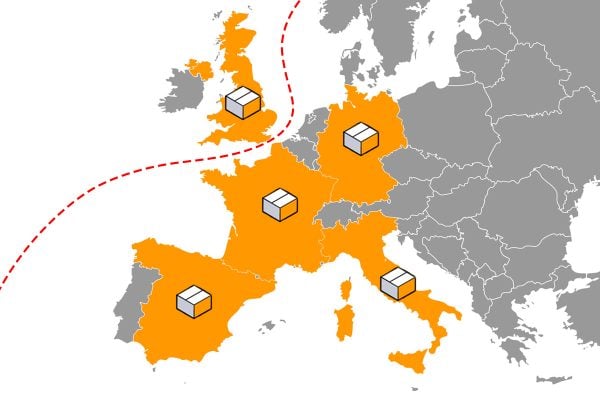

Nearly nearly 90% of online retailers surveyed by Tamebay already export and on average, online retailers who export expect international sales to total 30% of their turnover. The impact of Brexit is however throwing a cloud of uncertainty on Britain’s future trading relationship with the EU and online retailers are having to consider different options to protect their businesses.

The free movement of goods, the single market and customs union arrangements remain key unresolved questions and retailers crave stability and certainty so that they can plan for the years ahead.

“Brexit has put a fog across the future, particularly when it comes to staffing and cross-border trade: it’s impossible to plan or to build for the future in areas which might be affected, so decisions for growth are pushed to the “wait and see” bucket. It’s natural, you hope for the best, but you have to assume the worst, and so any certainty is almost always an improvement.”

– David Brackin, Stuff U Sell

Whilst Brexit may have put a damper on trading with our EU partners, the same can’t be said for the rest of the world with the most favoured future destination for export expansion being the USA. Australia and Canada are the next top non-EU targets for cross border trade for online retailers, perhaps due to the lack of language barriers.

“Fears that the UK would be plunged into recession proved unfounded, but the lack of clarity over the path the nation would take post-Brexit undeniably inhibited growth in the 18-months following the decision.

Although the UK’s future relationship with the EU is uncertain, this merely creates the chance to explore other, potentially more lucrative, foreign markets. The situation has also encouraged many businesses to take stock of their current operating processes and explore avenues for mitigating risk, reducing outgoings and stabilising costs.”

– Phil McHugh , Chief Market Analyst at Currencies Direct

The Brexit effect on sterling weakness, currency fluctuations, EU citizens unwilling to come to the UK to work are all issues cited by retailers. However, shipping, fulfilment and overseas returns were the biggest barriers when trading overseas. Cross border tax compliance is also a concern.

“Language barriers, dealing in different currencies, shipping cross-border, and also processing returns, all represent significant logistical problems for retailers large and small. And those problems are all magnified by the current period of political and economic change.”

– Dan Wilson, Editor, Tamebay

In our White Paper ‘Harnessing volatility: maximising profitability on international ecommerce sales’, we delve deeper into the impact of Brexit on online retailers which you can download for free today.

2 Responses

Wish only 30% off our turnover was just the EU we are a lot more, we have built so much of our business on EU trade, so much so we hardly even target the UK market. Today we had specific Italian Stock arrive, so clearly sell to Italians. See the markets we work with overseas they do not want all this either.

It is a difficult situation, like your man said everything is in the “wait and see” box.

We have even made enquiries with An Post in Ireland with a thought to relocate (partner is IRISH so easy for us) which is something personally I don’t want to do, just bought a brand new house for a start. However we would not last with just the domestic market, we need the EU trade.

Language issues, currency, Cross border compliance (Germany with us), yes are all issues but can be overcome. However Free and and easy movement of goods is essential, the Norway model is not good enough either that will not work in this day and age.

Really hope common sense prevails.

Absolute nightmare. We seem to be losing EU business with no pick up from other regions despite the currency fall. The think Brexit supporters don’t realise is that you can have as many trade deals as you like but to develop trade with new markets take years rather than days and may never come to fruition in a meaningful way. Just hoping that we can cling on to our European business if common sense prevails. UK market is flat as well. So nothing positive to report. Madness.