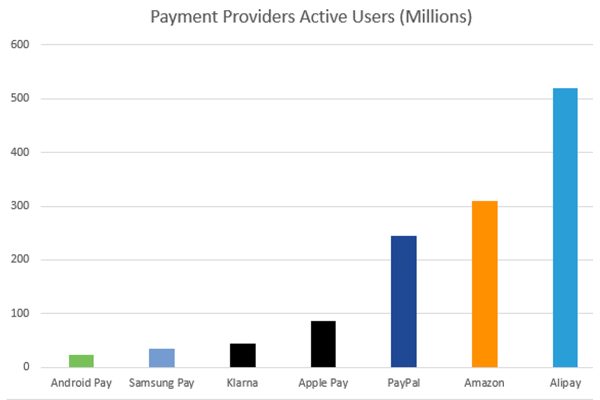

Google Pay is the new brand for payments, replacing both Android Pay (generally used for contactless payments via smartphones) and Google Pay (generally used for online purchases).

In truth the two brands for practically the same payment method were confusing and the new name Google Pay, a bigger brand than Android, makes sense. This is a long overdue merger of two similar services with different names into a unified platform with a single brand name to promote. Consumers probably didn’t even really know what the difference between Android Pay and Google Wallet were, especially those that used both on their Android mobiles.

“With Google Pay, it’ll be easier for you to use the payment information saved to your Google Account, so you can speed through checkout with peace of mind. Over the coming weeks, you’ll see Google Pay online, in store, and across Google products, as well as when you’re paying friends”

Google Pay is already available on Airbnb, Dice, Fandango, HungryHouse, Instacart, and other apps and websites. There’s little doubt that Google want to make a big play in the payments marketing in 2018 and they say “Bringing everything into one brand is just the first step for Google Pay. We can’t wait to share more”.

With adverts getting increasingly trickier for Google to monetise due to new platforms (fewer ads on mobile than desktop, none on voice assistant products), payments is one area that Google could add to their bottom line. If you can take a slice of every transaction then although the amounts may be small they add up in the long term.

The real interest for Google has to be getting shopping enabled on their Google home devices, even if it simply be to send users to a link in the Google Home app as they currently do, if they can also get users to pay with Google Pay then they’re in the game.