was just a very laborious process and it was very inflexible. Amazon and Paypal were options as well, but the overall package of iwoca was just better. For us it was the speed of responsiveness, the level you were prepared to lend to us and the overall transparency of the repayments that persuaded us to chose iwoca.”

– Thomas Rollett

Tom and David plan to keep growing their business with some big projects on the horizon. “I plan to stick with iwoca”, Tom tells us. David adds, “It suits our business perfectly, iwoca gave us total peace of mind.”

Why are you different?

We set out to help as many businesses as possible. This means iwoca is able to approve e-sellers based on recent trading history, regardless of time in business and without rigid requirements to produce annual company accounts. We even offer start up finance of up to £10,000 for new businesses.

Unlike many e-seller financial products out there, we offer unrivaled flexibility, with no hidden fees or commitments. You can draw down funds when you need them and repay as early as you like – some customers use us for a few days at a time while others keep the funds for several months or a year.

Anything else you’d like to tell Tamebay readers?

Whether you’re looking for funds now or just want to check what’s available, it’s worth signing up now to see what you can borrow.

Applying is free, take only 5 minutes and will not affect your credit rating. We invite all Tamebay readers to check out iwoca.co.uk or call our friendly team at 0203 778 0461 – we always like to chat!