At last year’s Catalyst Europe 2017 Conference, ChannelAdvisor CEO David Spitz made five predictions for the future of Amazon and ecommerce. This week marks the first anniversary of his predictions so each day we’ll examine one prediction and see if it’s holding true. Today we look at Amazon’s predicted growth and market dominance in comparison to total ecommerce growth.

At last year’s Catalyst Europe 2017 Conference, ChannelAdvisor CEO David Spitz made five predictions for the future of Amazon and ecommerce. This week marks the first anniversary of his predictions so each day we’ll examine one prediction and see if it’s holding true. Today we look at Amazon’s predicted growth and market dominance in comparison to total ecommerce growth.

If you’ve missed the other articles in this series they are:

2. The future of Amazon and Ecommerce: China-sourced products

3. The future of Amazon and Ecommerce: Private label products

4. The future of Amazon and Ecommerce: Amazon Logistics

5. The future of Amazon and Ecommerce: Ad spend on Amazon

1. Amazon will follow Alibaba’s trajectory and drive the majority of UK ecommerce

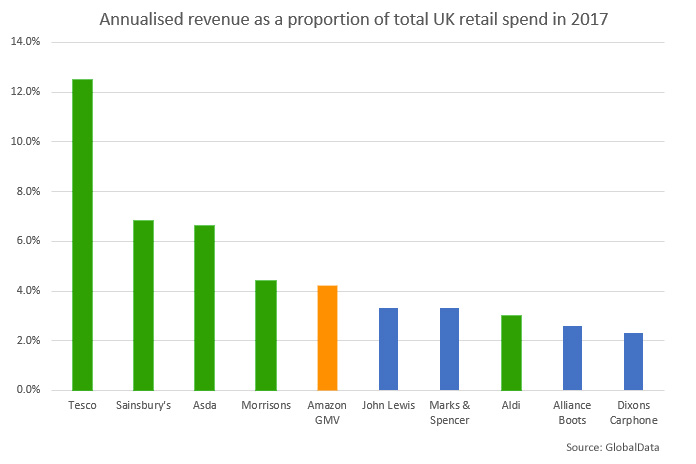

Amazon have consistently ramped up sales in the UK and are now the fifth largest retailer in the UK according to data released from GlobalData. They are beaten only by the big four grocers (Tesco, Sainsbury’s Asda and Morrisons) but Amazon’s growth has resulted in them outgrowing the likes of John Lewis and Marks & Spencer and Amazon don’t have a single high street outlet in the UK.

The picture is even clearer when we look at online spending – Amazon accounted for 33.5% of all UK online spend in 2017 and that’s up from 29.6% of UK online spend in 2016. Amazon appear to be growing at around 22.5% year on year compared to total online spending which is dragging it’s heels just 8.4%.

“Its dominance in the retail market considering it primarily sells non-essential items in comparison to the grocers who benefit from selling indispensable, everyday goods, and that it does not have any physical stores in the UK, is evidence of how Amazon has continually innovated and succeeded in meeting consumer needs, in terms of both product range and shopping experience.”

– Sofie Willmott, Senior Retail Analyst, Globaldata

One of Amazon’s strengths which is driving growth is that they’re not just a retailer. Amazon, with their Prime program, lock users into the Amazon ecosystem with TV, music, free delivery and a host of other benefits. Amazon have also become the dominant virtual assistant in the UK with a 75% market share. There is plenty of room for growth with only about 10% of the population owning a smart speaker but that doubled over the Christmas period from 5%. In rough numbers, that equates to 2 million UK households who own an Amazon Echo speaker and talk to Amazon’s Alexa.

Was David right?

It’s too early to call David Spitz’ first prediction and say that Amazon are driving the majority of UK ecommerce, but with 35% market share they’re well on their way to becoming the dominant player. Perhaps more surprising is that they’ve already achieved dominance in the offline retail world and are already the UK’s largest non-grocer retailer without opening a single physical store.

Read about David’s second prediction here.

One Response

Just today the BBC has reported that footfall in to shops has fallen by %4.8 in the last month and %6.2 over 2 months. That shows a shift towards ecommerce and Amazon is the major benefactor. What also confirms this shift is that Amazon,s prime video which is part of the prime package increased by 1.6 million in Britain to 4.3 million members last year which was a %40 growth year over year.