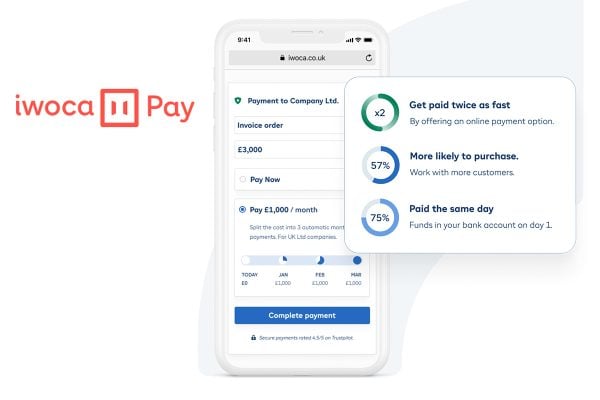

iwoca has recently announced it has more capacity to keep on lending to ecommerce merchants. They have secured a new £50m pot they can draw on to to fuel cashflow for relevant SMEs.

Obviosuly iwoca started out as marketplace lender focussed on eBay and Amazon merchants who needed some extra wedge but now offer a broader rage of services. They are now also lending to many different SMEs and powering growth there, and stepping into the gap where traditional banks are failing.

The increased debt funding was led by NIBC Bank and includes existing lenders and investors Shawbrook Bank and Pollen Street Capital. That is a vote of confidence from people who already know the business well and are willing to put more money into the firm.

iwoca says of the new development:

This new debt facility provides iwoca with more fuel to provide critical finance to the micro and small businesses that are chronically underserved by the banks. Our mission is to break down barriers that stand between small business and finance. We are proud to have provided funding to 20,000 small businesses already but we’re only scratching the surface and hope to be able to reach many more.

-Michael Elalouf, CFO iwoca